Alston & Bird Racks Up Big Gains in Revenue, Profit

The firm also opened a San Francisco office with big lateral hires from Reed Smith and MoFo.

March 12, 2018 at 10:26 AM

6 minute read

Alston & Bird posted another strong year in 2017, besting its 2016 gains in revenue and profit while steadily increasing head count.

The firm reported an increase of 7 percent in revenue, to $781.8 million, and a 10.7 percent rise in net income, to $295.2 million.

The gains boosted revenue per lawyer (RPL) by 3 percent to $962,000. Profit per equity partner (PPP) jumped 6.3 percent to $1,926,000—just shy of the $2 million mark.

Meanwhile Alston added lawyers and opened a San Francisco office, giving the firm nine U.S. offices and 11 locations worldwide.

“It was another year of strong growth. There is a lot of volatility in the [legal] market and in the performance of law firms. We were pleased to see all our core metrics increase for the third consecutive year,” said Alston's managing partner, Richard Hays.

“It was another year of strong growth. There is a lot of volatility in the [legal] market and in the performance of law firms. We were pleased to see all our core metrics increase for the third consecutive year,” said Alston's managing partner, Richard Hays.

Alston's financial gains last year followed increases of 6.2 percent in revenue and 7.9 percent in net income the prior year, as well as a $65,000 increase in PPP to $1.81 million in 2016.

Average annual head count last year increased by 30 lawyers for a total of 812, and the firm expanded its equity partner ranks from 147 to 153 partners. It has 358 partners total.

The San Francisco office launch last March came with high-profile new lawyers, including Michael Agoglia, who'd co-chaired Morrison & Foerster's financial services litigation team, and a seven-lawyer class action defense team led by Robert “Bo” Phillips Jr. from Reed Smith, where Phillips had co-headed the class action team.

Two other Reed Smith partners came with Phillips: Tom Evans in San Francisco and Kathy Huang in Los Angeles, where Alston has an office.

The American Lawyer included Alston's recruitment of Agoglia and Phillips in San Francisco in its top 25 lateral moves for 2017.

“We're seeing a lot of interest there and continuing to look for growth opportunities,” Hays said, adding that in San Francisco the primary practices are in litigation, but Alston plans to diversify into other areas.

The San Francisco location is the third California office for the Atlanta-based firm, including Silicon Valley and Los Angeles. Alston's other offices are in Dallas, New York, Washington, Durham and Charlotte, North Carolina, with outposts in Brussels and Beijing.

The Talent

Alston added 12 lateral partners in 2017 and nine partners in January 2018. The firm also promoted 21 associates to partner in 2017, more than in the past several years.

“For us, growth always starts at home, investing in our existing people,” Hays said. “We have had a lot of success doing that.”

“But you have to fill gaps, especially when you need to move quickly,” he added. “That's all been to accelerate growth in existing areas. That's been our strategy and will continue to be our strategy. We see that paying off.”

In Atlanta the firm recruited partner Paul Monnin from Paul Hastings for its white-collar and government investigations practice.

All of Alston's other lateral partner adds last year were in San Francisco, Los Angeles and New York. In New York, Alex Yanos joined from Hughes Hubbard & Reed to co-chair Alston's international arbitration practice; bankruptcy specialists Gerard Catalanello and James Vincequerra joined from Duane Morris; and finance partner Paul Hespel joined from Pepper Hamilton. Alston also landed Paul Tanck, who'd chaired the IP group at Chadbourne & Parke (acquired last year by Norton Rose Fulbright), and investment bank deal adviser Stuart Rogers from Credit Suisse.

This year's additions include deal lawyer Jeremy Silverman in Atlanta and government contracts pro Jeniffer De Jesus Roberts in Washington, both from Dentons.

In Los Angeles this year, environmental litigation partner Jeffrey Dintzer and counsel Matthew Wickersham joined from Gibson, Dunn & Crutcher, and another partner, litigator Jeff Rosenfeld, came from DLA Piper, following last year's addition of John Hanover, who'd been the CEO of Hanover Securities, in the construction and government contracts practice.

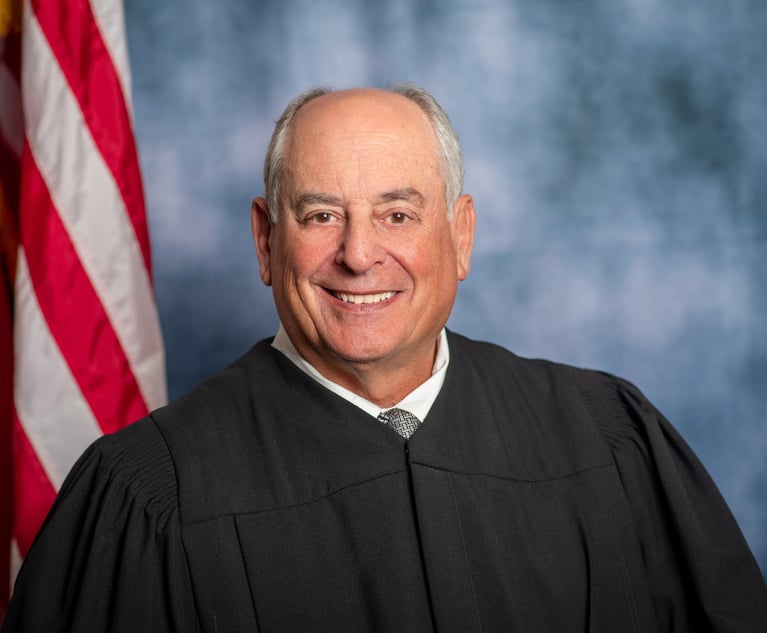

Several Alston partners departed for government jobs. In Atlanta, Mike Brown became a U.S. District Court judge for the Northern District of Georgia, while Brian Stimson became the deputy general counsel for the U.S. Department of Health and Human Services. In New York, Craig Carpenito was appointed interim U.S. attorney for New Jersey.

Also in Atlanta, Kevin Gooch, who handles financing transactions, joined DLA Piper; Brandon Williams became the general counsel for World Group, the holding company for entertainer Steve Harvey's enterprises; and senior tax practitioner Jack Sawyer went to Taylor English Duma. (An internecine dispute over a family-owned business that had used Sawyer for tax advice prompted a malpractice suit against Alston in 2012. In March, a Fulton County jury found Alston liable, awarding it 32 percent of the fault and the majority to Maury Hatcher, the eldest sibling who'd managed Hatcher Management Holdings—and against whom the company had already won a $4 million default judgment.)

In New York, litigator Mike Johnson left to become managing counsel for Wells Fargo, an Alston client, in the litigation and workout division, while Scott Samlin became the head of Pepper Hamilton's consumer finance and bank regulatory practice.

The Work

Hays said Alston's M&A and transactional practices were busier last year than in 2016, a trend that's continuing. “It's a reflection of what's going on in the economy and of our practice strength in finance, financial services, corporate and securities work,” he said.

In addition to those areas, Hays said, the firm saw increased demand in health care, intellectual property, complex litigation and government investigations.

Alston handled several billion-dollar deals, advising Graphic Packaging in its $1.8 billion combination with International Paper's consumer-packaging business and Total System Services in its $1.05 billion acquisition of payments firm Cayan. It represented Transamerica in a major outsourcing deal for a nearly $3 billion contract with Tata Consultancy Services.

Alston also served as counsel to Credit Suisse, Wells Fargo, Citi and other investment banks on 22 deals last year with a combined value of more than $24 billion.

On the litigation front, Alston represented Delta Air Lines in the dismissal of an anti-price-fixing case over passenger baggage fees after eight years of litigation and for Dell won a reversal of a lower-court decision in a long-running shareholder appraisal action in Delaware Chancery Court.

Alston represented longtime client Nokia in securing a $137 million international arbitration award against BlackBerry over a patent license agreement, and the firm continued to defend Home Depot, Mazda Motor Corp. and Porsche Cars North America in major class actions.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'A 58-Year-Old Engine That Needs an Overhaul': Judge Wants Traffic Law Amended

3 minute read

Appeals Court Removes Fulton DA From Georgia Election Case Against Trump, Others

4 minute read

Glynn County Judge Rejects Ex-DA's Motion to Halt Her Misconduct Trial in Ahmaud Arbery Investigation

Trending Stories

- 1Homegrown Texas Law Firms Expanded Outside the Lone Star State in 2024 As Out-of-State Firms Moved In

- 2'In Re King': One Is Definitely the Loneliest Number When Filing an Involuntary Petition

- 35th Circuit Overturns OFAC’s Tornado Cash Sanctions

- 4The Forgotten Ballot: Expanding Voting Access for Incarcerated Populations

- 5Data Breaches, Increased Regulatory Risk and Florida’s New Digital Bill of Rights

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250