Kirkland Overtakes Latham as World's Biggest Firm by Revenue

There's a new leader atop the Am Law 100. Kirkland & Ellis has surpassed Latham & Watkins as the world's largest law firm, as determined by gross revenue.

March 21, 2018 at 03:07 PM

6 minute read

The original version of this story was published on The American Lawyer

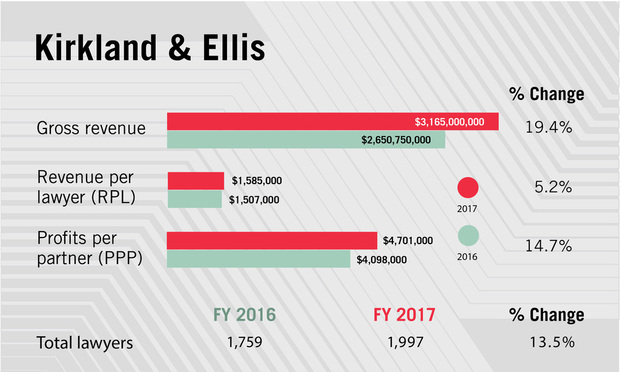

Kirkland & Ellis has dethroned Latham & Watkins as the world's largest law firm by gross revenue after growing its top line by 19 percent last year, to $3.165 billion, according to preliminary data and analysis by ALM.

The American Lawyer reported last month that Latham boosted gross revenue by 8.5 percent in 2017, to $3.064 billion, about $100 million shy of Kirkland's new record. The two firms are the first to cross the $3 billion threshold in the history of the Am Law 100.

Kirkland also saw its profits per equity partner rise nearly 15 percent last year, to $4.7 million, a number topped by only two firms in the last Am Law 100: Wachtell, Lipton, Rosen & Katz and Quinn Emanuel Urquhart & Sullivan. Both those firms had PPP of over $5 million for fiscal 2016.

A main driver of Kirkland's growth was its significant increase in head count, which rose 13.5 percent, to 1,997 lawyers. Even still, the firm's premium practice groups, including litigation, private equity, public M&A and restructuring were able to keep those bodies busier than in years past, as revenue per lawyer rose 5.2 percent, to $1.585 million.

The firm, which had $2.65 billion in gross revenue in 2016, declined to comment on its financial performance in 2017.

A Kirkland spokeswoman also declined to comment Wednesday on a report by legal newswire Law360 that claimed Kirkland lawyers were contacted by a woman looking for legal representation related to a confrontation with now former Latham global chairman and managing partner William Voge. Voge resigned from the firm Tuesday following sexually-charged communications he allegedly had with a woman that led to Latham issuing a statement about “lapses in personal judgment” that made his leadership of the firm “untenable.”

A Kirkland spokeswoman also declined to comment Wednesday on a report by legal newswire Law360 that claimed Kirkland lawyers were contacted by a woman looking for legal representation related to a confrontation with now former Latham global chairman and managing partner William Voge. Voge resigned from the firm Tuesday following sexually-charged communications he allegedly had with a woman that led to Latham issuing a statement about “lapses in personal judgment” that made his leadership of the firm “untenable.”

For a firm that has not engaged in a major merger—Kirkland added 17 lawyers through its acquisition of elite appellate boutique Bancroft in 2016—the Chicago-based legal giant has been on a nearly unparalleled trajectory over the past five years.

Since crossing the $2 billion mark in fiscal 2013, Kirkland's gross revenue has now grown 57 percent. Its head count during that span has grown 28 percent and its PPP has surged 43 percent. The firm's revenue per lawyer has increased, on average, 4.4 percent per year dating back to 2013. (Kirkland, which a year ago changed its framework for allocating equity partner profits, is known for having a large class of nonequity partners.)

Notably, the firm, led since early 2010 by Chicago-based corporate lawyer Jeffrey Hammes, has invested in some of the highest-priced geographies and practice groups.

Kirkland's fastest-growing offices include London, which has grown 61 percent since 2013, to 189 lawyers last year; New York, where head count is up 42 percent over the past five years, to 503 lawyers; San Francisco, up 36 percent since 2013, to 126 lawyers; and Houston, where the firm now has 107 lawyers since setting up shop in 2014.

The firm's decadelong transformation into a transactional powerhouse continued with one of its strongest years in private equity and public company M&A work. Kirkland's M&A team ranked No. 4 by the value of the deals it advised on in 2017, according to data compiled by Mergermarket. Kirkland also advised on more transactions (489), than any other firm, and saw the largest increase in the value of the deals it advised on from the previous year (up 63.5 percent in 2017, to $432 billion).

Some of the firm's biggest public M&A deals included advising Mead Johnson Nutrition Co. on its $17.9 billion acquisition by U.K.-based Reckitt Benckiser Group plc and Equity One Inc. on its $15.6 billion stock-for-stock merger with Regency Centers Corp.

In the private equity market, where Kirkland has long been a top player, the firm handled almost twice the number of deals (304) than its closest competitor, Latham (159), according to Mergermarket. Kirkland also led on the value of those deals, at $131.6 billion—up 12 percent from the prior year.

Kirkland's private equity practice was bolstered with the opening of a Boston office, where it has since recruited well-known private equity partners from firms with well-established practices in the city, such as Choate, Hall & Stewart, McDermott Will & Emery and Ropes & Gray.

The firm's vaunted restructuring practice also had another solid year, representing the debtor in three of the four largest Chapter 11 bankruptcies filed in 2017, according to BankrtuptcyData, which tracks bankruptcy filings. That work included representing deep water drilling firm Seadrill Ltd., struggling retailer Toys “R” Us Inc. and telecommunications company Avaya Inc. Other large restructuring deals include engagements for 21st Century Oncology Holdings Inc., Cobalt International Energy Inc., Payless ShoeSource Inc. and The Gymboree Corp.

Kirkland's two-plus-year representation of gaming giant Caesars Entertainment Operating Corp. also came to an end last year after the firm earned more than $70 million in fees from that Chapter 11 case alone.

On the litigation front, Kirkland argued seven cases in front of the U.S. Supreme Court, and helped clients to 34 victories at trial and 93 appellate wins. The results were propelled by a stellar year from James Hurst, a high-profile lateral hire from Winston & Strawn in late 2014, who won six cases at trial.

Kirkland was again aggressive on the lateral hiring front last year.

In August, a five-partner team on three continents came to Kirkland from Ropes & Gray, led by the latter's former global anti-corruption and international risks co-chair Asheesh Goel in Chicago and New York-based securities and futures enforcement co-head Zachary Brez. Several other Ropes & Gray lawyers subsequently joined Kirkland following that move.

In December, David Higgins, a high-powered private equity partner, joined Kirkland as co-managing partner of its London office from Freshfields Bruckhaus Deringer. Higgins reportedly received a $10 million payday to leave the Magic Circle firm.

Kirkland made another splash in the lateral market at year's end by bringing aboard a team of lawyers from Debevoise & Plimpton in New York led by Erica Berthou, the former global head of the investment management and funds group at Debevoise, and Jordan Murray, a former deputy corporate chair at the firm.

Kirkland has set itself up for another growth year after starting 2018 with a slew of lateral hires, including hiring its third partner from Cravath, Swaine & Moore in M&A expert Eric Schiele in New York, as well as Jennifer Perkins, a former global co-chair of Latham's private equity practice in the city.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Am Law 100 Partners on Trump’s Short List to Replace Gensler as SEC Chair

4 minute read

Trending Stories

- 1The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 2Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 3As Litigation Finance Industry Matures, Links With Insurance Tighten

- 4The Gold Standard: Remembering Judge Jeffrey Alker Meyer

- 5NJ Supreme Court Clarifies Affidavit of Merit Requirement for Doctor With Dual Specialties

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250