Big Law and the Case of the Missing Demand

We have a serious situation on our hands. The 2017 Report on the State of the Legal Market, presented by The Center for the Study of the Legal Profession at Georgetown University Law Center and Thomson Reuters Legal Executive Institute, has concluded, "The past decade has been a period of stagnation in demand growth for law firm services."

February 21, 2017 at 11:28 PM

6 minute read

It's time to issue an APB on missing demand for legal services from law firms. Put pictures on the backs of milk cartons. Someone check the Upside Down. We have a serious situation on our hands. The 2017 Report on the State of the Legal Market, presented by The Center for the Study of the Legal Profession at Georgetown University Law Center and Thomson Reuters Legal Executive Institute, has concluded, “The past decade has been a period of stagnation in demand growth for law firm services.”

But a closer reading of the report reveals that it may be too soon to panic. According to the report's methodology, “Demand for 'law firm services' is viewed as equivalent to total billable hours recorded by firms during a specified period.” To reiterate a point I made in a previous column, “Falling demand for Big Law services is not the same as falling demand for all legal services.” The missing demand growth cited in the Thomson Reuters/Georgetown report only refers to legal services from law firms. Demand for legal services more broadly is safe and sound.

Now, back to the case at hand: the missing demand for services from law firms. Let's start by examining how we know it's missing and where it might have gone. The fact that demand is being measured in terms of total hours billed by law firms is significant for two reasons: one that is not so good for law firms, and one that might contain a hidden silver lining.

First things first: the bad news.

As I've stated before, the total number of hours billed by law firms on a year-over-year basis may be stagnant or trending downward, and the data provided via Thomson Reuters Peer Monitor support that claim. But the demand for legal services is not stagnant. Law departments have money to spend, and in an increasingly complex and unpredictable business environment, the businesses they serve need legal guidance.

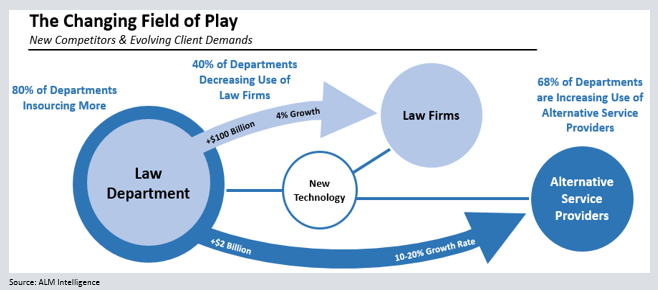

My colleagues at ALM Intelligence, Daniella Isaacson and Nicholas Bruch, touched on this very point during their terrific opening presentation on the State of the Legal Industry at ALM's Legalweek, The Experience conference in late January. Speaking to the graphic below and commenting on the changing field of play in the legal market, Daniella and Nick identified three prime suspects in the case of missing demand for law firm services: law department insourcing; alternative service provider (ASP) outsourcing; and new technology.

We all know that law departments are in the midst of completely rethinking their approach to how they procure legal services. (For additional information on this topic, see the recent ALM Intelligence report Build or Buy? The Evolution of Law Department Sourcing.) According to ALM Intelligence survey data, 40% of law departments say they are decreasing use of outside counsel. Double that say they plan on moving in-house work that was previously sent to outside counsel. Further, more law departments are moving high-value work in-house. When departments are outsourcing, they are using a wider range of providers. (Over 70% are leveraging ASPs.) Meanwhile, technology sits in the middle, enabling all the players to create new efficiencies that could ultimately reduce the number of hours billed by law firms.

Upon the surface, it seems an open-and-shut case. The demand for law firm services is being siphoned away by new technologies, law department in-sourcing, and new competitors in the form of alternative service providers.

But what if there is more to the story? I mentioned earlier that there was a silver lining for law firms. Think back to the definition of demand for law firm services used by Thomson Reuters/Georgetown in the 2017 Report on the State of the Legal Market. It is the “equivalent to total billable hours recorded by firms during a specified period.” What if the some of the demand — and remember, for these purposes demand is equal to hours billed — isn't missing at all, but rather hiding in the form of alternative fee arrangements (AFAs)?

The Thomson Reuters/Georgetown report even contains a section titled, “The Death of Billable Hour Pricing,” noting that firms are more frequently turning away from the traditional billable hour. ALM Intelligence has data on this too. In the 2016 Law Firm Leaders survey, respondents reported that, on average, 20% of client matters included an AFA component; and that, on average, approximately 14% of the firm work was on a non-billable-hour basis. With that in mind, perhaps when there are reports that demand, as measured by total hours billed, has stagnated, we shouldn't be so surprised given that more and more firms are doing work under fee arrangements that do not rely on billable hours.

However, there may be even more nuance to this story. Many firms engage in the practice of shadow billing (tracking hours billed even in flat-fee AFAs) so it is possible that in some cases those hours are being included in the Peer Monitor data. That said, regardless of the extent to which some of the hours worked by firms may or may not be captured by the Thomson Reuters/Georgetown definition of demand, I wholeheartedly concur with my colleagues when they assert that there is a changing field of play in the legal market.

The good news for all the participants is that lawyers and other professionals with the ability to understand risk and navigate the regulatory landscape are needed more than ever in this complex and ever-changing world of ours. Thus, the outstanding question is, Which players will best adapt to these conditions and deliver a client-centered value proposition in a way that allows them to capture that demand and remain the go-to service provider?

ALM Intelligence Notes:

- Know Thy Lateral Partner Candidate: According to The American Lawyer, in order to better understand the personality and cultural fit of potential lateral hires, some firms are requiring candidates to submit to formal personality and behavioral assessments. For more information on the topic of due diligence in lateral partner hiring, see the recent ALM Intelligence report Minimizing Risk in Lateral Partner Hiring: Effective Due Diligence;

- Intelligence in Your Inbox: Subscribe to the ALM Intelligence Analysts Brief, featuring the latest thinking from our analysts, delivered directly to your inbox.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

5 minute read

'Utterly Bewildering': GCs Struggle to Grasp Scattershot Nature of Law Firm Rate Hikes

NC Attorney Earns Nearly $570K for $3.5M Reverse Discrimination Verdict, Appeal Against Health Care Employer

Trending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250