The Big Four Are at the Door - And They're Better at Meeting the Future Needs of Your Clients

Read the introduction of ALM Intelligence's report on how the Big Four meet client needs

April 12, 2018 at 01:04 PM

3 minute read

Below is the introduction of The Big Four Are at the Door – And They're Better at Meeting the Future Needs of Your Clients. The full report is available on the ALM Intelligence website.

ALM published its Elephants in the Room series beginning in late 2017, diving into the expansion of the Big Four — Deloitte, EY, KPMG, PwC — into the U.S. and U.K.-dominated legal industry, and examining the future of these organizations in that legal industry, with a focus on three strategic scenarios:

- Deepening Focus on Legal Services with an Accounting or Consulting Overlap: The legal arms of the Big Four could remain in their current form – ancillary businesses designed to support the core tax and advisory arms.

- Expanding into a “Full Service” Offering: The Big Four could expand into a wider range of legal services and transform their legal arms' capabilities into standalone businesses similar to their current tax and consulting offerings. Such a move would bring them into direct competition with leading law firms.

- Developing a Managed Legal Service Offering: The Big Four could develop a range of managed legal services similar to the current offerings of alternative legal service providers.

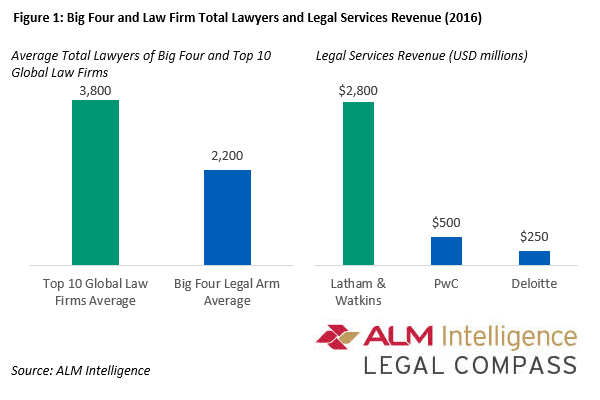

The Elephants series also compared the Big Four to traditional law firms, which resulted in some interesting findings. While these four organizations certainly are comparable to top global law firms in headcount, their revenue earned from legal services is nowhere near the highest-earning law firms. For example, Latham & Watkins' 2016 legal services revenue was almost six times that the largest of the Big Four, PwC, and still far more than all of the Big Four combined (Figure 1).

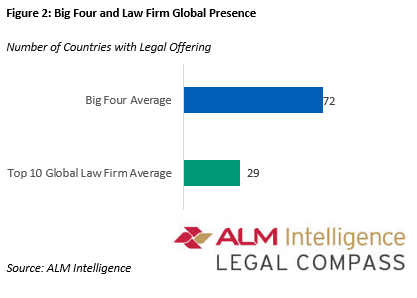

This drastic contrast in revenue has counter-intuitively created more of an opportunity for the Big Four than an advantage for the traditional law firm, though. The corporate legal department client is increasingly looking for alternatives to the traditional legal services model in pursuit of greater transparency and efficiencies, and even more to ultimately solve business problems rather than discrete (albeit potentially voluminous) legal issues. The Big Four are in a prime position to meet this need with a larger global footprint than the traditional law firm – with offices in 72 countries on average for the Big Four versus 29 for the top 10 global law firms (Figure 2) – along with a broad services portfolio and deep technology infrastructure, not to mention longtime expertise in change management, methodology and best practices in myriad disciplines.

This article dives deeper into this fast-emerging reality by looking at the strategic advantage the Big Four have over traditional law firms, created by more abundant and diverse resources available, as well as deeply engrained use of technology and process improvement techniques.

Download the full report here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Was It Ever A Profession? A Look at the History of Law Firms as a Business with RJon Robins

1 minute read

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

4th Circuit Upholds Virginia Law Restricting Online Court Records Access

3 minute read

Law Firm Sued for Telemarketing Calls to Customers on Do Not Call Registry

Trending Stories

- 1UK Firm Womble Bond to Roll Out AI Tool Across Whole Firm

- 2Starbucks Hands New CLO Hefty Raise, Says He Fosters 'Environment of Courage and Joy'

- 3Blockchain’s Fourth and Fifth Amendment Privacy Paradoxes

- 4Prior Written Notice: Calabrese v. City of Albany

- 5Learning From Experience: The Best and Worst of Years Past

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250