Greenberg Traurig Turns Up the Heat on Growth Plan

In its 50th year in business, the global legal giant saw its gross revenue climb to $1.477 billion.

February 25, 2018 at 09:30 PM

5 minute read

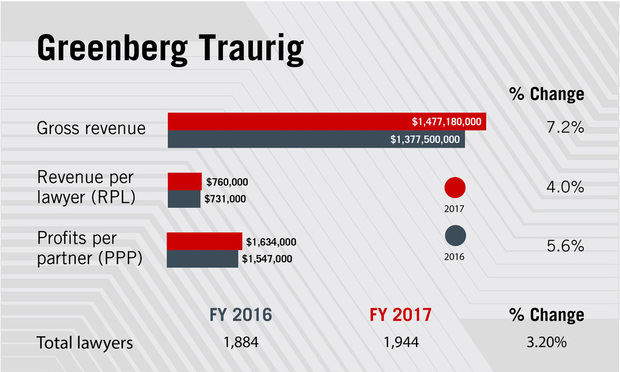

After making steady financial gains in 2016, Greenberg Traurig has doubled down on its growth efforts as the firm's gross revenue jumped 7.2 percent last year, to $1.477 billion.

Revenue per lawyer also grew 4 percent in 2017, to $760,000, up from $731,000 the year before. Profits per partner at the Am Law 100 firm, which celebrated its 50th anniversary last year, also grew 5.6 percent, reaching $1.634 million in 2017, up from $1.547 million the year prior.

Greenberg Traurig CEO Brian Duffy credits a strong, successful year for the firm's clients as spurring its financial success in 2017.

“It was a broad-based and deep, strong year for Greenberg Traurig,” said Duffy, who was elevated to the CEO role in 2016.

He noted that the firm saw increased performances across all practice groups and industries and throughout all of its offices, particularly in Europe, where Greenberg Traurig has made the strategic decision to invest in key markets such as Amsterdam, Berlin, London and Warsaw.

Greenberg Traurig, which was founded in Miami in 1967 with just a handful of lawyers, watched its head count hit 1,944 worldwide in 2017, up 3.2 percent from the year prior. However, the firm did see a slight dip in its number of equity partners, which dipped 3.2 percent last year, to 298, down from 308 in 2016.

Greenberg Traurig, which was founded in Miami in 1967 with just a handful of lawyers, watched its head count hit 1,944 worldwide in 2017, up 3.2 percent from the year prior. However, the firm did see a slight dip in its number of equity partners, which dipped 3.2 percent last year, to 298, down from 308 in 2016.

Part of the decrease was attributable to several of its partners being tapped for several key positions within the Trump administration. In March 2017, Greenberg Traurig partner Eric Hargan in Chicago was appointed deputy secretary of the U.S. Department of Health and Human Services, while partner Robert Charrow was tapped in June to become general counsel at the DHHS. And after much debate and speculation, Greenberg Traurig partner Geoffrey Berman was officially appointed in January as interim U.S. attorney for the Southern District of New York, a seat previously held by Preet Bharara.

Despite those departures, Greenberg Traurig was quite active in the lateral market in 2017. The firm welcomed back former corporate and transactions partner Benjamin Aguilera to its ranks in Phoenix last October, the same month that Greenberg Traurig expanded its real estate practice in Florida with a trio of hires in its home state.

Greenberg Traurig also grew its real estate practice in Denver and Los Angeles late last year by bringing on land use and land development partners Ellen Berkowitz and Brady McShane from Sunshine State-based rival Akerman. Greenberg Traurig also tacked on tacked on LeClairRyan's Lee Albanese and Brian Petrequin as corporate partners for its office in Morristown, New Jersey.

Looking abroad, Greenberg Traurig bolstered its Warsaw office last year with the addition of an 11-lawyer real estate team from Hogan Lovells that included the latter's former local practice head Jolanta Nowakowska-Zimoch. The move came a little more than a year after Greenberg Traurig backed away from a potential merger with British firm Berwin Leighton Paisner.

“At the end of the day the finances and the fact that we had such a strong financial year in 2017 is just reflective of the talent of the firm and great lawyers who do fantastic work for wonderful clients,” said Duffy, who is part of a new management team at Greenberg Traurig, which saw longtime leader Richard Rosenbaum move into the new role of executive chairman. “Then the financial performance follows.”

But not all of Greenberg Traurig's clients were a boon to the firm last year. In December, the firm found itself owed more than $1.4 million by bankrupt energy services and water treatment provider RDX Technologies Corp., while the bankruptcy earlier this year of another client, insurer Patriot National Inc., left Greenberg Traurig out another $779,230.

Nonetheless, Greenberg Traurig had plenty of lucrative matters to offset such setbacks, even forking over $15,000 to start the new year by sponsoring a prize-winning goat.

The firm landed a lead role in December representing Australian mall owner and operator Westfield Corp. Ltd. in its roughly $25 billion sale to Unibail-Rodamco SE. Greenberg Traurig also advised longtime client Exactech Inc. on the medical device company's $640 million sale to private equity firm TPG Capital Management LP.

In addition to those deals, Greenberg Traurig continued to represent the Puerto Rico Electric Power Authority (PREPA) in issues related to the utility's ongoing bankruptcy. The city of Hartford, Connecticut, also hired the firm to navigate its potential Chapter 9 bankruptcy filing.

Despite roles for these clients and other high-profile matters, Rosenbaum said his firm's success isn't merely tied to such engagements.

“We always focus on two concepts, which today everybody's trying to focus on: excellence in what you do [and] value,” Rosenbaum said.

Value means a lot of things, he added, including a focus on cost, but it also means focus on relationships and other ways of helping your clients.

“We don't focus on just doing a deal or a litigation for a client, we focus on long-term relationships,” Rosenbaum said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute read

Big Law Practice Leaders 'Bullish' That Second Trump Presidency Will Be Good for Business

3 minute read

Trending Stories

- 1Trump's DOJ Files Lawsuit Seeking to Block $14B Tech Merger

- 2'No Retributive Actions,' Kash Patel Pledges if Confirmed to FBI

- 3Justice Department Sues to Block $14 Billion Juniper Buyout by Hewlett Packard Enterprise

- 4A Texas Lawyer Just Rose to the Trump Administration

- 5Hogan Lovells Hires White & Case Corporate and Finance Team in Italy

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250