Saul Ewing saw its gross revenue barely rise and its profits per partner (PPP) fall slightly in what managing partner David S. Antzis called a stabilizing year after experiencing big gains in 2010.

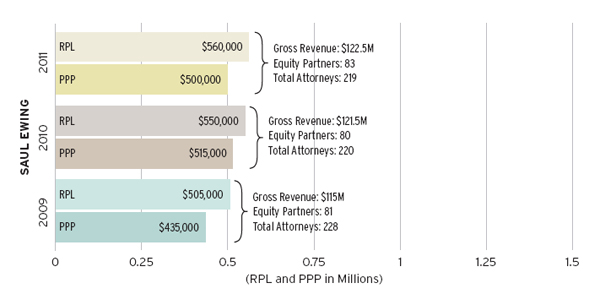

The firms revenue increased by about 0.8 percent, from $121.5 million in 2010 to $122.5 million in 2011.

But Antzis said the firms growth over the past two years is more impressive, pointing to the fact that its revenue shot up about 5.7 percent in 2010 from $115 million in 2009.

Antzis reiterated this point with regard to the firms PPP, which dipped by about 3 percent, from $515,000 in 2010 to $500,000 in 2011.

According to Antzis, 2011s figure still represents an increase of about 15 percent over two years since the firm saw a tremendous spike in that metric in 2010, when PPP grew by more than 18 percent, from $435,000 in 2009.

Antzis said the firm was busy with several significant matters in 2011, including representing Cantor Fitzgerald in its ongoing lawsuit against American Airlines over the Sept. 11 attacks.

The firm also spent nearly all of 2011 representing both Exelon Corp. and Constellation Energy Group Inc. before the Maryland Public Service Commission in their merger, which closed this past March, according to Antzis.

Antzis said the firms corporate and real estate practices were on the uptick in 2011 after taking a hit during the economic downturn.

Our firms practice is two-thirds transactional and one-third litigation so we had to be careful during the recession, Antzis said, but added that he believes the firm will benefit as those practices make a comeback.

Antzis said the big theme in 2011 was that the firm had entered a time of opportunity.

Over the years, Antzis said, Saul Ewing has been adamant about keeping our balance sheet clean, steering clear of potential pitfalls such as unfunded pensions and long-term debt and avoiding large expenses such as overseas offices and guaranteed contracts.

This is important in a legal landscape where the cautionary tales of firms like Wolf Block, Heller Ehrman and, most recently, Dewey & LeBoeuf have made potential hires more wary of firms financial health, Antzis said.

For the first time, laterals are asking about firms balance sheets, he said. They realize that promises can be illusory. They used to just ask, What are you going to pay me and for how long? Now, a clean balance sheet matters.

Meanwhile, he said, lawyers at megafirms are currently experiencing enormous rate pressure, while a firm like Saul Ewing is able to offer comparable or better service and turn a profit with attorneys charging as low as $450 to $500 per hour.

Larger firms also lack the sort of collegial atmosphere Saul Ewing seeks to provide to its attorneys, Antzis said.

In big firms, there are barely partnerships anymore, he said. Its impossible to feel like you know your partners.

Antzis added that the philosophy at Saul Ewing is that cross-selling is easier when partners know each other.Antzis said all of this has put the firm in a prime position to attract talent.

I told our partners last year that we were going to go into an aggressive growth mode, he said.

In July, the firm opened a Boston office with the acquisition of seven of the nine lawyers from real estate boutique Dionne & Gass.

We wanted a foothold in Boston with indigenous lawyers, Antzis said, adding that the firm currently has enough office space in the city to grow to about two dozen attorneys.

The firm is currently looking to hire intellectual property, intellectual property litigation, life sciences and higher education attorneys in Boston.

The firms headcount stayed nearly static in 2011, dropping by one attorney from 220 in 2010 to 219 in 2011.

That slight change nudged the firms revenue per lawyer (RPL) up by 1.8 percent, from $550,000 in 2010 to $560,000 in 2011.

Meanwhile, its equity partner tier grew by about 3.8 percent, from 80 partners in 2010 to 83 in 2011, and its nonequity partner tier inched up by about 2.1 percent, from 48 attorneys in 2010 to 49 in 2011.

Antzis said the firm added nine new partners in 2011 but noted that it also lost a few partners to state government positions.

In January of last year, Stephen S. Aichele left his position as Saul Ewings chairman to become Pennsylvanias general counsel, and the former chairman of Saul Ewings insurance practice, Michael F. Consedine, was named Pennsylvanias insurance commissioner.

In March of last year, former partner David Raphael left the firm to become chief counsel of the states Department of Environmental Protection.

But less than six months into 2012, the firm has continued to implement its aggressive growth strategy.

On May 1, the firm opened an office in Pittsburgh, bringing on four attorneys from the Pittsburgh office of Schnader Harrison Segal & Lewis who focus on corporate finance, business counseling, tax, and mergers and acquisitions.

Antzis said the firm also felt having a physical presence in Western Pennsylvania would be beneficial for the work it already does for clients in the Marcellus Shale natural gas play.

Looking ahead, Antzis said the firm may seek to expand its geographical footprint further across the eastern half of the country, having identified potential opportunities in Virginia, Bethesda, Md., Hartford, Conn., and Ohio.

The firm is also interested in expanding in Manhattan, according to Antzis.

We have a presence there now but not of any significance, he said.

Zack Needles can be contacted at 215-557-2493 or [email protected]. Follow him on Twitter @ZNeedlesTLI.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]