What Happens to Kirkland's Legions of Income Partners?

Kirkland & Ellis makes up a lot of partners. Most of them don't stay at the firm longer than five years. So where do they go?

October 09, 2017 at 05:48 PM

5 minute read

Kirkland & Ellis announced last week that 97 new lawyers will be joining the firm's income partnership. That partnership tier is relatively welcoming—both compared with other Am Law 100 firms, and especially compared to Kirkland's equity partnership.

Consider this: Kirkland had 359 equity partners last year, according to The American Lawyer's reporting. The firm currently lists about 975 total partners.

The simple fact is that most income partners—or “nonshare partners” in Kirkland lingo—will not go on to reap the windfall that comes with an equity stake in the high-powered firm. But just how many nonequity partners don't make the cut? And what happens to them?

Past reporting by The American Lawyer has described the Kirkland partnership as an “up-or-out” model, with roughly 20 percent of income partners joining the equity tier after they become eligible about four years into their income partner tenure.

But an analysis of past income partner classes suggests that Kirkland's so-called sharp elbows may not be all that pointed. The American Lawyer researched the current jobs of the 315 lawyers that Kirkland announced as incoming partners between 2010 and 2013.

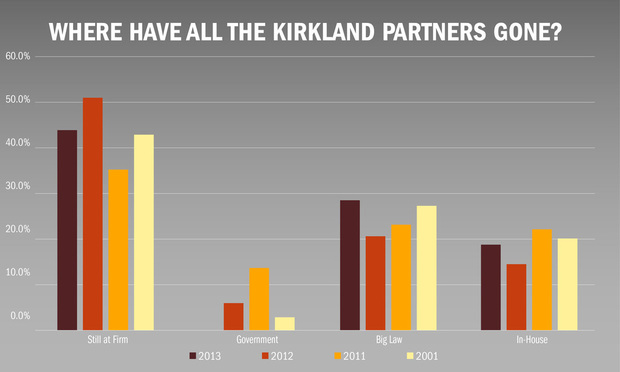

Of the 316 partners promoted during that four-year period, 43 percent remain at the firm. The analysis found that 43 percent of the 70 income partners made up in 2010 are still at Kirkland. The 2011 class, which featured 82 lawyers, has winnowed to 29, or 35 percent. Half of the 84 partners made up in 2012 are still at the firm. And 44 percent of the 2013 class remains at Kirkland.

While more lawyers enter Kirkland's income partnership every year than almost any other firm, the position at Kirkland is less of a long-term play than at other firms. Jones Day's partnership is comparable only insofar as it promotes a relatively high number of lawyers every year. In 2012, the firm promoted 45 lawyers to what it states is a “one-tier” partnership. Today, 73 percent remain at the firm.

The most common landing ground for Kirkland's income partners is at other Am Law 200 firms. Across the four Kirkland income partner classes analyzed by The American Lawyer, roughly a quarter of those lawyers are now practicing at other firms, according to those firms' websites, state bar registrations and individual profiles on professional networking website LinkedIn. Two of the most common firms for Kirkland refugees are King & Spalding and Sidley Austin.

After other jobs in Big Law, the second most common role after a Kirkland income partnership is an in-house position. That is where about 21 percent of former Kirkland lawyers end up. These are often high-ranking positions, with 13 partners from just four years' worth of income partner promotions now occupying chief legal officer or general counsel roles. The list of companies that now employ Kirkland partners as in-house attorneys includes: Amazon.com Inc.; Boeing Corp.; Hulu LLC; Intel Corp.; Johnson & Johnson; Kate Spade & Co.; Koch Industries Inc.; McDonald's Corp.; Sony Corp.; Target Corp. and more than a dozen others.

Government jobs—ranging from assistant U.S. attorneys to administrative judges at the U.S. Patent and Trademark Office—are the third most common, with less than 10 percent of lawyers taking a government paycheck. A sprinkling of lawyers start their own firms, become entrepreneurs in business or go into academia.

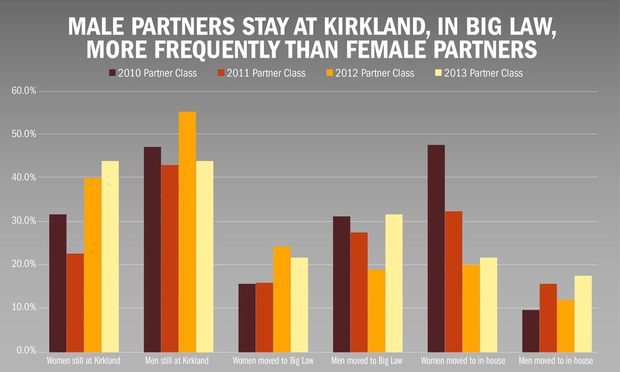

There are also significant gender disparities in the jobs data. The gaps show up mostly in three places.

First, men are more likely to be promoted to income partner than women, with 69 percent of the 316 partners promoted at Kirkland over the four-year span being men. That is roughly in-line with the percentage of nonequity partners that are women—about 30 percent—according to the latest survey by the National Association for Women Lawyers. (The highest percentage of women promoted to income partner in a single year of those analyzed at Kirkland was 2011, when 38 percent of new partners were women.)

Second, men are also more likely to stay at Kirkland than women. Of the 99 women promoted to income partner in the four-year period analyzed by The American Lawyer, 31 percent are still at the firm. Of the 217 men promoted in that same timeframe, 47 percent remain at Kirkland.

Thirdly, women are more likely to work in-house than men after leaving Kirkland. About 30 percent of the women who have been promoted to partner at the firm are now working in-house, compared to about 18 percent of men. In recent years, Kirkland has invested in programs that help lawyers at the firm find their next job, while also trying to strengthen bonds between the firm and its impressive list of alumni.

For instance, Kirkland launched a training program aimed at teaching its associates and alumni about in-house career paths. Thirty participants attended seminars from December through March of this year that included panel discussions with current in-house lawyers. Kirkland said the goal of the program was to prepare lawyers for future transitions to in-house roles and to support women who used to work at the firm in their effort to return to the practice of law.

Kirkland did not immediately return a request for comment about the data. In the past, the firm's management has attributed the turnover in its partnership as a necessary byproduct of turning itself into a global legal giant. According to the most recent Am Law 100 rankings, Kirkland trailed only Latham & Watkins as the world's most profitable firm when measured by gross revenue. Kirkland came in at No. 5 when measured by profits per equity partner.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Climate Disputes, International Arbitration, and State Court Limitations for Global Issues

![Judicial Face-Off: Navigating the Ethical and Efficient Use of AI in Legal Practice [CLE Pending] Judicial Face-Off: Navigating the Ethical and Efficient Use of AI in Legal Practice [CLE Pending]](https://images.law.com/cdn-cgi/image/format=auto,fit=contain/https://images.law.com/contrib/content/uploads/sites/276/2024/10/Image-request_767x633pxl.jpg)

Judicial Face-Off: Navigating the Ethical and Efficient Use of AI in Legal Practice [CLE Pending]

4 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250