Innovations in Technology and Policies Drive Citizens Financial Group GC

Gannon, a veteran in-house legal leader, touched on numerous issues in an interview with Corporate Counsel, including artificial intelligence, cybersecurity and law firm convergence.

April 27, 2018 at 05:56 PM

5 minute read

The original version of this story was published on Corporate Counsel

(Photo: Helen89/Shutterstock.com)

(Photo: Helen89/Shutterstock.com)

Lawyers are so bound by precedent that they can be caught in a trap of becoming backward-looking, according to Stephen Gannon, the veteran general counsel and chief legal officer of Providence, Rhode Island-based Citizens Financial Group Inc.

Steve Gannon

Steve Gannon

“Our clients are completely focused on innovation, and particularly on what technology can do to help customers,” noted Gannon. “So much so that someone said, 'We are becoming technology companies with banking licenses,' and I think that's true.”

Gannon spoke with Corporate Counsel recently about significant trends he is seeing in the banking industry, ranging from the use of technology to diversity to outside counsel management.

He spoke from experience—35 years of advising the financial services industry. Before joining Citizens, Gannon served seven years as deputy general counsel at Capital One Financial Corp. in McLean, Virginia, and six years as general counsel of the Retail Brokerage Group at Wachovia Securities in Richmond, Virginia.

Prior to that, he was in private practice for 20 years at several firms as a litigator and securities counsel in Richmond, including LeClairRyan; what was then McSweeney, Burtch, and Crump; and Hunton & Williams. He also spent two years with the U.S. Securities and Exchange Commission's Enforcement Division in Washington D.C., including one year as a branch chief.

His work at Citizens, though, has been some of the most challenging of his career. He led his legal team when the bank separated from a troubled Royal Bank of Scotland in 2014, and the same year oversaw the bank's initial public offering—the largest commercial bank IPO in history.

These days, Gannon said, he is “putting a lot of thought an effort into artificial intelligence. All internal legal departments must get smarter about using it.”

Gannon said Citizens now uses AI in risk management and human resources, “and we want to use it more in legal to better manage outside legal bills and to drive more stability and predictability with regulators.”

He also finds cybersecurity threats worrying. “It's no secret everybody is concerned about that,” he said, explaining that the legal team conducts tabletop exercises on what happens in case of a breach or if some part of the bank's network goes down.

“There will be a legal and regulatory impact, and we want to be ready when it happens,” he said.

For how long? “This will probably never end, and we will always be preparing,” he said. “We are baking it into our culture.”

Gannon said when he arrived at Citizens in 2014 that there were “a couple hundred law firms” on the bank's provider list. “We shrunk it to 70. Then, in another round, to 45. And there will be more shrinking, as AI data gets richer every year, to compare and assess law firms,” he explained.

But it's not just about the money. It's also about the quality of results and the length and depth of relationships. “At the end of the day,” Gannon said, “when you are thinking hard about a difficult problem that can really impact the bank, you want advice you can trust. Use the data but value the relationships.”

Gannon's sense is that GCs are in “a pretty good place” when it comes to hiring outside law firms. The legal industry has bounced back strongly from the recession, he said, and a series of recent mergers have created strong, robust firms that can deliver services across a wide variety of business and geographic areas.

“If there's one firm not able to deliver the value proposition we want, we are happy to move on to another,” he said. “There are a wide variety of firms that have set a high [performance] bar for themselves, and I have broader choices than ever. There is a smorgasbord out there for us.”

Gannon touched on other aspects of his work as well:

- Diversity. The legal department created an “innovation council” made up of nonmanagement employees so that ideas would “bubble up.” Gannon said he has accepted every recommendation on diversity and inclusion, including adding diversity to the scorecard used to evaluate outside law firms. He brings in diverse speakers from the legal world and is actively involved in the bank's business resource groups, which are networks for women, people of color, veterans and LGBT.

- Regulations. He said efforts are underway to simplify and streamline the complex regulations adopted under the Dodd-Frank Act. “Regulators have a new commitment to transparency and to giving us more predictability,” Gannon added.

- Corporate Governance. The GC said he oversaw significant changes in the corporate governance function in support of the bank's board of directors. The enhancements include more board involvement, with outreach to investors and listening to understand their concerns; more board training on important issues; and continual board evaluations. “In 2017, we had the best year ever, financially,” Gannon said. “And we think the board leadership and good governance did a lot to contribute to that.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

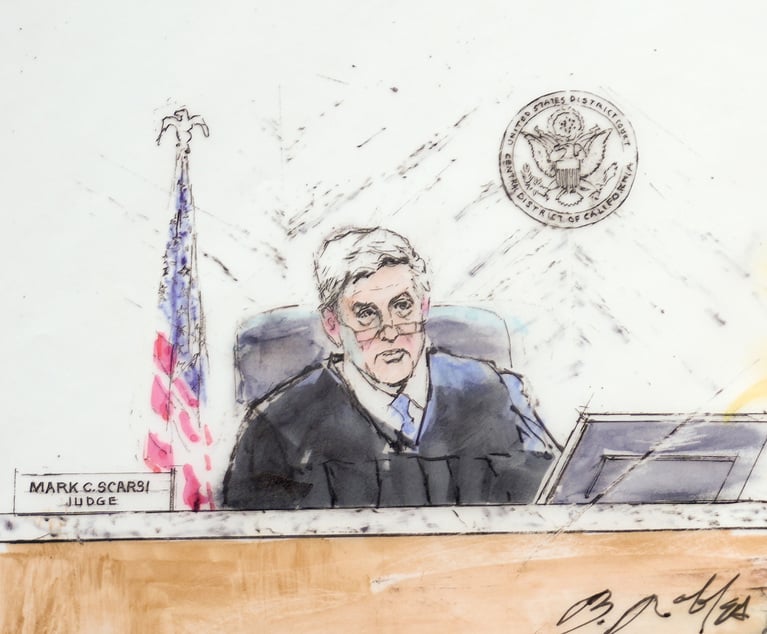

Federal Judge Named in Lawsuit Over Underage Drinking Party at His California Home

2 minute read

Financial Watchdog Alleges Walmart Forced Army of Gig-Worker Drivers to Receive Pay Through High-Fee Accounts

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250