Skadden and Davis Polk top M&A rankings for Q1-Q3 as deal volumes fall to four-year low

European deal volumes fall to lowest quarterly total since first quarter of 2013

October 05, 2017 at 05:34 AM

5 minute read

The original version of this story was published on Law.com

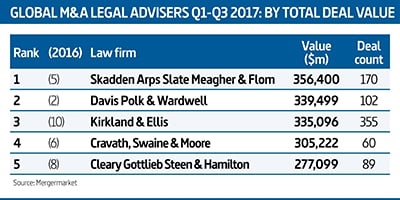

Skadden Arps Slate Meagher & Flom and Davis Polk & Wardwell have secured top spots in the M&A rankings by deal value for the first three quarters of 2017.

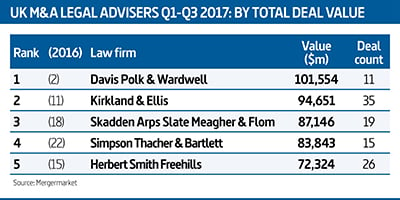

Figures from Mergermarket put Skadden at the top of the table by total global deal value for Q1-Q3, with Davis Polk leading the European and UK rankings after a subdued third quarter which saw global, European and UK deal volumes fall to four-year lows.

During the first nine months of the year, Skadden advised on 170 deals worth a total of $356.4bn (£268.7bn), placing it ahead of a clutch of US rivals (see table, right).

During the first nine months of the year, Skadden advised on 170 deals worth a total of $356.4bn (£268.7bn), placing it ahead of a clutch of US rivals (see table, right).

Davis Polk took first place in the UK rankings after acting on 11 deals worth a total of $101.6bn (£76.6bn), while in Europe, the US firm advised on 29 deals worth $216.4bn (£163bn).

Total global deal values and volume for the quarter were significantly down on Q3 last year, with total deal value falling 23% to $674bn (£508bn) and volume dropping 16% to 3,772, the lowest quarterly total since Q3 2013.

Skadden New York M&A head Stephen Arcano commented: "Deal activity has been healthy this year, despite some initial hesitation early in the year as the market assessed potential implications for policy, economic and regulatory changes. The pace of activity generally seemed to pick up over the course of the year.

Skadden New York M&A head Stephen Arcano commented: "Deal activity has been healthy this year, despite some initial hesitation early in the year as the market assessed potential implications for policy, economic and regulatory changes. The pace of activity generally seemed to pick up over the course of the year.

"While deal activity has been strong, we have seen fewer of the so called 'mega deals' this year. For companies that are considering strategic acquisitions, it may be that it's easier for them to move ahead notwithstanding some of the geopolitical and policy-related uncertainties if they're not pursuing a 'bet the company' kind of deal."

The total value of UK deals during the quarter was 20% down on the equivalent period last year, with just 326 deals – down 6% year on year – representing the least active quarter since Q1 2014.

Deal count in Europe, meanwhile, fell 16% year on year to 1,428, the lowest quarterly total since Q1 2013.

Only two UK firms made the top 10 European advisers by value: Freshfields Bruckhaus Deringer and Linklaters, while Clifford Chance (CC) and Herbert Smith Freehills secured top 10 places in the UK value rankings.

Freshfields Bruckhaus Deringer, which was top for both European and UK M&A by value for Q1-Q3 last year, has dropped to third and 11th place respectively this year. Meanwhile, Slaughter and May fell seven places to 19th in Europe and from fourth place to 13th in the UK.

Despite this, Allen & Overy corporate co-head Richard Browne (pictured) said the market "remains very strong". He added: "Any political or economic upheaval should theoretically have a dampening effect on the M&A markets, but there have been a lot of surprising events this year and the market has remained very stable. I'm not sure if people are more tolerant of those sort of risks being out there, but it hasn't had a knock-on effect as yet."

Despite this, Allen & Overy corporate co-head Richard Browne (pictured) said the market "remains very strong". He added: "Any political or economic upheaval should theoretically have a dampening effect on the M&A markets, but there have been a lot of surprising events this year and the market has remained very stable. I'm not sure if people are more tolerant of those sort of risks being out there, but it hasn't had a knock-on effect as yet."

Other top performers include Kirkland, which advised on 355 global deals during the nine-month period, second only to DLA Piper on 400.

Other top performers include Kirkland, which advised on 355 global deals during the nine-month period, second only to DLA Piper on 400.

Kirkland also ranked fifth by value in Europe, having advised on 69 deals worth $133.8bn (£100.9bn) and second in the UK value rankings, after acting on 35 deals worth $94.7bn (£71.4bn).

Kirkland City corporate partner Gavin Gordon said: "We have continued to see a lot of US inbound investment in Europe, as well as a robust private equity market, both of which play to our strengths. Looking forward, the pipeline continues to feel strong, particularly in sectors like healthcare and fintech."

The top European deal of Q1-Q3 by value was US industrial group Praxair's $45.5bn merger with German chemicals group Linde. The deal handed lead roles to Cravath, Linklaters and Hengeler Mueller for Linde, and Sullivan & Cromwell for Praxair. Other major US acquisitions in Europe included Johnson & Johnson's $33.1bn purchase of Switzerland's Actelion Pharmaceuticals, which saw Slaughters, Cravath and Freshfields take key roles.

In the UK, the largest deal during the period was Blackstone's €12.25bn (£10.7bn) sale of its European warehouses and logistics business Logicor to China Investment Corporation, which handed lead roles to CC and Simpson Thacher & Bartlett.

As well as topping the global deal volume rankings for Q1-Q3, DLA also retained the top spots for volume in Europe (254 deals) and the UK (82 deals), ahead of second-placed CMS in both instances.

As well as topping the global deal volume rankings for Q1-Q3, DLA also retained the top spots for volume in Europe (254 deals) and the UK (82 deals), ahead of second-placed CMS in both instances.

DLA global corporate head Robert Bishop (pictured), said: "Although the first half this year has been better in value terms, it has been worse in volume terms and that has intensified into Q3. I think there is less opportunistic buying than there was in the second half of last year, when people were taking advantage of the weaker sterling."

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Big Law Sidelined as Asian IPOs in New York Are Dominated by Small Cap Listings

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute read

Trending Stories

- 1Blank Rome Adds Life Sciences Trio From Reed Smith

- 2Divided State Supreme Court Clears the Way for Child Sexual Abuse Cases Against Church, Schools

- 3From Hospital Bed to Legal Insights: Lessons in Life, Law, and Lawyering

- 4‘Diminishing Returns’: Is the Superstar Supreme Court Lawyer Overvalued?

- 5LinkedIn Accused of Sharing LinkedIn Learning Video Data With Meta

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250