MoFo Delivers Record Year for Revenue, Partner Profits

The Bay Area-based Am Law 100 firm saw big gains across the board in 2017.

February 14, 2018 at 09:59 PM

4 minute read

(Photo Diego M. Radzinschi/ALM)

(Photo Diego M. Radzinschi/ALM)

After a year of tepid growth, following another year with a decline in gross revenue, Morrison & Foerster's financial performance spiked to an all-time high in 2017, an outcome that chairman Larren Nashelsky attributed mostly to the firm's investments in key practices and lateral hires.

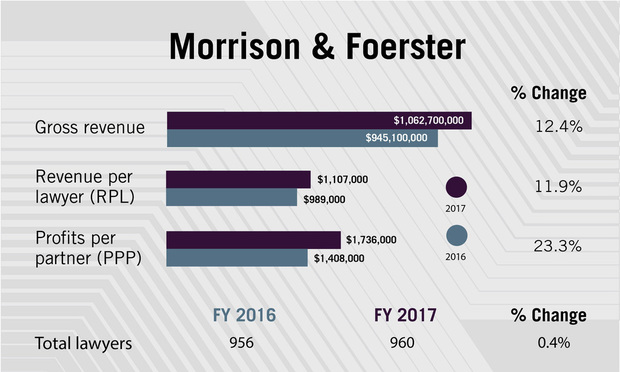

The Bay Area-based Am Law 100 firm pulled in $1.06 billion in gross revenue last year, a 12.4 percent increase from 2016, surpassing the firm's previous record result by more than $50 million. Revenue per lawyer at the firm jumped 11.9 percent to $1.11 million, and profits per equity partner surged 23.3 percent to $1.74 million. Net income also rose 16.9 percent to $388.8 million.

“We have definitely seen a strong result from the investments we made in both 2016 and the prior year. 2017 was certainly a year where those investments paid dividends,” said Nashelsky, who was a co-chair of the firm's bankruptcy and restructuring practice before being elected to its top leadership role in 2012.

Nashelsky said MoFo laid the foundation for the firm's strong financial performance in 2017 by investing in key lateral hires the two years prior. The firm also expanded in practices such as bankruptcy and restructuring, government contracts, intellectual property litigation, M&A and private equity. A number of MoFo's new recruits started up to pay off in the second half of 2016 and continued to 2017, Nashelsky said, which contributed to the firm's robust growth in 2017.

MoFo's head count remained mostly flat at 960 in 2017, although the firm made nine lateral partner hires, a relatively low number compared to the 28 lateral additions the firm made the previous year. Equity partner head count at MoFo fell to 224, a 3.5 percent decline from 2016, making last year the fifth consecutive year that MoFo shed more equity partners than it added.

MoFo's head count remained mostly flat at 960 in 2017, although the firm made nine lateral partner hires, a relatively low number compared to the 28 lateral additions the firm made the previous year. Equity partner head count at MoFo fell to 224, a 3.5 percent decline from 2016, making last year the fifth consecutive year that MoFo shed more equity partners than it added.

“There was nothing unusual,” said Nashelsky, when asked about the firm's equity tier. “When you look at our performance in litigation in 2017, it was just incredible. It was the busiest department in the firm, and we brought in significant laterals in that area, especially IP litigation. There was nothing unnatural in the changes to [the partnership] during that time period.”

Nashelsky noted that 2017 was a record-breaking year for MoFo as the firm made headlines for representing its technology and life sciences industry clients in high-stakes cases, such as defending ride-sharing giant Uber Technologies Inc. in its self-driving technology trade secrets fight with Alphabet Inc.'s auto unit Waymo LLC, which abruptly settled last week; advising SoftBank Group Corp. on its multimillion-dollar deals with Uber and WeWork Cos. Inc.; and representing Toshiba Corp. in the $18 billion sale of its chip business to an investor group led by private equity firm Bain Capital LP.

In June 2017, MoFo scored a major appellate victory for its client Sandoz Inc. as the U.S. Supreme Court unanimously ruled in favor of biosimilar developers in a case involving the Biologics Price Competition and Innovation Act.

Nashelsky said that MoFo also handled a number of matters outside the technology and life science space, noting that the firm advised Singapore-based warehouse operator Global Logistic Properties Ltd. Private in an $11.6 billion takeover offer from Chinese investors.

In 2018, MoFo will likely continue to focus on growing in the Bay Area and Washington, D.C., as the firm's office in the nation's capital is poised to relocate to 2100 L Street N.W. at the end of 2020. Outside the U.S., the firm hopes to keep building on its presence in Asia and Europe, especially London, where MoFo saw several lawyers decamp for rival Cooley in early 2015.

“We believe that we saw a significant uptick in activity in London,” said Nashelsky, adding that MoFo is keen on strengthening its corporate and finance capabilities in the city.

While none of the 10 lawyers promoted to partner by MoFo in January are based in London, the firm announced this week its hire of Clifford Chance finance partner Caroline Jury in the city.

“That strong year we had has continued in early 2018, and we are really optimistic about what 2018 is going to look like,” Nashelsky said.

The American Lawyer will release its full Am Law 100 report in May.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Meta’s New Content Guidelines May Result in Increased Defamation Lawsuits Among Users

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250