Bryan Cave posts falling revenue and partner profits for last full year before BLP merger

US firm pins hopes on pending BLP tie-up to turn around financial performance

March 05, 2018 at 02:48 PM

3 minute read

The original version of this story was published on Law.com

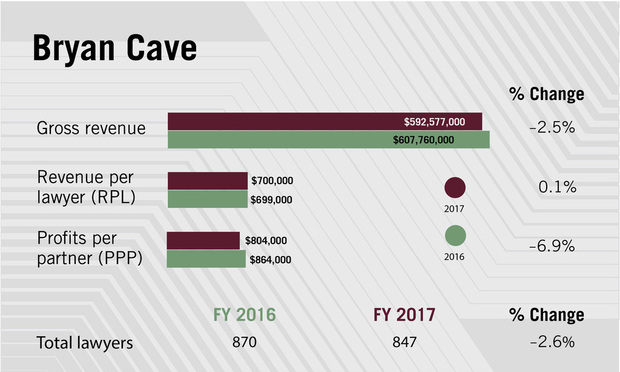

Bryan Cave saw both revenue and profit per equity partner (PEP) dip in its last full financial year before its merger with Berwin Leighton Paisner (BLP), a deal the US firm is expecting to turn its financial performance around.

The St Louis-based firm firm saw gross revenue dip 2.5% to $592.6m in 2017, as PEP fell nearly 7% to $804,000. Revenue per lawyer remained flat at $700,000.

Bryan Cave's top-line figure has now fallen four straight years by a total of 7.8% since it topped out at $643m in 2013.

A firm spokeswoman issued a brief statement noting that Bryan Cave is "very pleased" with the "extremely strong" financials.

A firm spokeswoman issued a brief statement noting that Bryan Cave is "very pleased" with the "extremely strong" financials.

A decrease in mortgage litigation work and slightly shrinking headcount (down 2.6% to 847 lawyers) partly accounted for the gross revenue dip, the statement said.

"We expect the pending combination with BLP to grow revenues and boost profitability as a direct result of our improved ability to provide our clients with broader and deeper legal services," said Bryan Cave in its statement.

This year will be the last set of financial figures reported by Bryan Cave before it becomes Bryan Cave Leighton Paisner (BCLP). That merger is expected to create a combined firm of some 1,600 lawyers with more than $900m in gross revenue.

A firm with $900m in gross revenue last year would have ranked 37th in the most recent Am Law 100 list and 44th in the Global 100 rankings, directly between McDermott Will & Emery and Milbank Tweed Hadley & McCloy in both tables.

For its part, BLP saw revenue rise 7% to £272m (roughly $376m at current exchange rates) during 2016-17, its last full financial year, as PEP fell nearly 8% to £630,000 ($871.000).

Bryan Cave last year trimmed its non-equity partner ranks by 6.2%, down to 166. The firm's equity partner ranks grew by 2.5% to 204, up from 199 the year before, helping to explain some of the PEP decrease.

BLP's partners will be interested in that figure, as the combination they are entering into is one of the few fully financially integrated transatlantic law firm mergers. In an earlier interview, Bryan Cave chair Therese Pritchard said the single-profit pool structure made it easier to reward partners for working together across geographies than a Swiss verein construction.

"In our mind it provides the incentives to find the best people in the firm to service the clients' needs," Pritchard said. "And we think at the end of the day that is a better way to operate. We are all in it together."

- Submissions are now being accepted for the Transatlantic Legal Awards 2018, which recognise excellence in transatlantic legal work, as well as innovation, pro bono work, strategic thinking and in-house excellence. The winners will be announced at a gala dinner in London on 14 June. Click here for more information on the event.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A Plan Is Brewing to Limit Big-Dollar Suits in Georgia—and Lawyers Have Mixed Feelings

10 minute read

HUD Charges Texas HOA With Housing Discrimination in Last Days of Biden Administration

5 minute read

Trending Stories

- 1Litigators of the Week: A $630M Antitrust Settlement for Automotive Software Vendors—$140M More Than Alleged Overcharges

- 2Litigator of the Week Runners-Up and Shout-Outs

- 3Linklaters Hires Four Partners From Patterson Belknap

- 4Law Firms Expand Scope of Immigration Expertise, Amid Blitz of Trump Orders

- 5Latest Boutique Combination in Florida Continues Am Law 200 Merger Activity

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250