US Tort System Costs $429B, but Plaintiffs Get Just 57 Percent of That, Report Says

The U.S. Chamber of Commerce's Institute for Legal Reform released the report on Wednesday at its annual summit, along with a white paper that called on Congress to reform securities laws.

October 25, 2018 at 09:24 AM

5 minute read

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System.”

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System.”

U.S. tort system costs totaled $429 billion in 2016, or 2.3 percent of the nation's gross domestic product, but plaintiffs got just 57 cents on the dollar. That's according to report released on Wednesday by the U.S. Chamber of Commerce's Institute for Legal Reform at its annual summit in Washington, D.C.

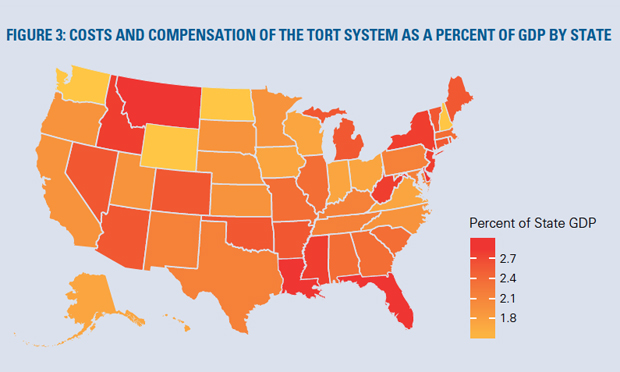

The report, called “Costs and Compensation of the U.S. Tort System,” gave a state-by-state breakdown of costs that also included insurance payouts and legal fees to both defense and plaintiffs attorneys.

“Historically, we have the most expensive tort system in the world, but cost does not equal value when little more than half of each dollar goes to plaintiffs,” said Institute for Legal Reform President Lisa Rickard in a statement on Wednesday. “Our tort system totaled about $3,330 per household—or almost double the average cost of putting gas in your car—an alarming trend when you consider that over 40 cents per dollar go to attorneys' fees and other costs.”

The group also released a white paper, prepared by Mayer Brown partner Andrew Pincus in Washington, D.C., on the growth of securities class action filings. Citing the findings of other reports, such as Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse, that paper found that shareholders filed lawsuits in 85 percent of mergers and acquisitions worth more than $100 million.

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System”

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System”The white paper, called “A Rising Threat: The New Class Action Racket That Harms Investors and the Economy,” encouraged Congress to enact the first reforms in securities laws since the Private Securities Litigation Reform Act of 1995, which has failed to stem a new wave of shareholder cases.

“Securities class action lawsuits are spiraling out of control: Plaintiffs' lawyers are filing more meritless lawsuits than ever before,” Rickard said in a statement. “This scam forces companies to provide a few meaningless disclosures and to pay fees to plaintiffs' lawyers, while shareholders get nothing.”

The Chamber's Institute for Legal Reform released both reports while outlining emerging trends at its 20th annual summit. Those trends included third-party litigation financing, class actions in Europe and “locality litigation,” or the practice of cities and counties bringing lawsuits, such as the majority of the cases brought over the opioid epidemic.

The American Association for Justice, the nation's largest plaintiffs' bar organization, discounted the findings of the Chamber's reports.

“The Chamber's claims on the costs of litigation have no basis in reality and include items tangentially associated with litigation, like insurance companies' administrative costs and profits,” wrote AAJ spokesman Peter Knudsen. “Then, on the same day, they advocate curbing the ability of shareholders to hold a company accountable if it defrauds its investors. These 'reports' serve as more proof that the Chamber will do and say anything to make sure that unscrupulous pharmaceutical companies, big banks, and large corporations are never held accountable in court.”

But Bryan Quigley, senior vice president of strategic communications at the Institute for Legal Reform, said the tort costs study is the most comprehensive since a 2011 report by Towers Watson (now Willis Towers Watson). He said the report's goal isn't to recommend fixes but to provide data to back up many of the Chamber's concerns, some of which are at the heart of legislative proposals.

“We believe this is really a foundational set of data for what we do in terms of advocating for a better civil justice system,” Quigley said.

The tort costs report was based on insurance claim data compiled by The Brattle Group, which is a consulting firm, and the Alabama Center for Insurance Information and Research at the University of Alabama's Culverhouse College of Business.

The report, which looked at litigation brought under both common laws and statutory laws, found that $250 billion of the 2016 tort costs came from a broad range of commercial and personal liability claims. Another $160 billion came from automobile accident claims, and medical malpractice litigation accounted for $19 billion.

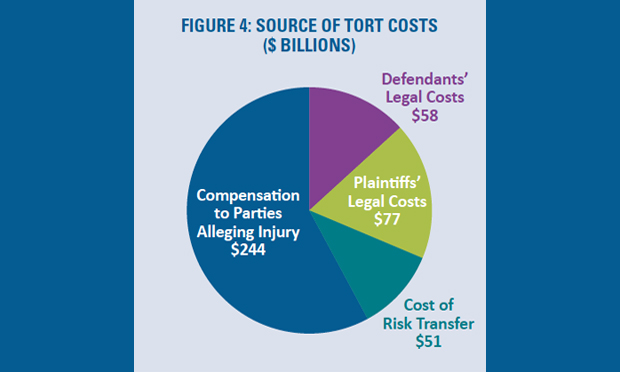

The report revealed what it deemed an inefficient legal system. Of the $429 billion total, $244 billion went to compensate plaintiffs, but plaintiffs lawyers got $77 billion, defense lawyers $58 billion, and $51 billion covered insurance costs.

“If you break down the cost component, our study shows only 57 cents of every dollar is actually getting to the victims,” Quigley said. “The rest goes to plaintiffs and defense costs, or administrative and transfer costs. All the costs are not going to the people who purportedly the system is there for: the plaintiffs themselves.”

The report has a breakdown of each state's tort costs as a percentage of its gross domestic product. The report found that states with the most-expensive tort systems had costs up to 2.1 times larger than the least-expensive states. Wyoming, for instance, was the least expensive, with costs of 1.6 percent its gross domestic product, while Florida had the highest at 3.6 percent. Other states with the most expensive tort systems were New Jersey (3.1 percent), New York (2.9 percent) and Delaware (2.7 percent).

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'That's Disappointing': Only 11% of MDL Appointments Went to Attorneys of Color in 2023

7 minute read

Confusion Over New SEC Cyber Rules Leading Firms to Overstate Attack Readiness

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250