The Law Firm Disrupted: Will 'Alternative' Providers Ever Go Mainstream?

Ernst & Young's acquisition this week of Riverview Law, which was launched in 2012 with backing from DLA Piper, has the Big Law world buzzing.

August 09, 2018 at 09:00 PM

7 minute read

In this week's Law Firm Disrupted, we look at the number of clients who use alternative legal providers and ask a simple question: Will there come a point where they will no longer be considered alternatives?

I'm Roy Strom, the author of this weekly briefing on changes in the legal market. You can reach me here: [email protected]. Or, alternatively, here: @RoyWStrom.

➤➤ Would you like to receive The Law Firm Disrupted as an email? Sign up here.

Many people don't even like the name Alternative Legal Service Providers. It is a mouthful. And ALSP is, IMHO, even worse.

So let me start with an apology, which is what people who don't like that name may end up wanting out of this column. Instead of the acronym, I'm going to use the term alternative providers. Apologies to those who may be offended.

But I'm doing it for the sake of a simple question that is crucial to the business of alternative providers: When will they not be alternatives? When will a large mass of corporate clients engage these companies to handle large portions of their work?

I have said before that the pace of change in the legal industry is the most bedeviling question facing would-be disruptors. (Coincidentally, that piece was timed to professional golf's first major championship of the year. The last major is underway this week. Take that FWIW.)

Anyway, it is a topic worth revisiting in the wake of the big news this week: Ernst & Young's acquisition of a 100-employee alternative provider, Riverview Law. One basic reason the acquisition garnered so much attention, I'd argue, is the idea that a Big Four accounting firm could supercharge the adoption of the types of services that Riverview sells.

The basic business argument for EY's acquisition is relatively straightforward: With its 2,200 lawyers, list of near-countless corporate clients and its massive balance sheet, the accounting giant is perhaps the best positioned company to convince legal departments that it can efficiently handle wide swathes of their basic needs. Those might include contract management, intellectual property counsel, immigration issues and other process-based matters.

There is still a large amount of convincing to do. That is seen in a survey of 156 in-house departments released last November by CLOC, a group whose efforts to redefine the delivery of legal services I wrote about earlier this year.

The CLOC survey showed that contract management systems and alternative providers had a long way to go before they are considered mainstream. Nearly half the respondents (46 percent) didn't even use a contract management system. And nearly two-thirds didn't spend any money on alternative providers.

The two alternative providers that were most frequently hired by those respondents were Elevate Services Inc. (9 percent) and Axiom Global Inc. (8.3 percent). Sure, they are called “New Law” for a reason. You have to start somewhere.

But change in the legal industry is slow. And it is important to understand the purchasing decision clients now face as they contemplate hiring the likes of EY Riverview Law. Much of the work alternative providers will do likely is taken off the plate of in-house lawyers. And in-house lawyers have arguably been the most disruptive force in the legal market for the past decade or more.

Are clients ready to switch their investment from their own employees to alternative providers?

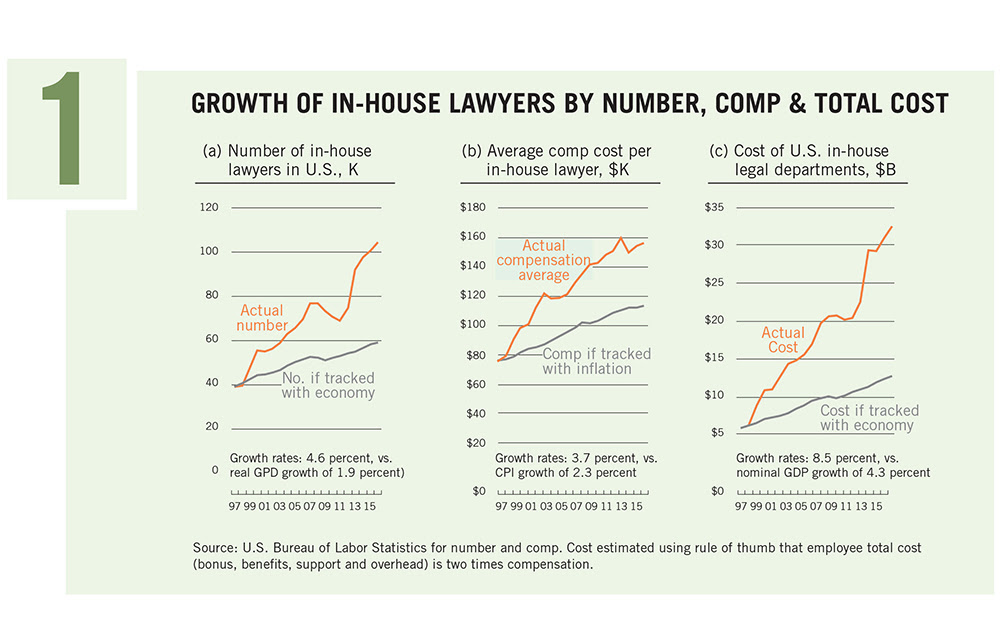

Helpful in answering that question is an in-depth article that Hugh Simons and Gina Passarella wrote for The American Lawyer in February. The article showed that in-house lawyers grew at a pace four times faster than law firm lawyers from 2000 to 2007, before accelerating to six times faster between 2007 and 2016.

That growth has come with significant costs to companies: In-house department salaries and wages accounted for $33 billion in spending in 2016, according to the story. That cost has grown at an annual rate of 8.5 percent, a surge that Simons and Passarella say smart managers should look to limit.

The article states the way to limit that spending is to look to outsourced service providers—the “alternatives.”

From the story's summation on how alternatives should attack the market: The winning outsourced provider strategy is not for the faint of heart. It rests on the principle that service providers will ultimately win by being less expensive than competitors and that the way to such a low-cost position is to accumulate as much experience, and build as much scale, as quickly as possible. This translates to pricing very aggressively, using long-term contracts priced below today's costs, to bring in sufficient business volume so that your costs will eventually decline.

It sounds something like the ambitions expressed this week by EY: Investing in Riverview's people and technology to bring the alternative model to scale as quickly as possible.

I asked the question, so I'll take a stab at an answer.

I don't think there will be a revolution that ushers alternative providers into the mainstream over the course of a few years. I think the buildup of their business will occur over a timespan similar to that of in-house lawyers. It will require well-capitalized businesses that are willing to spend the time and money convincing law departments that they're worth it. And the next CLOC survey should tell us a lot about how that's going.

Roy's Reading Corner

More on EY-Riverview: Here is a list of stories about a transaction it seems like everyone was talking about this week. · Liam Brown, founder and executive chairman of Elevate, writes on LinkedIn that the deal is “another validation of the alternative legal services opportunity.” · For ALM, Hannah Roberts covered the nuts and bolts of the deal and DLA Piper's sale of its stake in Riverview, while Nick Bruch took a look at what it might mean for accelerating the pace of change in the legal services industry. · Legal Business writes that the deal puts Riverview “into the mainstream,” while estimating the company's revenue at £10 million (about $12.8 million today). · Artificial Lawyer writes that the deal represents “the incremental industrialization of the provision of legal services to the global economy and society as a whole.”

On Women in Law: The Young Lawyers Editorial Board at The American Lawyer writes on three stereotypes that persist in law regarding women. Those stereotypes are that they avoid confrontation; that they lack confidence; and that parenthood holds all women back. The main point of the story is a good one: “The notion that women, due to their gender, necessarily share personality traits, capabilities, weaknesses or responsibilities is nonsense.”

More from the story: “To the extent any of the traditional assumptions about men and women were ever true, they are as relevant today as three-martini lunches. Young lawyers have different ideas about gender roles—and about gender identity itself—than older generations do. Law firms are part of the older generation. Employers need to adapt to reflect the ideas of their workforce.”

And here is a story I wrote about an American Bar Association analysis of women in large law firms that discusses how they experience Big Law life much differently than men, and especially managing partners.

That's it for this week! Thanks again for reading, and please feel free to reach out to me at [email protected]. Sign up here to receive The Law Firm Disrupted as a weekly email.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Law Firm Disrupted: Big Law Profits Vs. Political Values

The Law Firm Disrupted: Quality Partner Training—The Exception or the Rule?

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250