Fenwick & West Bounces Back With Record-High Revenue

The Am Law 100 firm shrugged off a sluggish 2016 by posting financial gains in several key metrics last year.

March 06, 2018 at 07:02 PM

5 minute read

The original version of this story was published on The Recorder

The Silicon Valley stalwart opened a New York office in 2016.

The Silicon Valley stalwart opened a New York office in 2016.

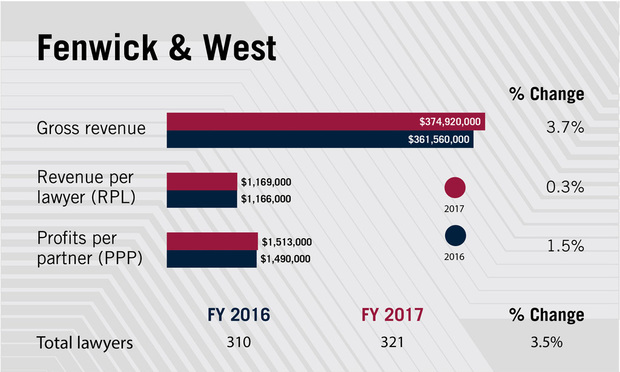

After a slight dip in 2016, Fenwick & West's financial growth bounced back up last year, as the firm hit a record high for gross revenue.

That metric rose 3.7 percent in 2017 to $374.9 million, while profits per partner inched up 1.5 percent to $1.51 million. Revenue per lawyer at Fenwick & West, a firm known for letting some of those in its employ work in far-flung locales, remained mostly flat last year at $1.17 million.

“Our razor-sharp focus in the technology and life sciences space has been key as our clients succeed and grow rapidly,” said Fenwick chairman Richard Dickson, who took over as head of the firm in 2014. “[As those industries] become an increasingly important contributor to the economy overall, that has fueled our extraordinary growth over the past several years.”

Dickson said his firm's strong performance last year in transactional work helped fuel its growth. Fenwick & West handled a number of notable M&A deals for corporate clients, including technology industry titans like Cisco Systems Inc., Facebook Inc. and Symantec Corp. The firm closed five deals last year for Cisco alone, handling the company's $1.9 billion buy of BroadSoft Inc. and $3.7 billion acquisition of AppDynamics Inc.

Dickson said his firm's strong performance last year in transactional work helped fuel its growth. Fenwick & West handled a number of notable M&A deals for corporate clients, including technology industry titans like Cisco Systems Inc., Facebook Inc. and Symantec Corp. The firm closed five deals last year for Cisco alone, handling the company's $1.9 billion buy of BroadSoft Inc. and $3.7 billion acquisition of AppDynamics Inc.

Fenwick & West also helped Symantec complete its $2.3 billion purchase of LifeLock Inc. It advised Facebook, to which it serves as primary outside corporate counsel, on three other transactions: The social media giant's acquisitions of anonymous teen compliment mobile application To Be Honest, conversational artificial intelligence startup Ozlo Inc. and content rights management startup Source3 Inc.

According to numbers provided by the Mountain View-based firm, whose Silicon Valley roots run deep, Fenwick & West worked on nearly 60 M&A deals in 2017 with an aggregate deal value of nearly $17 billion.

Dickson said that Fenwick & West made several investments last year, which could have contributed to its 2 percent dip in net income, down to $127.1 million in 2017. The firm has substantially invested and expanded its privacy practice, said Dickson. In addition to hiring cybersecurity expert James “Jim” Koenig as a partner and co-leader of its privacy and cybersecurity practice in New York, the firm has recruited 12 privacy professionals to the group.

Fenwick & West has continued to grow its New York office since setting up shop in the Big Apple in 2016 with 10 lawyers. Since then, the firm hired transactional partner Ethan Skerry from Lowenstein Sandler and brought on Foley & Lardner partner Jeffrey Greene last year to bolster its intellectual property practice in the city. Dickson said Fenwick & West now has more than 35 team members in New York, where last month the firm hired emerging companies and technology partner Eli Curi, a former chief legal and business affairs officer at Operative Media.

Picking up its focus on lateral recruitment was a primary objective of Fenwick & West last year, Dickson said. The firm made four lateral partner additions, which helped contribute to a 3.5 percent increase in head count, to 321. Besides its New York hires, Fenwick & West welcomed back former associate Idan Netser as a tax partner in Mountain View after recruiting him away from DLA Piper in Palo Alto.

“What we see is consolidation happening in the industry with talent migration to the stronger firms,” Dickson said. “Our focused platform puts us in a very strong position to participate in that and we intend to do so.”

In future years, Dickson said Fenwick & West will continue focusing on growing its presence in the New York market and expanding its privacy and cybersecurity practice. Dickson said his firm hopes to add new capabilities to its life sciences and technology practice, as well as gaining expertise in artificial intelligence, autonomous vehicles, fintech, machine learning and other emerging sectors.

In late January, Fenwick & West corporate and securities partner and Chinese business expert Eva Wang, who joined the firm in 2013, moved away from her partnership role after heading to Andrew Ng's $175 million machine learning startup incubator the AI Fund as a partner and COO. She follows former Fenwick & West partner Theodore “Ted” Wang into the startup world. The latter Wang left the partnership in January 2017 to become an investing partner at Cowboy Ventures, which focuses on seed stage investments. Both Wangs remain special counsel at Fenwick & West in Mountain View.

Dickson believes that Fenwick & West's focus on its corps strength—last year litigation partner and gaming and digital media chair Jennifer Kelly was elected as head of TechLaw Group Inc., a global network of 25 technology-focused law firms—helps it remain true to its mission of serving its technology industry clients.

“One of the benefits is that our attorneys have become very knowledgeable about the industry, [and] that focus creates differentiation,” Dickson said. “The combination of that differentiation is hard to match.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Promotes 42 Lawyers to Partner, Prioritizing Corporate Practices

3 minute read

Wachtell Helps Miami Dolphins Secure One of NFL’s First Private Equity Deals

3 minute read

830 Brickell is Open After Two-Year Delay That Led to Winston & Strawn Pulling Lease

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250