SEC Wallops Yahoo With $35M Penalty Over Breach Disclosures—or Lack Thereof

The company, now known as Altaba, has settled SEC claims that it misled investors about a 2014 data breach which affected more than 500 million user accounts.

April 24, 2018 at 05:14 PM

4 minute read

The original version of this story was published on The Recorder

The company formerly known as Yahoo Inc. has agreed to pay $35 million to settle SEC claims that it misled investors about a 2014 data breach that affected more than 500 million of its user accounts.

Yahoo employees learned of the breach of users' data, including usernames, birth dates and telephone numbers, in late 2014, but didn't disclose anything about it until after the 2016 announcement that the company's operating assets would be acquired by Verizon Communications Inc., according to the U.S. Securities and Exchange Commission.

The SEC claims that Yahoo's financial disclosures, including its quarterly and annual filings from 2014 through 2016, were “materially misleading” since they only mentioned potential risks associated with future breaches without disclosing that “the largest known theft of user data” had already occurred. The SEC also claims that Yahoo's stock purchase agreement with Verizon, which was filed with the SEC in July 2016, falsely denied the existence of any significant data breaches.

Yahoo announced in a March 2017 filing with the SEC that certain senior executives at the company and members of its legal team “had sufficient information to warrant substantial further inquiry” about the breach as early as 2014. The company announced the resignation of then-general counsel Ron Bell the same day as the filing.

The company, which has changed its name to Altaba Inc. since Verizon acquired its operating business, neither confirmed nor denied the SEC's allegations as part of the settlement. The company's lawyers, Craig Martin and Jordan Eth of Morrison & Foerster, didn't immediately respond to messages.

In a press release announcing the deal, Steven Peikin, co-director of the SEC Enforcement Division, said the agency doesn't “second-guess good faith exercises of judgment about cyber-incident disclosure.”

“But we have also cautioned that a company's response to such an event could be so lacking that an enforcement action would be warranted. This is clearly such a case,” Peikin said.

Jina Choi, the director of the SEC San Francisco regional office which handled the Yahoo investigation, added that “Yahoo's failure to have controls and procedures in place to assess its cyber-disclosure obligations ended up leaving its investors totally in the dark about a massive data breach.”

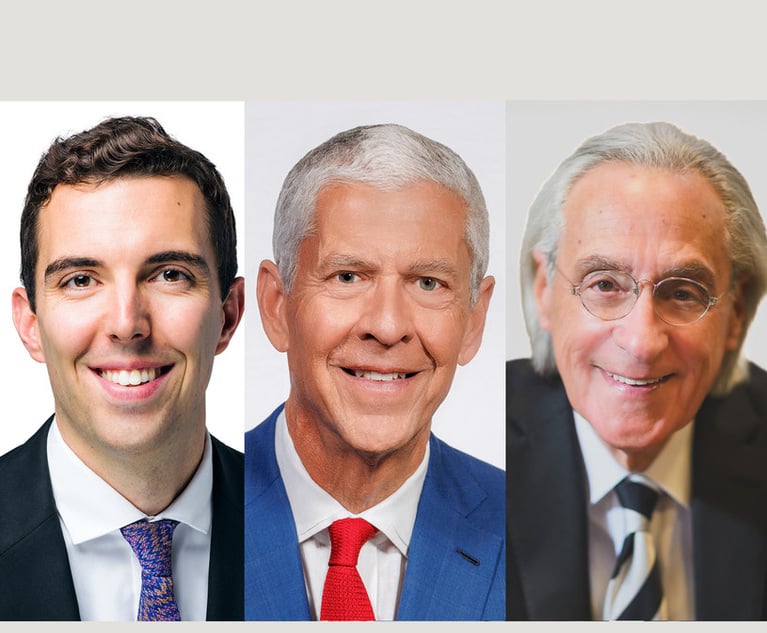

Michael Dicke, the co-chair of Fenwick & West's securities enforcement group and the former enforcement chief of the SEC's regional office, points out that this is the agency's first enforcement action against a company accused of failing to disclose a breach that had a material impact of the company's financial performance.

He said the underlying order specifically notes that Yahoo's breach response plan failed to consider whether the company had a duty to disclose material information about a breach to the market and that the company didn't tell its outside counsel or auditors about it.

“[While a company] has to have lots and lots of technical support as part of the plan, you really have to have someone on the primary response team with the ability to assess the disclosure issues,” Dicke said.

The SEC's investigation was conducted by Tracy Combs with the agency's Cyber Unit and supervised by Jennifer Lee and Erin Schneider in the San Francisco office.

Tuesday's announcement comes after shareholders represented by lawyers at Pomerantz and Glancy Prongay & Murray agreed to an $80 settlement last month over claims that Yahoo misled them about a series of four data breaches that affected as many as 3 billion accounts. That proposed deal still requires a sign-off from U.S. District Judge Lucy Koh in San Jose, who is overseeing the investor suit as well as multidistrict litigation targeting Yahoo with claims on behalf of users whose data was stolen.

Yahoo is represented in the MDL by Gibson, Dunn & Crutcher and Hunton Andrews Kurth.

Reached by email Tuesday, John Yanchunis of Morgan & Morgan, lead plaintiffs counsel in the MDL, said it was hard to tell how the SEC deal might bear on the case he's handling. “It at the very least demonstrates a desire to resolve claims arising from the data breach,” he said. “And our case now is the only one that remains.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Right Amount?: Federal Judge Weighs $1.8M Attorney Fee Request with Strip Club's $15K Award

Kline & Specter and Bosworth Resolve Post-Settlement Fighting Ahead of Courtroom Showdown

6 minute read

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute read

Morgan Lewis Shutters Shenzhen Office Less Than Two Years After Launch

Trending Stories

- 1Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 2CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 3Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 4Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

- 5The Week in Data Jan. 21: A Look at Legal Industry Trends by the Numbers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250