The Battle For Talent Is Disrupting The Business Of Law

A shift in the way firms are pursuing laterals is disrupting the market and New York will be the primary battleground.

August 15, 2018 at 01:18 PM

9 minute read

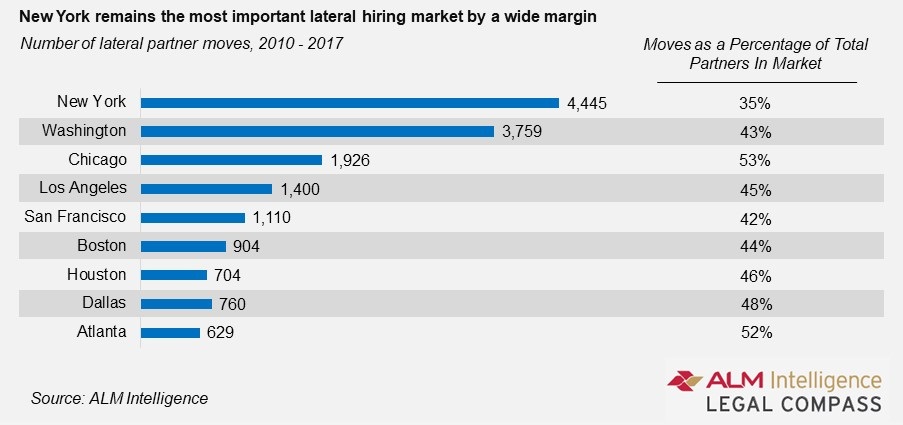

While recent years have seen Silicon Valley, Houston and Boston as the hotbeds for growth focus, the New York legal market is currently, and will continue to be for at least the next 5 years, the most active battleground for lateral movement and disruption, by far. And while this may not be an epiphany for some, the reasons as to why – the macro-changes in the traditional “system” – might be more interesting.

While recent years have seen Silicon Valley, Houston and Boston as the hotbeds for growth focus, the New York legal market is currently, and will continue to be for at least the next 5 years, the most active battleground for lateral movement and disruption, by far. And while this may not be an epiphany for some, the reasons as to why – the macro-changes in the traditional “system” – might be more interesting.

The markets are being disrupted, and NY, in particular, by a dozen or so hyper-aggressive, highly profitable lateral-acquiring firms – generally hailing from outside of NY – that have long since gone on the offensive by actively pursuing, courting and paying huge compensation packages for franchise-grade lawyers. In some cases, this is jarring loose, and enticing to move, majorly valuable (in the way of business, reputational capital and client relationships) partners that would have otherwise never considered moving. And this is where not only financials, but also optics, can get dangerous – see the spotlight that Cravath took when Scott Barshay left, in particular.

Now, of course the fallout adversely affects the firms that lose top-of-the-food-chain rainmakers, but on a grander scale, it also impacts the rest of the market due to the larger-than-life vacuums that are left in the wake. This is the real problem. Left behind the vacating partners are voids that the firms are aggressively trying to backfill with, of course, rainmakers from other firms, which creates a self-perpetuating cycle. Now, the concept of luring laterals away with money isn't new – it's been going on for decades – and of course firms have always sought to backfill those positions. But, it's never been this aggressive, the profile of the moves has never been this high, and the current market represents an escalation in “capillary action” – the movement of high-powered, apex partners upward in the hierarchy – that is creating a tit for tat² scenario and is changing the way that the business of law is being done.

Placing Tit for Tat Under A Microscope

When partners move (and big-money partners, in particular), they may give any number of reasons as to why, but when push comes to shove, the vast majority move for one or more of three reasons: (i) more money, (ii) and/or to stop carrying unproductive partners (this is a “social” aspect, is generally highly underrated by courting firms in the way of motivation, and goes hand in hand with making more money) and/or (iii) anxiety surrounding their firm's strategy and general durability. Let's look at each:

Aggressive payouts: When you are already making $5M and really like your firm, it is one thing to refute the allure of another $1M, but another $5-6M? That's a different animal altogether. This may sound, well, odd, to the average person – “another $1M isn't enough to jar someone loose?” – but in many-to-most instances at the higher levels, no, it is not. Generally speaking, the highest producers are not actually driven by money, which has helped them get to their current station in the first place. They work a lot because they like it; they are (almost exclusively) fiscally responsible; they focus on skill/knowledge/personal development, client service and solving practical problems; and their current financial success is a happy byproduct, not the driver, of their decisions. But, we all have our price, do we not? The current climate is proving this and it is happening more and more.

“Equality” issues: With the roots of all law firms hailing from a partnership culture – i.e., one of equality, contribution and having the same amount of “skin” in the game – it is generally very difficult for firms to openly discuss, much less act upon, what is effectively (and sometimes blatantly) unequal contributions to the firm's bottom line. Further, with (a) the ease of information flow, (b) the (almost uniform) presence of transparent compensation systems, and (c) the relatively recent spike in huge lateral paydays, it is becoming harder for major rainmakers to feel comfortable being paid “in-and-around,” or in some cases equal to, their lesser-contributing partners.

Durability: The movement of big names, firms' inability to backfill those names with commensurate finances and reputational capital, and the resulting optics have caused significant anxiety amongst partners in many firms, including those that once were considered bulletproof.

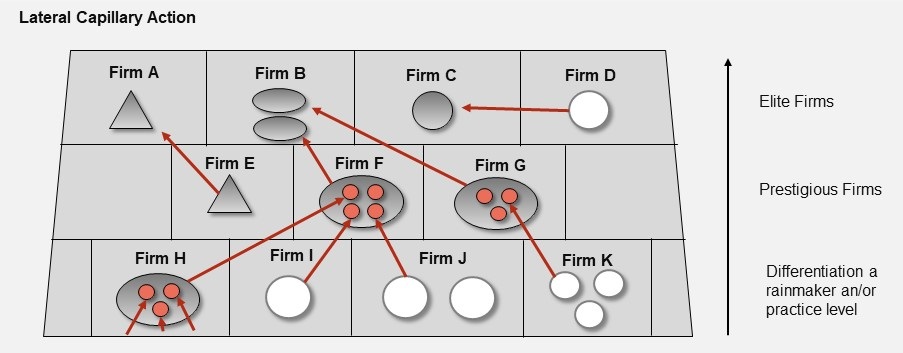

The combination of these factors has created an environment that is greatly facilitating capillary action in the marketplace. You see, when franchise-grade attorneys vacate a firm, regardless of the firm's patina, there are massive voids left behind – financially, reputationally, culturally, strategically, etc. – that need to be filled. This is doubly so if a firm is not an “elite” player (see figure below). Here, “elite” firms A, B and C have aggressively poached franchise-grade attorneys from “elite” firm D, and “prestigious” firms E, F and G. Left behind are large voids that D, E, F and G will seek to fill, but several factors leave these firms in a recently worse, and even potentially bad, position to do so.

For starters, the firms are newly-damaged goods now that they have lost the franchise-grade attorneys. Finances will certainly take a sizeable dip in the near future, and (very) importantly, the optics of the loss are dramatic. Internally, attorneys are skittish; externally, current clients and potential lateral recruits and clients are concerned – “Why did that partner actually leave?” The result of these factors is a void that is effectively larger than the attorney/s that left, rendering it often impossible to fill with a single attorney, if at all. So, at a minimum the firms must:

- Hunt for more than one attorney;

- Pay (potentially much) more than they ordinarily would have in order to get them;

- Work overtime to perform damage control both within and outside of the firm;

- Deal with the internal challenges of (now) paying lateral attorneys more than they are currently paying existing partners with commensurate business. (This one, in particular, is a doozy for leadership).

The optics of the franchise-grade moves have created, and continue to fertilize, the perception that huge paydays are necessary to get the “best”, and most importantly, the “best” can, indeed, be gotten with enough money! There wasn't really an active lateral market for the Scott Barshays of the world until there was an active market for the Scott Barshays of the world. It's kind of like the 4-minute mile: no one could do it until Roger Bannister and his crew broke it; now the new bar has been set.

So, the leadership of now actively hunting firms follow suit, offering bigger payouts for new laterals that can fill the huge empty shoes. As you might imagine, this pisses off existing partners – “Why is the new person with $9M in business getting paid $1.5M more than me when I have $9M in business AND I've been here 20 years; where the hell is the loyalty?” – further destabilizes the firm's partnership and facilitates outward-facing interest. In the end, this “life cycle” of sorts weakens the firms' appeal to current and potential partners and clients and otherwise leaves the firms vulnerable.

On a lesser scale (usually), those firms that have lost marquee, but not necessarily franchise-grade, partners will pay as close as they can to what is now “market” in order to draw in partners with the biggest books and the most reputational capital possible. And if they manage to make one or more great lateral hires, they inherently create another void to be filled elsewhere. The cycle begins again.

The result is a filtering and capillary effect, of sorts, whereby the best partners of some of the best firms are being drawn upward, or sometimes laterally, in the firm-brand hierarchy, creating vacuums behind them that are then drawing great, but perhaps not franchise-grade partners, upward and away from lesser-branded firms to further their own development. While this potentially benefits the individual lateral/s and the firms, it is also a treadmill that, possibly, some firms will never get off of – and no firm can run forever. It is an aggressive evolution.

Yeah, Yeah, We've Seen This Before…

But why is this market so different from those of the past? For a material number of firms, seeing franchise-grade partners move from what were once considered Kevlar-grade brands is sending waves of concern and anxiety through the partnerships. Suddenly, several points of interest are occupying real estate in the minds of partners: the viability of their firm's strategy; the durability of their institution; the ability of their respective practice to provide the best platform for personal development; etc. “If Cravath can't prevent departures, how the hell can we?” What may have previously been highly latent and subtle concern at one point is now explicit and prompting action. The result is the destabilization of some firms and their strategies, aggressively greasing the wheels of the lateral market.

Is capillary action new to the legal market? No. But, it is greatly magnified at this point in Big Law's timeline and is causing destabilizing shifts in power and money across the entire spectrum. Further, will Cravath live through the loss of Scott Barshay, Eric Schiele and Sandra Goldstein? Almost certainly; though, damn, what a rough stretch for the firm! But, for lesser brands, we shouldn't underestimate the fragility of the law firm structure.

David J. Parnell is an author and speaker, cofounder of the Legal Institute for Forward Thinking and founder of legal search and placement boutique True North Partner Management.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

‘The US Market Is Critical’: KPMG’s Former Head of Global Legal Services On the Big Four Firm’s Legal Arm Entering the US

6 minute read

Goodwin Procter Relocates to Renewable-Powered Office in San Francisco’s Financial District

Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

5 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250