Intellectual property attorneys advocate for routine, periodic, deep-dive IP audits for any company whose business is based on significant intellectual property. But there are certain times in the life of a company when a meticulous, close-up analysis of the company’s IP portfolio is not an optional exercise but is absolutely essential:

- The company, or a portion of it, or a major asset, is being sold.

- The company is seeking new financing or going public.

- The company is buying another business. (In this case, the primary objective will be to audit the intellectual property of the prospective purchase.)

- There has been a major turnover event, such as a change in management or the departure of key staff.

- The company has received a demand letter on behalf of a competitor challenging a key patent or patents.

Obviously, one of the first tasks of the auditing team will be to closely examine all the intellectual property held by the company, including patents, trademarks and trade secrets. Have maintenance fees—which increase with time–been maintained on all important patents, including international patents, which are often particularly expensive to maintain? Do the patents in place match the products actually being sold?

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

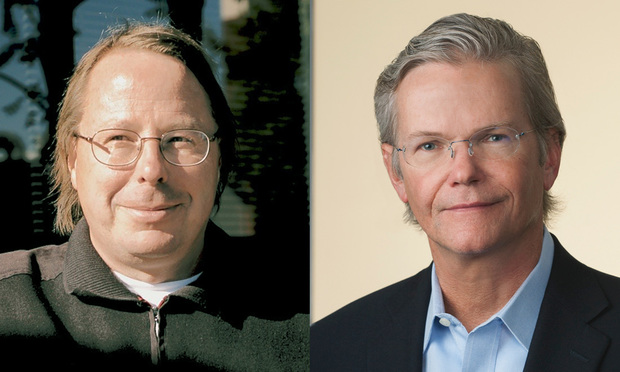

Donald Verplancken and Bruce Patterson, attorneys at Patterson + Sheridan.

Donald Verplancken and Bruce Patterson, attorneys at Patterson + Sheridan.