Australia's Class Action Plaintiffs Firms Prepare for Contingency Fees

Contingency fees have until now not been allowed in Australia. But the state of Victoria has introduced legislation to allow firms to charge contingency fees, and the legislation is expected to become law.

February 21, 2020 at 12:23 PM

6 minute read

Many of Australia's plaintiffs class action law firms are planning to embrace the looming introduction of contingency fees in Australia and are talking to litigation funders about how to finance contingency fee cases.

"We'll do as many as we can on a contingency fee basis because we do think it will produce a better outcome for clients," said Andrew Watson, national head of class actions at plaintiffs firm Maurice Blackburn Lawyers.

Contingency fees—where lawyers take a percentage of the proceeds of a successful case rather than billing by the hour—have until now not been allowed in Australia.

The state of Victoria has introduced legislation to allow firms to charge contingency fees, the first jurisdiction in the country to do so. While the legislation hasn't yet passed into law, it is considered likely, given the Andrews Labor government's majority in Parliament's lower house and the fact that it only needs votes from two out of 11 independent or minor party members of Parliament in the upper house.

In introducing the legislation to Parliament late last year, Attorney General Jill Hennessy said the class action regime is underutilized and contingency fees will increase access to justice by shifting the financial risk of a loss from the lead plaintiff to their law firm.

"This is an important access to justice reform because it will pave the way for class actions to proceed where they otherwise may not have been viable, such as class actions for silicosis, wage theft, and corporate wrongdoing," she said.

Additionally, contingency fees will produce higher returns for plaintiffs because the law firm's percentage of the winnings is likely to be lower than the combination of the firm's hourly billing and the commission to litigation funders, said Maurice Blackburn's Watson.

Watson rejected claims it would lead to a spike in class actions, saying that under the contingency fee arrangement and the adverse cost rule—where the losing party has to pay the other party's costs—lawyers will make a careful judgment before they launch a case because of the financial risk.

Lawyers in Australia are allowed to run cases on a "no win, no fee" basis, where they charge hourly fees, but Watson said the potentially higher earnings from a contingency fee arrangement will tip the risk-reward equation and allow firms to run cases that might previously have been unviable.

However, he said only large and well-funded firms will be able to run cases on a contingency basis because firms are rewarded only at the conclusion of a case and only if they win. The partners will have to agree to "constrained cash flows" for three or four years until a case is concluded.

The firm has had discussions with litigation funders, many of whom are awaiting the introduction of contingency fees so they can start funding firms, either for a single case or portfolio funding.

"We're talking to litigation funders all the time about all sorts of things," Watson said. "Obviously we're in a position where we have a pretty substantial financial capacity anyway and if contingency fees do come, we'll work out what the best way to fund the work that we do on a contingency fee basis is."

Jan Saddler, head of litigation and loss recovery at Shine Lawyers, said the firm has also held preliminary discussions with litigation funders, many of which already have experience funding law firms in the U..S and the U.K. "I won't be the only law firm that's had discussions with funders about how that might work in the Australian experience. And all sorts of different mechanisms have been suggested," she said.

Contingency fees will make it easier to run cases that litigation funders don't want to finance, such as human rights and products liability cases, where the funder doesn't want to be seen taking part of the proceeds. For instance, "they do not want to be seen to be taking money from the damages that somebody who is suffering physical pain and harm as a consequence of a medical product defect," she said.

In such instances, contingency fees could be the answer. "There'll be cases where it meets our social conscience metrics, and it just gives us another way of running those cases if it's appropriately filed in Victoria that isn't currently available to us," she said.

Saddler rejected claims the change will open the way to excessive profits for plaintiffs firms, noting that arrangements would have to be signed off by a judge, who would ensure plaintiffs would be fairly compensated.

Neither Saddler nor Watson expected the change to induce a rush to file cases in the Victorian Supreme Court over other states or the Federal Court, but said that in some instances they might file cases there instead of in other jurisdictions if it was in the interests of plaintiffs.

Indeed, some firms are more cautious about whether they will use the contingency fee regime at all. "We certainly wouldn't say no but it would be on an individual basis. It would depend on the matter," said Gordon Grieve, chairman of partners at national firm Piper Alderman.

He has doubts about how effective it will be and says the large class actions that the regime seems to be directed at would require firms to carry a lot of financial exposure if they used contingency fees.

Additionally, the legislation doesn't provide much guidance on how contingency fees will operate in practice. "You also have to get out of this first hurdle of satisfying a court that it's appropriate or necessary to ensure justice is done. I don't exactly know what that means," he said.

Stewart Levitt, senior partner at Sydney-based commercial and class action plaintiffs firm Levitt Robinson Solicitors, doubted contingency fees will serve the interests of justice. If lawyers have large amounts of money riding on a court case, this could affect the advice they provide to clients and how they conduct proceedings, despite the lawyer's duty to act in the best interests of clients.

"It tends to cheapen lawyers and I think the conflict becomes irremediable," he said. "The primary motivation for doing good is expropriating huge sums of money, often at the expense of victims."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

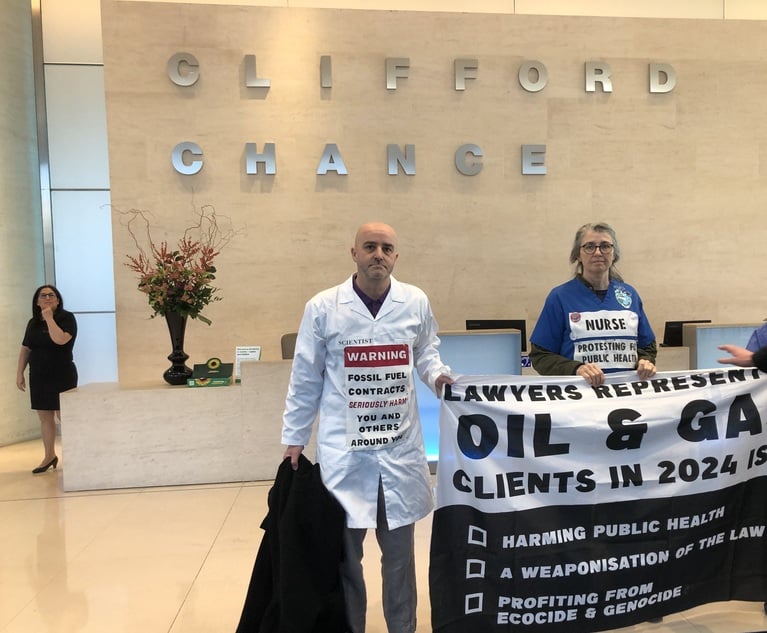

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250