Riverview Law and EY Law: A View from the Technology Side

A technology perspective of the recent Riverview Law acquisition by EY Law. Legal managed services are already evolving.

August 09, 2018 at 03:37 PM

5 minute read

ALM Intelligence has been keeping an eye on the Big Four as they stealthily encroach on the legal industry (see here, here and here). In fact, Senior Analyst Nick Bruch seems to have a crystal ball. In September 2017 he explored three likely scenarios of the Big Four's future in the legal industry. One of these was “Develop a managed legal services offering that look similar to the current offering of alternative legal service providers.” He expands on this (and takes some credit for predicting such an event) here.

Crystal ball aside, what does this acquisition mean for EY, Kim Technologies and legal managed services?

Riverview Law, EY and Kim

EY's strategy for the past several years has included building and expanding capabilities through acquisition and its vendor ecosystem. It wasn't too long ago that consulting clients would not consider EY for anything technology-related. Now the company, several years and over 20 acquisitions later, is fairly well-cemented as a consulting services provider in IT, digital and cybersecurity; and has a portfolio of services that span strategy, implementation and managed services.

What does Riverview Law give EY? Riverview provides EY Law with a nicely packaged legal managed services offering from which it can grow and expand upon building a bigger name in both the legal managed services and the broader legal industry. This is exactly in-line with the firm's approach to growing its technology- and IT-related consulting disciplines.

What EY Law doesn't get is Kim Technologies – a technology platform and basis for Riverview's managed services offerings. Kim uses AI to automate day-to-day work of attorneys and paralegals, cutting months and weeks of work down to days and hours. As many expected, Kim signed a contract (ten years) with Riverview Law after the acquisition announcement. This means EY Riverview Law can continue its operations without noticeable changes. For Kim, however, the implications are larger. Kim's portfolio already is more than legal operations and includes contract lifecycle management, compliance, HR services delivery and digital transformation. EY is also in all of these markets and is a great addition to Kim's partner ecosystem. With EY's broad industry and client reach, the company is constantly seeking ways to repurpose and reuse methodologies, processes and technologies to meet the needs of the next client, or solve a challenge faced by many. EY also already offers managed services (outside of legal managed services). This partnership for Kim has the potential to be a huge stepping stone in its growth (both revenue and capability) goals.

Managed Services Implications

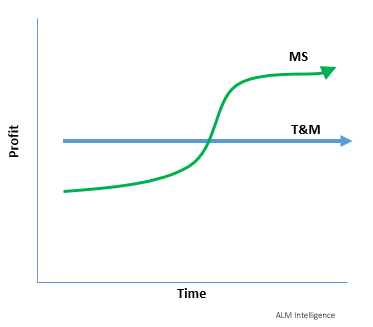

An interesting angle to the EY Law-Riverview Law acquisition is what this means for managed services, both legal and beyond. Managed services already are beneficial to both the client and provider. Through a managed services contract, services are provided with a subscription or license fee arrangement (rather than time and materials, or hours billed). For the client, this provides cost certainty and predictability, better manageability and is typically cheaper than the alternative. For the provider, it also makes revenue more predictable but opens the door wide for profitable growth. There is an upfront investment on the provider side, but the investment required wanes as the revenue becomes steady. Figure 1 compares managed services' (MS) profitability potential to the more traditional time & material (T&M), which is comparable with the legal industry's billable hour.

Figure 1: Managed Services Model vs Time & Materials

If you take an already profitable, more-efficient-than-the-alternative service that is already cheaper for the client and causes less of a headache, and apply tools and technology that drastically reduces the time it takes to do repetitive and manual, time-consuming tasks, the upside for both the provider and client shoot up. This is where AI enters. In addition to reducing, and in some cases eliminating manual, labor-intensive, and repetitive knowledge tasks, AI improves available information for decision making, enhances accuracy and captures subject matter expertise. This has proven itself successful in chatbot, support and self-service portal applications across numerous industries. AI will reduce the cost of providing the managed services and enable services and support to be much more efficient. For the client, this means a lower costs for managed services, often couple with expedited service. AI also has the potential to shape an already immature legal managed services market. In what is already a gray area of defining legal managed services, AI widens this with the potential of having some legal advice as a managed service, in addition to legal operations.

The impact on the legal market for AI-enabled managed services is still unclear, but quickly gaining clarity as the offerings evolve. Managed legal services is still a growing concept, and not yet widely adopted. But, as ALM Intelligence Senior Analyst Nick Bruch put it, “If ten percent of the legal market can be shifted to a managed services model this could blow a $10 billion dollar hole in the Am Law 200's existing revenue stream. That will create significant damage to their existing business models.” That's a big amount to lose, and a big opportunity for companies already well-versed in technology and providing managed services, such as the Big Four.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Meta’s New Content Guidelines May Result in Increased Defamation Lawsuits Among Users

Portuguese Law Firm Launches Tech Arm, Becoming Multidisciplinary Operation

Are Firms and In-House Teams Courting Technological Debt With Ambitious Purchases?

6 minute readTrending Stories

- 1An Eye on ‘De-Risking’: Chewing on Hot Topics in Litigation Funding With Jeffery Lula of GLS Capital

- 2Arguing Class Actions: With Friends Like These...

- 3How Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

- 4Fried Frank Partner Leaves for Paul Hastings to Start Tech Transactions Practice

- 5Stradley Ronon Welcomes Insurance Team From Mintz

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250