UnitedLex-GE Deal: Barbarians at Big Law's Gate (or ... Meh)?

UnitedLex and GE recently announced a huge outsourcing deal. What does it mean for the future of the legal market?

March 29, 2018 at 04:31 PM

7 minute read

UnitedLex Corp.'s agreement with General Electric Co. has the industry buzzing (see here, here, and here). As is my style, my take on this development is fashionably late. Nevertheless, it is still served scorching hot.

Is the arrangement another sign that Big Law's days are numbered? Probably not. Is it still a big deal? Sort of, and here's why.

First, this is unmistakably a big catch for UnitedLex. GE, once a global behemoth, recently posted market value less than that of Netflix, Inc. While the company as a whole may have lost some luster – especially to investors (GE's share price has fallen more than 58 percent over the past year) – its legal department is still held in high regard, arising out of the lasting legacy of its forward-thinking general counsel from 1997 to 2004, Ben Heineman Jr. Seeing that GE has blessed this type of arrangement, others will likely follow suit.

Second, are the implications for the broader legal services market. Much has been made over in-sourcing trends and the rise of the corporate legal departments. And those remain consequential. But, what is also true is that trend always has had a ceiling.

In-house departments are not driven by profit or revenue growth. Most companies don't want to be in the law firm business, and most legal departments don't want to be in the technology business, either. In-house legal departments don't exist to perpetuate themselves. Success for them is something different; they exist as a tool to serve the strategic goals for, and mitigate the risk of, the business.

That's why the UnitedLex-GE deal is significant. It's a clear signal what clients want is value. A term that, in a recent piece, Casey Flaherty, legal operations consultant and founder of the legal technology consultancy Procertas, rightly described as “nebulous” and defined as “not what customers say they want” but as “what customers actually buy.”

It's correct to conclude that different circumstances can lead to different approaches. That's why the Big Law (traditional law firms) vs. New Law (including ALSPs like UnitedLex, and others) story isn't zero sum game. The bottom line is the needs of law departments and the businesses they serve can vary. So, the question for outside providers is which needs do they want to support.

New Law Movement Blossoms

What's also clear is that the rise of alternative legal services providers (ALSPs) has been extraordinary. Elevate, the most widely used ALSP, according to a recent survey by the Corporate Legal Operations Consortium (CLOC), only launched in 2011. The following year Lawyers on Demand (LOD) was spun out of Berwin Leighton Paisner to become its own standalone business.

We started hearing rumblings of IBM Watson entering the legal industry in 2014, and in 2015, Axiom broke the $250m per year revenue barrier. Just last year, UnitedLex, made waves when it inked a deal similar to the GE agreement with DXC Technology Co [DXC was formed in April 2017 as the result of a merger between Computer Sciences Corp. (CSC) and the Enterprise Services business of Hewlett Packard Enterprise (HPES)].

DXC's UnitedLex Engagement

So what did DXC value in its UnitedLex deal? According to reporting by Sue Reisinger for Corporate Counsel, who spoke to William Deckelman, GC at DXC, it wanted the opportunity to maintain quality while significantly reducing spending.

And, by Deckelman's account, that goal has been achieved. In his conversation with Corporate Counsel, Mr. Deckelman stated that “[DXC] is still doing the same amount of high quality work with 40 percent fewer resources.”

As a practical matter, what did that mean for DXC's in-house legal department? Since the deal was announced in December of last year, it has meant a massive reduction in headcount. Mr. Deckelman told Corporate Counsel that DXC's in-house lawyer count was reduced by approximately 400 attorneys, and as a result, the unit is currently one quarter the size it was prior to the UnitedLex agreement.

Nearly 60 percent, or 225 of those 400 attorneys, still perform work for DXC. They were re-badged to UnitedLex at the same salary, Deckelman emphasized. Thus leaving 175 attorneys who no longer work for DXC and were not taken on by UnitedLex.

Value Propositions

With the GE deal, and the DXC one before it, we have solid evidence that the movement to in-source legal work has limitations. The fact remains that most businesses have few incentives to supplement their core mission with a side hustle running a mini, internal law firm that is largely a cost center. To that end, legal work will be in-sourced so long as it makes business sense to do so.

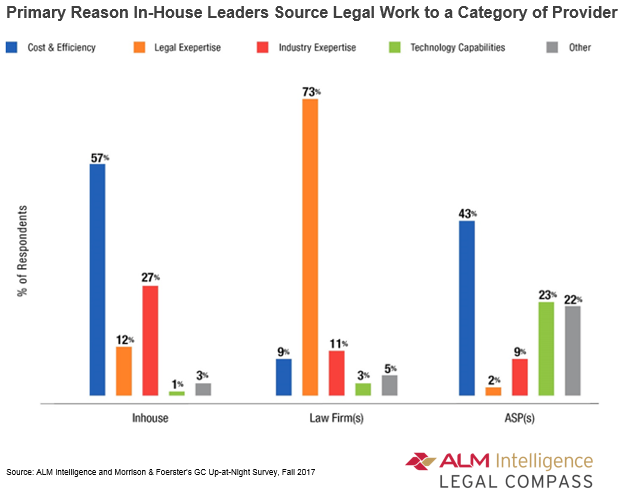

What is notable, though perhaps it shouldn't be, is that ALSPs like UnitedLex are best positioned to win work that was previously in-sourced. This was reflected in responses to the GC Up-at-Night survey recently fielded by ALM Intelligence in partnership with Morrison & Foerster.

According to the survey (see chart below), there is much more cross-over in the value proposition being presented between ALSPs and internal legal departments than that between ALSPs and law firms. This would suggest that, currently, ALSPs are more likely to take work that was already in-sourced than to steal work that was previously being sent to outside counsel.

In-house leaders, the survey results demonstrate, turn to outside counsel, not for reasons of cost or efficiency, but when they need legal experts to help them navigate complex, high stakes issues. Law firms leaders would be wise to take a hard look at how they stack up to their competition in terms of expertise and experience.

Does this mean New Law is not a threat to Big Law? I'd argue that law firms still should watch their backs.

Market Free-for-All

Axiom, another prominent ALSP, recently launched a Brexit AI tool. Commenting about the move on Twitter, Ron Friedmann, a partner at Fireman & Co. and a Fellow in The College of Law Practice Management, wryly mused whether Axiom was taking business that law firms never wanted in the first place.

But, there are law firms that want that business. Mayer Brown, for example, launched a Brexit toolkit in September 2016 and Hogan Lovells offers one too. And, don't forget about the Big Four. Deloitte also wants in on the Brexit business.

That said, Friedmann's point is well-taken. Some firms get so wrapped-up in the myth of their unique ability to provide superior expertise that begin to believe they are beneath focusing on legal solutions that are deemed “low value” or “commoditized.”

To those firms, I offer a word of caution. Nearly every market has room for elite, high-end service providers, but not every firm has the capacity to fill that role. Ignoring the day-to-day concerns of law departments to focus solely on bet-the-company matters is a risky proposition.

So, what does this mean for the significance of the UnitedLex-GE agreement? The deal certainly isn't “meh.” It just another sign that today's legal market is messy, or to use market analyst and blogger Jordan Furlong's terminology, multi-polar. At this stage, no single group of players, whether Big Law, New Law, in-house departments, or the Big Four have the upper-hand. Within each group, there are, however, individual organizations that are succeeding because they are focused on delivering value.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

SEC Puts Beat Down on Ex-Wrestling CEO Vince McMahon for Not Reporting Settlements

3 minute read

After Solving Problems for Presidents, Ron Klain Now Applying Legal Prowess to Helping Airbnb Overturn NYC Ban

7 minute read

Big Company Insiders See Tech-Related Disputes Teed Up for 2025

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250