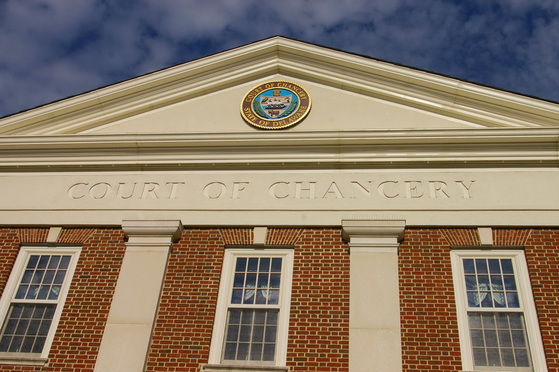

The Delaware Court of Chancery’s decision in In re Trulia Stockholder Litigation, 129 A.3d 884 (Del. Ch. 2016), was hailed as a meaningful step toward curtailing lawsuits alleging that corporate boards were breaching their fiduciary duties in nearly every public company merger transaction. The vast majority of those actions resolved quickly, before a stockholder vote (or closing of a tender offer), for nothing more than additional disclosures to stockholders in already-lengthy proxy or solicitation/recommendation statements. In exchange, corporate defendants received releases of any and all claims relating to the merger, and plaintiff’s counsel received a fee for the “corporate benefit” they provided. That all came to an end in Trulia, following mounting criticism from the corporate community of what many called a deal tax and increasing skepticism by the Delaware courts. [see note 1] Or did it?

Since Trulia, there has been a decline in Delaware in the number of run-of-the-mill challenges to nearly every public company merger transaction. That decline is likely attributable to Delaware’s disfavor of disclosure-only settlements, as expressed in Trulia, coupled with at least two other important developments: (1) the Delaware Supreme Court’s decision in Corwin v. KKR Financial Holdings, 125 A.3d 304 (Del. 2015), which held that a fully-informed and uncoerced vote in favor of a merger by a majority of a corporation’s stockholders invokes the business judgment rule standard of review; and (2) an amendment to the Delaware General Corporation Law that permits Delaware corporations to adopt forum selection bylaws to drive lawsuits concerning their internal affairs to Delaware.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]