Covington boosts City revenues by 16% as King & Spalding sees PEP pass $2.5m for first time

Covington raises City revenues to more than $80m as King & Spalding sees City top line inch up 1%

March 06, 2018 at 02:14 PM

6 minute read

The original version of this story was published on Law.com

Covington & Burling boosted revenue by more than $100m last year while opening new offices in United Arab Emirates and South Africa, with the firm's London base posting double-digit growth to pass the $80m mark.

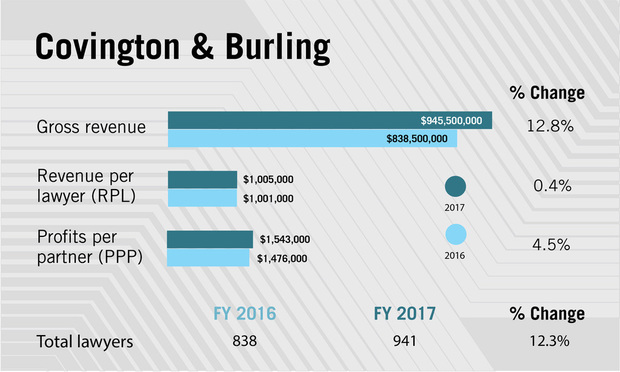

According to preliminary ALM data, firmwide revenue jumped nearly 13% in 2017, reaching $945.5m. Profits per equity partner (PEP) rose 4.5% to more than $1.5m.

Revenue per lawyer (RPL) increased by less than 1% to $1m, as the firm added more than 100 total lawyers, boosting its headcount by 12.3%.

Covington enjoyed a successful year in London, boosting its top line by 16% from $69.5m last year to $80.5m.

The US firm bolstered its London office with the hires of former Chadbourne partners Agnieszka Klich and Ben Donovan, international partners Ursula Owczarkowski, Li Zhang and Julie Scotto, who joined as of counsel, as well as King & Wood Mallesons' former Europe head of fraud and investigations Ian Hargreaves and former global head of disputes Craig Pollack, who joined in January, and project finance partner David Miles who joined from Allen & Overy in April.

"When I look at the numbers, we don't run the firm on these year-over-year numbers," said Timothy Hester, Covington's chairman. "Our approach has been to be very distinctive."

Hester attributed the firm's financial growth to its geographical footprint and its practice mix, and he said it is following a long-term growth strategy aimed at addressing clients' global needs.

Hester attributed the firm's financial growth to its geographical footprint and its practice mix, and he said it is following a long-term growth strategy aimed at addressing clients' global needs.

On the international front, Covington added offices in Dubai and Johannesburg last year, after hiring four partners from Chadbourne & Parke before Chadbourne's merger with Norton Rose Fulbright. The project finance partners brought a team of approximately 25 associates and counsel along with them.

Overall, Covington counted nine more equity partners in 2017 than in the previous year. Hester emphasised that the firm is focused on building the younger half of its partnership through internal promotions. The firm has also increased its associates' starting pay in the last two years.

Covington's white-collar practice has handled several prominent cases, and Hester said the practice is at the "top of its game". The firm guided Takata to its $1bn agreement with the US Justice Department over defective airbags. Covington partner Eric Holder, former US attorney general in the Obama administration, also investigated allegations of sexual harassment and workplace hostility at Uber.

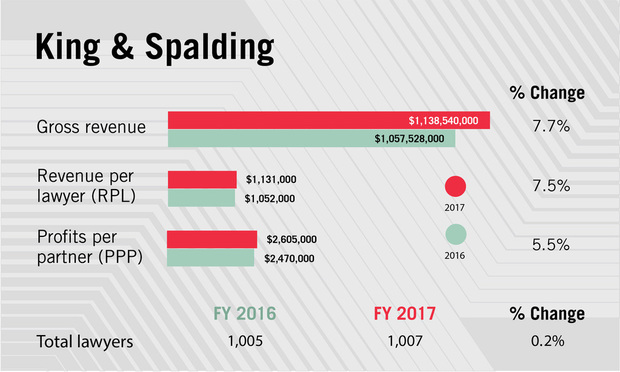

Meanwhile, King & Spalding has posted firmwide revenues of $1.14bn for 2017, a 7.7% increase on 2016, with PEP jumping 5.5% to $2.6m, breaking the $2.5m mark for the first time.

Net income rose 4.3% to $505.1m, pushing up average revenue per lawyer (RPL) by 7.5% to $1.13m.

In London, the US firm's turnover inched up by just 1%, rising from $42.6m last year to $43.1m. New City chief Thomas Sprange QC recently set out the firm's plans for London growth in practices including white-collar crime, corporate and energy.

2017 highlights for the firm included the launch of a Chicago office, as well as a number of notable hires in New York, Houston and elsewhere. Even so, chairman Robert Hays said the firm could have done even better.

"It was not spectacular in terms of the numbers. It was strong, though," Hays said. "I think my partners would agree with me that we could have actually done better. The first half of the year was not as good as I'd hoped, but that changed in the second part of the year."

"It was not spectacular in terms of the numbers. It was strong, though," Hays said. "I think my partners would agree with me that we could have actually done better. The first half of the year was not as good as I'd hoped, but that changed in the second part of the year."

Hays said revenue and net income in the first half of 2017 were higher than for the prior year but not at the targeted levels. (In 2016, revenue increased by 3.8%, and net income increased by 8.2%.)

"Admittedly, we err on the side of an aggressive budget," he added.

At mid-year, Hays said, he and his partners "did some reflection, so that we were competing in a way that was closer to what we had budgeted and expected". He added: "I'm proud to say that at year-end we met budget because we dug down the second half of the year."

One major engagement – defending Equifax in its massive data-breach litigation – popped up in the second half of the year. Equifax engaged King & Spalding at the beginning of August after a hack exposed personal information reported to affect at least 145 million Americans, as well as about 400,000 consumers in the UK.

The Equifax role came after previous large cases defending Home Depot in customer data breach litigation and General Motors over faulty ignition switches wound down in 2016.

King & Spalding raised rates last year in the 3%-4% range, Hays said. "We are off to a better start [of the year] than we've ever had," he said, in terms of demand as measured by accrual hours.

Headcount remained flat at 1,007 lawyers on average last year, while partner count also kept nearly constant. King & Spalding reported 194 equity partners last year, down from 196 in 2016, and had 398 total partners, up from 396, after making 31 lateral hires last year.

In a surprise coup, the firm convinced Zach Fardon, the former US attorney for the Northern District of Illinois, to launch a new Chicago office for the firm instead of returning to Latham & Watkins, where he had been a partner. That office is up to nine lawyers, so far focused on litigation and the firm's marquee government investigations practice.

King & Spalding stepped up its corporate game in New York, recruiting M&A hotshot James Woolery to head its M&A and corporate governance practice, while the firm lost a number of partners to the Trump administration and other government posts, most notably FBI Director Chris Wray, who had headed its government investigations practice.

As King & Spalding expands elsewhere, the percentage of lawyers based in Atlanta continues to shrink – down to less than 40% of the firm's 1,000-plus lawyers.

The new Chicago office gives King & Spalding 20 offices in the US and abroad, but Hays said the firm's primary goal is to grow in its existing offices, not open new ones.

"We're eager to double down on the strengths of the trial practice," Hays said, adding that the firm has been able to build its top-ranked international arbitration practice on those roots. "We want to grow further in the area of global disputes."

Expanding the firm's government investigations practice and its transactional practices in corporate finance and investments, which Hays noted have "picked up considerably in the last couple of years", are two other broad areas of emphasis.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A Plan Is Brewing to Limit Big-Dollar Suits in Georgia—and Lawyers Have Mixed Feelings

10 minute read

HUD Charges Texas HOA With Housing Discrimination in Last Days of Biden Administration

5 minute read

Trending Stories

- 1Litigators of the Week: A $630M Antitrust Settlement for Automotive Software Vendors—$140M More Than Alleged Overcharges

- 2Litigator of the Week Runners-Up and Shout-Outs

- 3Linklaters Hires Four Partners From Patterson Belknap

- 4Law Firms Expand Scope of Immigration Expertise, Amid Blitz of Trump Orders

- 5Latest Boutique Combination in Florida Continues Am Law 200 Merger Activity

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250