Sedgwick Among Law Firms Feeling Exposed in Penthouse Bankruptcy

At least eight firms are collectively owed more than $550,000 in the Chapter 11 filing by Penthouse Global Media Inc.

January 12, 2018 at 08:18 PM

4 minute read

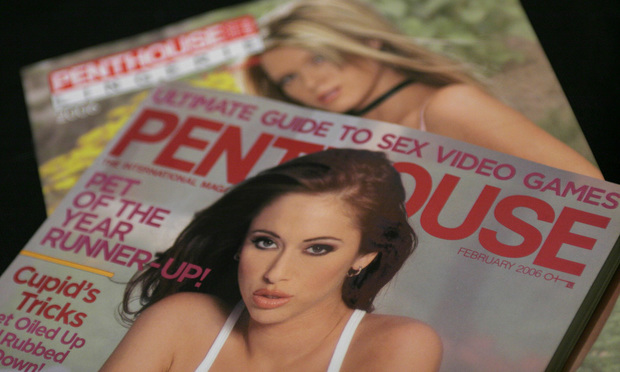

A company that inherited the Penthouse magazine and adult entertainment brand made famous by the late photographer and publisher Robert Guccione has filed for bankruptcy, leaving several large law firms on the hook for thousands of dollars in unpaid legal fees.

Chatsworth, California-based Penthouse Global Media Inc., which was formed in early 2016 after current CEO and majority shareholder Kelly Holland acquired the magazine and related assets in a management buyout from former parent company FriendFinder Networks Inc., sought Chapter 11 protection in San Fernando Valley on Jan. 11.

At least eight firms are collectively owed $556,424.43 from Penthouse, according to a list of the company's 20 largest unsecured creditors. Topping that list is Greenberg Traurig, which is owed $198,776.58, while Akerman is out another $15,000. Both firms previously represented FriendFinder Networks in its 2013 bankruptcy filing, a Delaware case that ended later that year. (Akerman also advised FriendFinder on a $50 million initial public offering in 2011 that generated $7.3 million in legal fees and expenses, according to securities filings.)

Other firms among Penthouse's largest unsecured creditors are Delaware's Bayard ($121,352.53), Hogan Lovells ($57,926.01), San Francisco's Miller Law Group ($46,745.99), Sedgwick ($45,674.83), Florida-based intellectual property and business litigation firm Allen, Dyer, Doppelt & Gilchrist ($38,829.08) and Bressler, Amery & Ross ($32,083.41).

Sedgwick, which dissolved its operations this month, has handled some litigation work for Penthouse through former partner Caroline Mankey, who recently joined Akerman's Los Angeles office. Mankey has been representing Penthouse in a copyright dispute with Academy Award-winning actor Jared Leto.

Michael Weiss and Laura Meltzer of Los Angeles-based Weiss & Spees are advising Penthouse in its Chapter 11 case. The company is based in the Los Angeles suburb of Chatsworth, a part of Southern California known colloquially as Porn Valley. The firm has not yet filed billing statements with the bankruptcy court.

Penthouse's former general counsel, Relani Belous, left the company late last year to become the in-house legal chief at superhero creator Stan Lee's POW! Entertainment Inc., according to her profile on professional networking website LinkedIn. (POW was acquired last year by a Chinese company, while Lee has recently faced allegations of sexual misconduct.)

Started in 1965 by Guccione, who died at 79 in 2010, Penthouse developed a reputation as having a more explicit style than its adult entertainment rival, Playboy Enterprises Inc. Both companies have struggled to remain profitable in recent years, in part due to shifting consumer tastes and an ever-changing media market.

Playboy founder Hugh Hefner kept plenty of his own lawyers busy until his death in September, a little more than a year after the $100 million sale of his famous mansion to billionaire Daren Metropoulos. Holland, Penthouse's latest owner, has said publicly that full nudity in its namesake magazine's pages is a key part of its business model.

Penthouse's plummet into bankruptcy comes a month after Herald Media Holding Inc., owner of the Boston Herald newspaper, filed for bankruptcy in Delaware. Brown Rudnick and Delaware's Morris, Nichols, Arsht & Tunnell are advising Herald Media in its Chapter 11 case, one in which Rochester, New York-based GateHouse Media LLC and Tampa-based investment firm Revolution Capital Group LLC are bidding for control of the newspaper.

According to a list of Herald Media's 30 largest unsecured creditors, the company owes $20,000 to Mintz, Levin, Cohn, Ferris, Glovsky and Popeo. Like Penthouse, in court papers Herald Media listed assets of and liabilities of between $10 million and $50 million.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Meta agrees to pay $25 million to settle lawsuit from Trump after Jan. 6 suspension

4 minute read

How We Won It: Latham Secures Back-to-Back ITC Patent Wins for California Companies

6 minute read

Trending Stories

- 1Ex-Kline & Specter Associate Drops Lawsuit Against the Firm

- 2Am Law 100 Lateral Partner Hiring Rose in 2024: Report

- 3The Importance of Federal Rule of Evidence 502 and Its Impact on Privilege

- 4What’s at Stake in Supreme Court Case Over Religious Charter School?

- 5People in the News—Jan. 30, 2025—Rubin Glickman, Goldberg Segalla

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250