Law firms need to consider a range of options for achieving their aspirations

Why laterals and combinations are options many firms pursue

September 18, 2018 at 09:01 AM

8 minute read

An increasing number of law firm leaders and many of their high performing partners have concluded that they need to grow high quality headcount in their areas of focus to remain competitive. Many have chosen to consider all potential options for achieving growth. This includes recruiting laterals, small groups, or combinations. They are not mutually exclusive options and many firms choose to put all three options on the table.

An increasing number of law firm leaders and many of their high performing partners have concluded that they need to grow high quality headcount in their areas of focus to remain competitive. Many have chosen to consider all potential options for achieving growth. This includes recruiting laterals, small groups, or combinations. They are not mutually exclusive options and many firms choose to put all three options on the table.

In The American Lawyer pieces on consolidation and stratification, authors Nicholas Bruch and Hugh Simons contend that law firms are pursuing those strategies because of incorrect perceptions about their value as revenue and profit growth drivers. Moreover, they contend that inorganic growth strategies create “…disruptive distractions for leaders…” that “…create no strategic advantage.” We agree that law firms need to create strategic advantages more than ever in an era of slow-growth exacerbated by new entrants. The question is how best to achieve strategic advantage. We believe that most firms will be best served if they consider all available alternatives as part of a robust strategic planning process.

Lateral hiring's impact on law firm financials

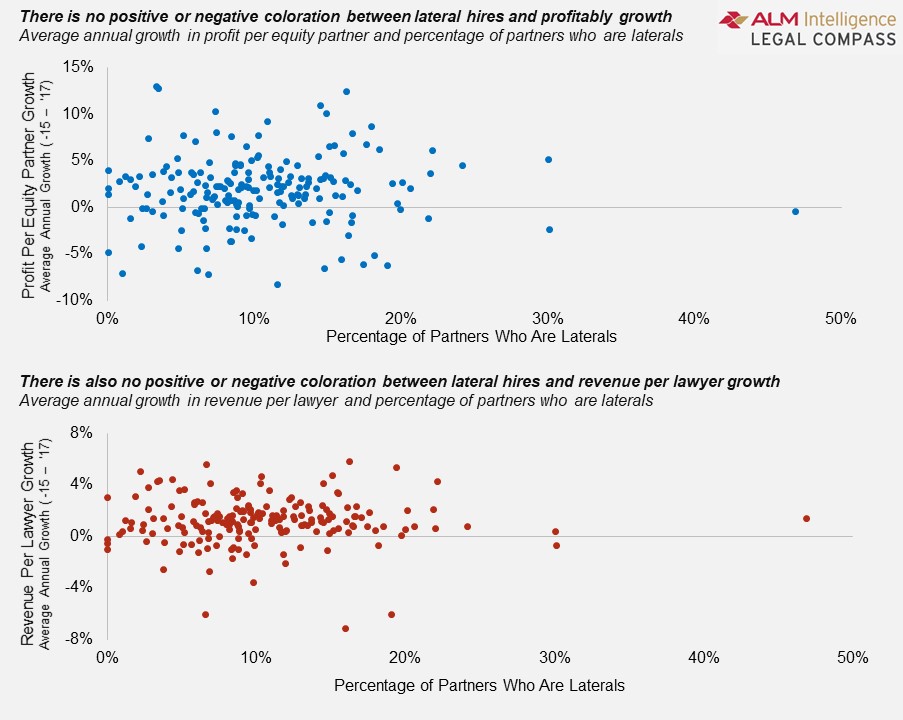

To better understand the role of lateral growth as a strategy in law firm success we took a look at whether lateral acquisition influences RPL or PPEP growth. The charts below plot the percent of total partners who joined Am Law 200 firms laterally over a three-year period and RPL and PPEP compound growth of those same firms over the same three-year period. Note that this analysis includes only partners who lateralled from another firm as solos or in small groups, not lawyers who joined the firm through combinations. This analysis indicates no positive or negative correlation between lateral growth and PPEP or RPL growth.

The data on its own suggests that the addition of laterals and small groups neither helps nor hinders growth in RPL and PPEP. In fact, there are many other factors that drive changes in RPL and PPEP including how well growth strategies are executed. This point was driven home by another piece in The American Lawyer on the importance of law firm management by Bruch and Simons. The data showed that of 25 firms in the Am Law 50 that experienced PPEP growth,18 grew due to management levers including higher leverage, lower costs, and managing the growth of equity partners. The thesis that well-managed firms are more likely to grow profitability is hard to argue with. However, to achieve sustainable competitive advantage, firms are best off if they are open to a wide range of options including improved management, lateral acquisitions, group acquisitions, and combinations.

Determining your strategic direction

So how does a firm decide which strategies to pursue? Developing a robust strategic plan provides the best basis for choosing among the growth options available to a law firm. An effective strategic planning process starts with taking stock of the firm's current situation, including analysis of the firm's financials, clients, talent, competition, governance, technology, and relevant market trends. The firm can then determine which strengths to prioritize for investment, weaknesses to correct, opportunities to pursue, and threats to guard against.

The next step is to articulate and build consensus around a vision of what the partners aspire to build together for their practice over three to five years. The vision should be both aspirational and reasonably achievable. It should also represent the views and desires of its key internal and external stakeholders. Finally, it should address the firm's sources of sustainable competitive advantage. How will it compete for market share in a world where the pie is not growing, and increased market share is the most available source of profitable growth? Only when the firm has achieved consensus about the vision, should the conversation turn to strategies to achieve the vision, including whether to consider growing through laterals, groups of laterals and/or a combination.

A strategic plan succeeds when the firm considers all the levers leaders have available to them to achieve the firm's vision. Everything is on the table but only the most important strategies—those that will be outcome determinative of achieving the vision—should emerge from the planning process.

When is growth through laterals and combinations a good option?

For firms that have a credible strength in a particular market—geography, practice, or sector—but need to bolster that strength to achieve leadership status, lateral growth or a combination may be the most expeditious tool available to them. Organic growth may simply take too long and doom the firm's ability to compete in that market. Lateral growth alone may not be enough either because it is expensive, takes time, and has a high margin of error due to its hit or miss nature. As a result, many firms will review all available alternatives to enhance their status in markets where they want to lead. Even if those strategies do not result in short-term profitability or RPL growth, they may be the best available alternatives to make the firm more resilient in the face of increasing competition for clients and lawyers, give it more money to grow in priority areas, create more depth and competitive advantage, and stave off potential revenue and profitability declines. A short-term investment may not have immediate returns, but it may be the best available alternative and has potential to pay dividends over the long haul.

For most firms, enhancing current client relationships will also be an important strategy for increasing market share and growing revenue and profits. Increasing headcount in chosen areas of focus can help shore up important relationships by ensuring that clients' needs can be met more deeply or broadly.

Disciplined execution is the key to success of laterals and combinations

The success of a lateral, small group, or combination growth strategy (or all of the above) depends on strong execution. Firms need to be proactive, thoughtful, and take a robust approach to identifying and vetting laterals and combination opportunities. They also need to develop a proactive approach to integrating new lawyers and groups or integrating combined firms.

To achieve their vision, many firms need to balance building scale and depth with enhancing profitability. Some firms need to focus initially on getting more profitable before assessing growth opportunities. This yields better options to grow, whether through laterals or a combination or both. Enhancing profitability may take priority when a firm is already perceived as a leader in key markets but needs to enhance its performance to ensure that top talent is not lured away by higher performing firms. Here the management focus should be on determining which levers will most likely increase profitability, including rates, realization, productivity, leverage, timely collections, and cost management. Again, disciplined execution will be the key to success.

The inevitability of disruption has become a leitmotif in the legal industry. Change is necessary for many of today's firms to stay competitive in a slow growth but rapidly changing market in which the competitive landscape is shifting. Many firms are becoming vulnerable to poaching from higher performing firms that are pulling away financially. Because the legal market is so rich and resilient, the legal industry continues to attract new competitors whose strategies are to drive costs down and service levels up. Surveys show that law firm leaders recognize the challenge. However, change is hard to achieve when most equity partners in surviving firms are earning more each year. The types of change necessary will vary from firm to firm. There is no silver bullet. Strategic headcount growth balanced against profitability enhancing measures will always be tools in the toolkit for achieving success. It is just a question of deciding when to deploy which tool and how. Strategic planning is a means to answering those questions while building consensus around a differentiated vision for the firm's future and measurable goals to get there.

Mary K Young and Kent Zimmermann are principals with Zeughauser Group and members of the ALM Intelligence Fellows Program.

Mary K's practice focuses on developing and implementing successful growth strategies and branding plans for law firms. Her work for law firms builds on six years as a CMO and 13 years as a business executive for Kraft and the distilled spirits industry.

Kent is one of the legal industry's leading advisors on strategic planning and law firm mergers. As a former general counsel and chief executive officer, Kent counsels the leaders of Am Law 100, 200, Global 100, and specialty firms on the challenges and opportunities they face in an increasingly competitive industry.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Morgan Lewis Closes Shenzhen Office Less Than 2 Years After Launch

AI's Place in Big Law Broadens, As Firms Embrace Fresh Uses of the Technology

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250