A New Approach to Law Firm Rankings

The Am Law rankings reveal the largest firms. A new approach looks at a broader range of metrics to identify firm's overall financial performance.

September 05, 2018 at 12:33 PM

8 minute read

The Am Law rankings reveal the largest firms in the US legal market. Higher revenue, though, does not necessarily equate to superior overall financial performance. Indeed, firms with lower revenue often have enhanced performance metrics. Consider DLA Piper, which ranks 4th on revenue, but 78th on revenue per lawyer and 85th by profit margin. On the other hand, Quinn Emmanuel ranks 1st on profit margin and 3rd on revenue per lawyer, but places only 21st on revenue. Firms with similar revenues may have very different financial profiles, as with Skadden Arps and Baker McKenzie; or Jenner & Block and Fox Rothschild.

The Am Law rankings reveal the largest firms in the US legal market. Higher revenue, though, does not necessarily equate to superior overall financial performance. Indeed, firms with lower revenue often have enhanced performance metrics. Consider DLA Piper, which ranks 4th on revenue, but 78th on revenue per lawyer and 85th by profit margin. On the other hand, Quinn Emmanuel ranks 1st on profit margin and 3rd on revenue per lawyer, but places only 21st on revenue. Firms with similar revenues may have very different financial profiles, as with Skadden Arps and Baker McKenzie; or Jenner & Block and Fox Rothschild.

Is there another way to rank firms in line with their financial performance? Our quest for an answer led us to a multi-dimensional approach, where we combine revenue with two reasonably non-correlated metrics: revenue per lawyer (RPL) and profit margin. Together, these fully describe the financial condition of any law firm. Revenue measures a firm's size, RPL measures the market value of a lawyer and profit margin the ability to convert revenue to profits. In other words, size matters, but so do equally lawyer value and profitability. Our construct is built on fundamentals, in assuming that individual lawyers with revenue generation capacity aggregate to form a law firm, which then manages costs to eventually generate profits.

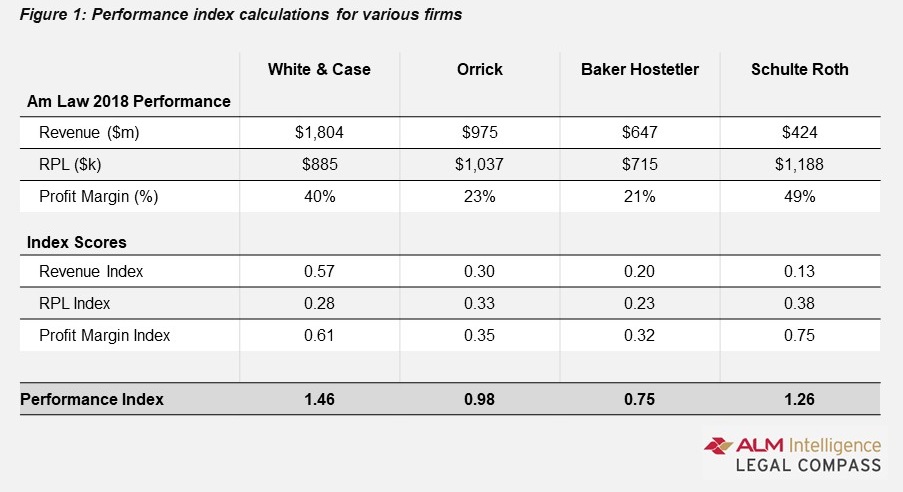

While multi-dimensionality is appealing, combining revenues in millions of dollars with RPL in dollars and with profit margin in percentages is tricky. Our solution was to standardize each metric, by dividing each firm's value by the highest value achieved by any Am Law 200 firm – which produces a score between 0 and 1. Once standardized, these metrics can be easily added. Let's illustrate this for White & Case:

- White & Case's Revenue Score: White & Case's 2018 revenue of $1.804 billion divided by Kirkland's revenue of $3.165 billion (the largest in the Am Law 200 last year) yields a score of 0.57

- White & Case's RPL Score: White & Case's 2018 RPL of $885,000 divided by Wachtell Lipton's RPL of $3.13 million (the highest in the Am Law 200 last year) produces a score of 0.28

- White & Case's Profit Margins Score: White & Case's 2018 profit margin of 40% divided by Irell & Manella's 66% (the highest in the Am Law 200 last year) yields a score of 0.61

In our methodology, we call each score an index. Thus each firm has three indices:

- Revenue Index = Revenue of firm / Revenue of highest-Revenue firm

- RPL Index = RPL of firm / RPL of highest-RPL firm

- Profit Margin Index = Profit Margin of firm / Profit Margin of highest-Profit Margin firm

We then construct a composite performance index as the sum of these three indices:

- Performance Index = Revenue Index + RPL Index + Profit Margin Index

Ranking on performance index blends in other metrics with revenue. Firms with a higher performance rank have more revenue, their lawyers have a higher market value and are more profitable – all combined, they indicate higher financial performance. Conversely, firms with a lower performance rank have lower revenue, their lawyers have a lower market value and are less profitable, together they point to lower financial performance. Each individual index has a moderating impact on the overall result. A firm can overcome a lower level on one index with higher levels on other two indices. And of course, vice versa. In our approach, we have purposefully omitted leverage – as this reflect how a firm is internally organized; as also PPP – as partner profits are the end-result of a firm's business structure.

How did we devise our method? Our approach was pragmatic – we recognized revenue needed to be combined with other factors. Revenue per lawyer and profit margin turned out to be most relevant and non-correlated. Standardization was required to facilitate comparison. Further experimentation led us to a process which produced robust results, yet was simple and repeatable.

Now we can re-rank the Am Law 100 firms on the basis of decreasing performance index. We highlight three key findings from our analysis:

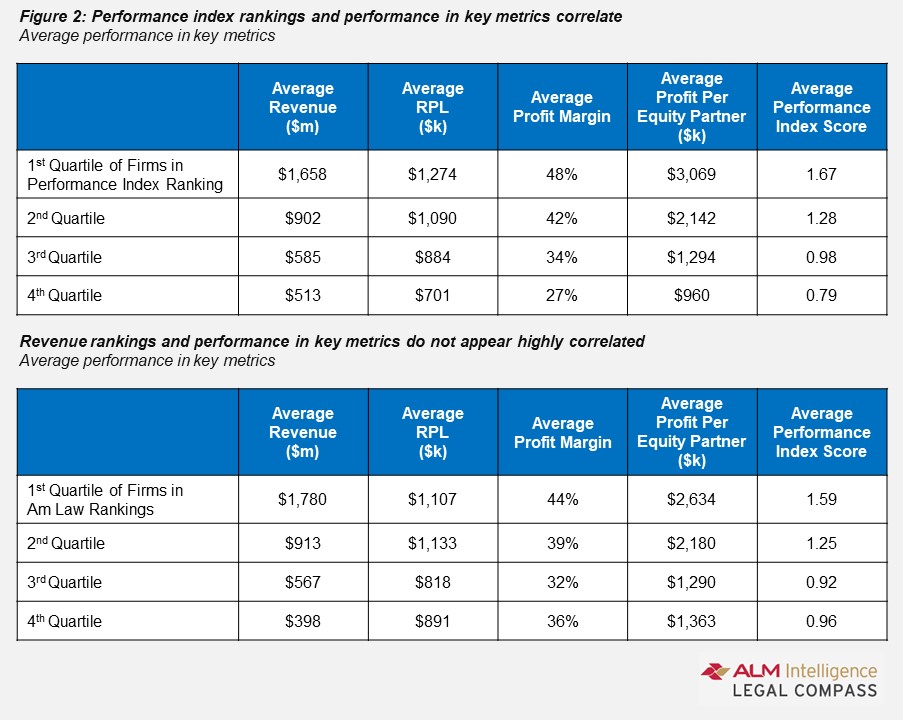

Performance Index Rankings and Performance In Key Metrics Correlate: Ranking on the basis of decreasing performance index does truly correlate with firm performance. To illustrate this, let's divide the 100 firms into 4 quartiles of 25 firms each and look at the average of each quartile. When ranked by performance index, it is evident that the performance in key metrics distinctly drops off as firm rankings increase (see Figure 2).

When we conduct a similar analysis for Am Law 100 firms ranked only by revenue, it's not fully clear that performance is highly correlated with rank (see Figure 2). Indeed, we see that profit margin for quartile 4 is higher than quartile 3; and the RPL for quartile 2 exceeds that of quartile 1. The direct correlation between revenue rank and overall performance is not fully evident.

Peers Close to Each Other: Rankings firms on overall performance ranks law firms in such a way that firms with similar performance indices turn out to be the close financial peers. As we have illustrated earlier, this is not the case for revenue-based rankings. Figure 3 shows the top ten peers for two example firms Akin Gump and Katten Muchin. The performance index for their peer firms are seen to be close to these two firms.

Another interesting outcome of our exercise is that the rankings reflect gradations in qualitative similarity. Said differently, firms close to each other are quite similar; and firms far apart are quite dissimilar. If we start from our top ranked firm at number 1, Kirkland and Ellis, we find as the rank increases, firms become increasingly dissimilar. Thus, Wachtell is most similar firm to Kirkland in terms of financial performance, while Lewis Brisbois would be the most dissimilar.

Ranking Matches Intuition: We discussed our approach with several legal industry observers, who concurred that results generally matched their own rankings of firms on the basis of performance. In their qualitative judgment, higher ranked firms did have performance superior to lower ranked firms. Indeed, our top 5 performing firms are Kirkland, Wachtell, Latham, Skadden and Quinn Emmanuel. For Wachtell and Quinn Emmanuel, their strong showings in RPL and profit margin offset their lower revenue based rankings of 48th and 21st. Conversely, Baker McKenzie, which places 3rd on revenue ranks 14th on performance; and DLA Piper's 4th ranking on revenue takes it to 21st on the basis of performance. Firms with lower performance rank are not only smaller but also have lower RPL and profit margins. In many cases, the indices offset each other – a larger but a less profitable firm may rank lower than a smaller but more profitable firm. We are hopeful our readers also find this ranking more closely aligned with their internal constructs.

Visualization of Firm Trajectories: We can plot the performance index of a single firm over the years as a nice visual representation of its overall performance. We find that each firm does have its own unique trajectory, and analysis of such trends will be explored in detail in our next article.

Summary

We are suggesting a more robust method to rank law firms, which supplements, rather than substitutes for, traditional rankings. We believe it is more reflective of overall financial performance as it equally weights key metrics. The added advantages of peer grouping and comparison across years make it an attractive framework. Further, the stronger correlation between ranking and performance would argue that comparison to say a Performance Index 25 may be more insightful than the Am Law 25. In other words, the comparison benchmark would be the top 25 firms by performance rather than the top 25 firms simply by size. As we have shown earlier, simply aggregating firms based on their size mixes up firms with superior and inferior performance and makes comparisons less meaningful.

In the next article, we will look at analyzing trends in performance indices over multiple years for individual firms.

Madhav Srinivasan is the Chief Financial Officer at Hunton Andrews Kurth LLP, leading the global finance and pricing competencies. Madhav is an ALM Intelligence Fellow and also an adjunct faculty at Columbia Law School in New York and University of Texas at Austin School of Law.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250