US law firms took half of the lead roles on Europe's 10 biggest M&A deals in 2016, in a year in which the total value of UK M&A activity more than halved in the wake of the Brexit vote.

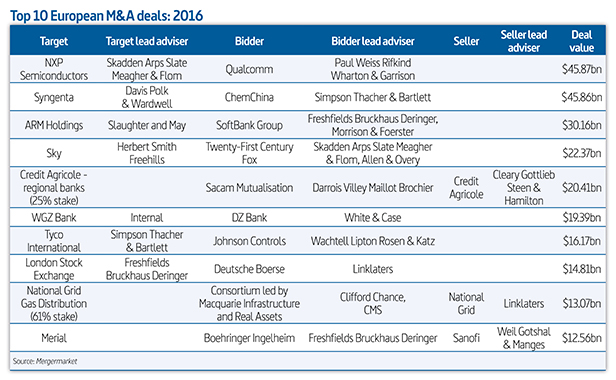

Europe's top 10 deals during 2016 – topped by Qualcomm's $46bn (£37bn) takeover of Netherlands tech company NXP Semiconductors (see full list below) – handed 11 lead roles to US firms, including two each for Simpson Thacher & Bartlett and Skadden Arps Slate Meagher & Flom.

Skadden led for NXP on the Qualcomm deal and also took the key role for 21st Century Fox on its takeover bid for Sky. Simpson Thacher, meanwhile, led for ChemChina on its $46bn (£37bn) bid for Swiss agribusiness Syngenta, and advised Tyco International on its $16.2bn (£13bn) merger with Johnson Controls.

Despite the dominant showing from US firms, Freshfields Bruckhaus Deringer and Linklaters picked up three and two lead roles on the top 10 deals respectively, including acting on opposite sides of the London Stock Exchange-Deutsche Boerse merger.

The findings, based on Legal Week research into Mergermarket's largest deals by value in Europe in 2016, follow a tumultuous year for UK M&A value after the UK voted to leave the European Union in June that year.

Mergermarket's data shows the total value of UK M&A activity more than halved from $415bn (£340bn) in 2015 to $188bn (£160bn), as total deal volume fell by 3.5% to 1,418.

Total European M&A value fell by more than 10% to $797bn (£656bn), although deal volume remained broadly stable, while total global M&A value dropped 18% to $3.24trn (£2.6trn), as volume fell 4% to 17,369.

The largest instruction for Freshfields was representing Japan's SoftBank on its £30.2bn (£24.3bn) bid to acquire UK smartphone chip designer ARM. The deal, which completed in September, was the third biggest deal in Europe last year. It was announced less than one month after the shock Brexit vote, with SoftBank spurred on by a plunge in the pound that followed the vote, making ARM a more attractive target.

As well as its role on the LSE-Deutsche Boerse merger, Linklaters also took a lead role on National Grid's sale of a 61% stake in its gas distribution network to an international consortium of investors.

Trump's strongly pro-business policies and appointments make the US a very attractive market for investment

Commenting on activity levels last year, Linklaters corporate partner Iain Fenn said overseas buyers dominated public transactions in the latter half of 2016. He added: "2016 was strong for us – not quite a game of two halves; a very busy first half, with a little bit of a hiatus through Brexit, then a pickup towards the back end of the year."

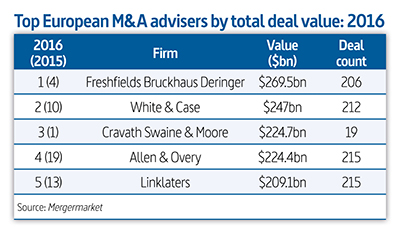

Overall, the top European adviser by value was Freshfields, which acted on 206 deals with a total value of $269.5bn (£215.9bn), with Allen & Overy, Linklaters and Clifford Chance placing 4th, 5th and 6th respectively, behind White & Case and Cravath Swaine & Moore in 2nd and 3rd.

Overall, the top European adviser by value was Freshfields, which acted on 206 deals with a total value of $269.5bn (£215.9bn), with Allen & Overy, Linklaters and Clifford Chance placing 4th, 5th and 6th respectively, behind White & Case and Cravath Swaine & Moore in 2nd and 3rd.

By volume, DLA Piper retained first place with roles in 268 deals worth a total of $75bn (£60.1bn), followed by CMS, A&O and Linklaters.

Globally, White & Case topped the 2016 rankings by total deal value, advising on 319 deals worth a combined $665bn (£534bn), placing it ahead of Sullivan & Cromwell and Davis Polk & Wardwell, while DLA also topped the global rankings by volume, after advising on 473 deals during the year.

Outlook for 2017

Looking ahead, M&A partners are expecting the new US administration to be positive for the global market, with an expectation of 'big-ticket' foreign takeover deals in the UK due to the falls in sterling and a rise in European investment into the US.

Freshfields US corporate head and global M&A co-head Matthew Herman said: "We think the US M&A market will continue to be very robust, with the new administration likely to be more positive for M&A overall. We believe that the increase in activism in Europe will continue, and that will drive transactions, as will bullishness in the boardroom from the best placed corporates."

Fellow M&A co-head Bruce Embley said several European corporates have "a lot of cash and debt still readily available for the right deals".

Scott Simpson, co-head of the global transactions practice at Skadden Arps Slate Meagher & Flom, told Legal Week-affiliated publication Focus International last month that Brexit could lead to an increase in outbound M&A activity in 2017 from Europe, as corporations seek to increase their exposure in the US and other less volatile markets. "We're in a period where people are just trying to recalibrate," he said. "The uncertainty in Europe isn't going to go away for a while, whereas the US is likely to be a growth engine."

White & Case global M&A head John Reiss said: "Donald Trump's strongly pro-business policies and appointments make the US a very attractive market for investment, and we believe the perceived strength of the US will encourage increased confidence, leading to continuing heavy interest in complex, cross-border M&A on a global basis."

Fenn highlighted Chinese interest and South African interest in the UK. "As the pound is cheaper, a certain number of European clients have been also been looking at opportunities and we expect they will continue to do so," he said.

Despite some positive signs, Herman concluded that "much more work" needs to be done to avoid deals falling through. "Our optimism is tempered by the historically high levels of failed deals last year, emphasising the need for that much more work done upfront – either ahead of approach or prior to signing and announcement," he added.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Be Prepared and Practice': Paul Hastings' Michelle Reed Breaks Down Firm's First SEC Cybersecurity Incident Disclosure Report

Big Law Practice Leaders Gearing Up for State AG Litigation Under Trump

4 minute read

Deal Watch: Private Equity Dealmakers Make 2025 Predictions Amid Deal Resurgence

12 minute readTrending Stories

- 1Greenberg Traurig, Holland & Knight Leaders Expect AI Investments to Jump in 2025

- 2NY Lawmaker Eager to Advance 'Weinstein Bill' in 2025 to Open Door to Evidence of Prior Sexual Offenses

- 3AI's Place in Big Law Broadens, As Firms Embrace Fresh Uses of the Technology

- 4Critical Mass With Law.com’s Amanda Bronstad: First Lawsuits Over Los Angeles Wildfires Name Edison, J&J Talc Trial in Los Angeles Delayed As Fires Rage

- 5Five Key Predictions on How AI Will Reshape Law Firms in 2025

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250