Higher Law: SEC Warns Pot Investors | Cannabis Lawyers Go Back to School | Plus: Wine v. Weed

The Cannabis Law Institute is underway in Washington this week—what's the buzz? Plus: the SEC issued a new warning to cannabis investors about the risks of the industry. And a trademark spat pits wine versus weed. Thanks for reading Higher Law.

September 06, 2018 at 04:00 PM

7 minute read

Welcome back to Higher Law, our weekly briefing on all things cannabis. I'm Cheryl Miller, reporting for Law.com from Sacramento, where California's legislative session ended Friday night. It looks like Washington, D.C. will be providing more than enough political drama to fill the local vacuum for a while.

Speaking of the nation's capital, this week we'll take a look at the state of the marijuana legal industry as the second annual Cannabis Law Institute gets underway in Washington this week. Plus, wine and weed don't always mix, at least not for the publisher of a go-to guide for oenophiles. And scroll down to see what the SEC is saying about cannabis investing.

Thanks as always for reading—and for your feedback. Tips? Story ideas? I'll take them all via email at [email protected] or you can call me at 916-448-2935. Follow me on Twitter at @capitalaccounts.

|

Cannabis Lawyers Go Back to School

More than 200 lawyers and marijuana industry insiders are trekking to The George Washington University Law School this week for the National Cannabis Bar Association's Cannabis Law Institute, two days of panels and talks focused on big issues in the practice.

You might expect lawyers in the field to be a little wary, if not weary, these days. Marijuana businesses, and sometimes their lawyers, are still being shut out by banks. Congress can't agree on what, if any, protections it should offer to cannabis-legal states. And the patchwork of state regulations, taxes and deadlines keeps changing.

But Shabnam Malek, the NCBA's president, said the industry attorneys she's hearing from are actually “optimistic and enthusiastic,” especially as the midterm elections draw closer.

“People think there's going to be some real change,” says Malek, a partner at Brand & Branch in Oakland, California.

Some change in public attitudes has already happened as evidenced by the politicians appearing at this week's event. Congressmen Earl Blumenauer, D-Oregon, and David Joyce, R-Ohio, are scheduled to talk Friday morning about state-federal pot dynamics. U.S. Sen. Elizabeth Warren of Massachusetts is sending a video for a panel on federal legislation that afternoon.

Sundie Seefried, CEO of Safe Harbor Banking Services—a prominent banker of state-compliant cannabis businesses—gives a keynote address Friday about “emerging risks for the banking sector.” The Minority Cannabis Business Association is also offering a track of programming. There will be panels, too, on ethical considerations for cannabis attorneys, preparing companies for IPOs and mergers and issues for in-house counsel.

“One of the biggest issues right now for cannabis lawyers is the role of in-house counsel,” Malek says. “It's a growing part of lawyering for the cannabis industry.”

|

Who Got the Work

• Attorneys at Reed Smith in New York are representing M. Shanken Communications Inc., the publisher of Wine Spectator, in a trademark infringement case against online pot-rating site Weed Spectator. “Plaintiff has no interest in associating Wine Spectator magazine and its affiliated brands with cannabis, a drug that cannot legally be consumed recreationally in 42 states and under federal law,” according to the complaint filed in the federal court of Southern New York by Reed Smith partner Peter Raymond and associate Henry Ciocca III. The named defendants, California-based Modern Wellness Inc. and two company officers, have not yet filed an answer.

• California's fledgling Cannabis Control Appeals Panel named Anne Hawley as its executive director and Christopher Phillips as its chief counsel. Hawley was deputy appointments secretary under Gov. Jerry Brown before accepting the new position. Phillips was a senior staff attorney at the California Public Employees' Retirement System. Once functional, the panel will hear appeals of any state cannabis licensing decision. You can read the panel's proposed regs here.

|

In the Weeds

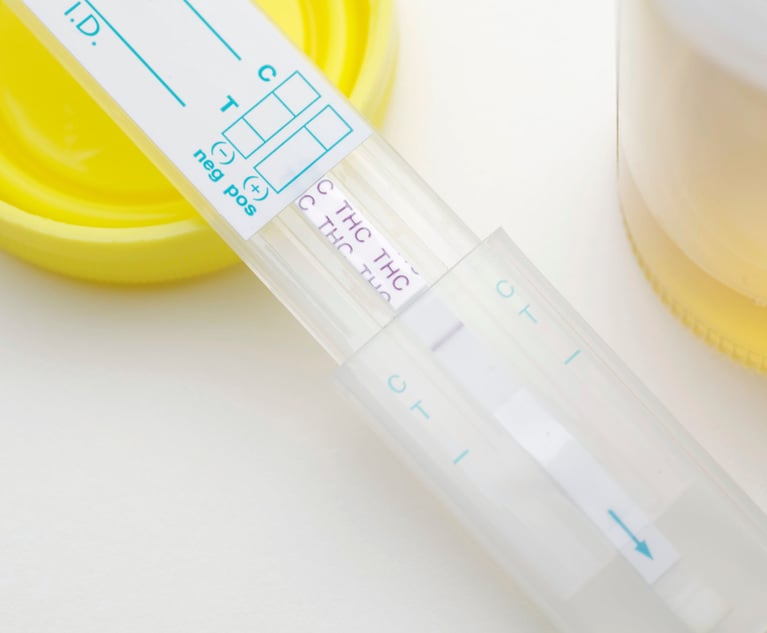

>> Federal regulators say investors should be wary of the Green Rush. “If you are considering investing in a company with operations relating to the marijuana business industry, understand that the company may be criminally prosecuted and this may impact the value of your investment,” the Securities and Exchange Commission said in an alert. The warning was issued Wednesday alongside news that the SEC charged Texas-based Greenview Investment Partners and its founder, Michael Cone, with securities fraud for promising cannabis-industry investors big returns while spending their money on luxury cars and designer clothes. [The National Law Journal]

>> New Jersey received 146 applications from 106 entities seeking medical marijuana licenses, according to the office of Gov. Phil Murphy. The new dispensaries will be limited to opening two locations in each of three sections of the state. Licensees will be responsible for cultivation, manufacturing and operating their dispensaries. The new set of licenses will double the number of medical marijuana outlets operating in the state. [nj.com]

>> An Oregon county's lawsuit challenging the state's marijuana legalization laws should be dismissed, according to a federal magistrate. Judge Mark Clarke wrote that southern Oregon's Josephine County lacked standing to sue the state and that it had failed to show the state stopped it from enacting its own anti-growing restrictions. Clarke's recommendations will go to a district court judge for final approval. [Portland Business Journal]

>> Attorneys for the IRS accused Colorado dispensary owners of “scaremongering” in attempting to recoup $53,000 in rejected tax deductions. The U.S. Department of Justice urged the U.S. Court of Appeals for the Tenth Circuit not to disturb a panel ruling that said the IRS has broad powers to block tax deductions sought by state-legal marijuana businesses. The owners of Alpenglow Botanicals have argued that the panel's ruling opens “a Pandora's box” that could allow the IRS to scrutinize the returns of vendors that do work for marijuana companies. [The Recorder]

>> Oregon regulators may need a year to process a backlog of recreational marijuana applications. The Oregon Liquor Control Commission stopped accepting new recreational license requests in June to get a handle on the existing workload. But a surge of applications arrived just before the June 15 cut-off date, making the problem worse. The commission had received 2,210 new applications by mid-June. [KDRV]

|

Stuff for Your Calendar

Sept. 7-8: The Grow Up Cannabis Conference & Expo will be held in Niagara Falls, Ontario. Scheduled speakers include Micheline Gravelle, co-leader of Bereskin & Parr's cannabis group, and Trina Fraser, co-managing partner of Brazeau Seller Law.

Sept. 13: Kahner Global hosts the Cannabis Private Investment Summit in New York, NY. Scheduled speakers include Duane Morris partner David Feldman and Dorsey & Whitney partner Michael Weiner.

Sept. 15: Michigan has set this day as the deadline for medical marijuana businesses to either be licensed by the state or to shut down. Businesses and cities have pleaded with state leaders to extend the deadline because of lengthy license application processing times. On a side note, here's why Michigan regulators use the word “marihuana” instead of “marijuana.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

NY Cannabis Marketing Rulings / Rescheduling Effects / Honigman's Work on Trademark Suit / Goodbye

9 minute read

Workplace Weed and Labor Pacts / State AGs and Hemp / Maryland Licensing Suit / Vicente Sues Recruiter

9 minute readTrending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250