A Foreshadowing of Big Law's Future: Intellectual Property's Turbulent Decade

The IP market's pricing crash and competitor churn offer an instructive tale

October 31, 2018 at 09:01 AM

11 minute read

Gillette rode a simple business model for three decades: add product complexity, raise price, and watch profits soar. Big Law has followed the same formula. But just as Dollar Shave Club blew apart the Gillette model, in-house counsel's taking of work away from outside firms is hollowing out Big Law.

Gillette rode a simple business model for three decades: add product complexity, raise price, and watch profits soar. Big Law has followed the same formula. But just as Dollar Shave Club blew apart the Gillette model, in-house counsel's taking of work away from outside firms is hollowing out Big Law.

When I share the Gillette story with law firms I get the predictable reactions: nitpicking at the analogy and assertions of law's uniqueness: “Interesting, but it wouldn't happen in law”. Actually, it has already happened in law: the intellectual property (IP) market has been the bellwether. It's a cautionary and instructive tale.

The IP Market's Decade of Turmoil

The IP market has two major segments: patent prosecution (securing and maintaining patents) and litigation (fighting infringements); other segments (e.g. IP due diligence, licensing) are smaller and more integrated with their contiguous transactions and industry practices. Both of the major segments have undergone profound change in the last decade.

While some patent prosecution work is rocket science, the vast majority is not. Rather, it is work best executed by following standard, pre-defined, processes. Client value stems less from 'doing the right thing' (because all service providers deliver essentially the same result) and more from 'doing the thing right' (i.e. speed, efficiency, and consequent low cost). Optimizing workflows, and integrating new technology, are central to delivering client value.

This growing primacy of efficiency has changed the prosecution segment's dynamics. Law firms, through their focus on billed hours as the principle measure of lawyer performance, are set up to be effective (i.e. do the right thing) rather than to be efficient (i.e. do the thing right). They have been slow relative to clients in adopting new technology. Thus, it is no surprise that large technology and life sciences companies took much patent prosecution work in-house. Client companies that were too small to justify in-sourcing continued to use outside firms but drifted over time to those whose partners had the foresight to change their way of practicing to include operating at great leverage (including extensive use of non-lawyers) and who had convinced their firms to invest in the requisite workflow redesign and technology. The net result has been a contraction in aggregate demand and a shifting in the relative competitiveness of the firms left fighting over the smaller pie.

The litigation segment has been no less in flux. One big change has been the establishment of the PTAB (patent trial and appeal board). The PTAB provides a path to dispute resolution that is significantly lower cost than the traditional litigation approach. It is applicable to many IP situations but particularly to patent “troll” work, i.e. defending big companies from (often nuisance) suits from non-practicing entities. As the PTAB came up to speed, the aggregate volume of work for litigators contracted markedly.

Another major change in the litigation arena has been the ending of the “smartphone wars”. This term refers to the almost decade-long patent battle between Apple and Samsung that dragged in collateral players and technologies through the networks of alliances involved. The perceived technology infringements were taken as almost personal affronts; tough counter measures were seen as critical to ensuring the transgressions weren't repeated. Consequently, law firms were instructed to go all out.

The smartphone wars have now run their course and are winding down. As they do so, they are having both direct and indirect consequences on the segment. The direct consequence is the drying up of a high-volume stream of compelling work; the indirect consequence is that the war has left the technology industry circumspect about the value of big-ticket litigation. The protagonists have little to show for the time, effort, and (literally) hundreds of millions of dollars paid in legal fees. The settlement amounts (still being argued about), while large in absolute terms, are small potatoes in the scheme of the tech industry. Technology progresses so much faster than litigation that the latter loses relevance. Patent fights have gone from being seen as must-win to being wars of choice, and increasingly the choice is not to bother. The upshot has been a sharp curtailment in aggregate demand and a reshaping of the competitive landscape as firms fight for share of the re-sized pie.

When demand in a market undergoes structural contraction, we expect supply to follow suit. However, law firms have demonstrated themselves to be less capable than normal businesses at addressing supply imbalances (i.e. an excess of lawyers). There are a number of reasons for this. One is that some firms fail to recognize when a structural contraction occurs and instead assume it is a cyclical low in demand. Another is that leaders of some firms are humane to the extent of being conflict-avoidant so that, rather than address the lawyer excess, they use the ongoing record-setting financial performance of other practices to gloss over the problem. Big Law's inability to address excess capacity is particularly pronounced in IP. Compared with general corporate, transaction, or litigation lawyers, IP lawyers are harder to re-purpose into other practice areas. Theirs is a narrow specialty with hard boundaries. Even those lawyers with the requisite versatility are loath to change as their self-identity is tied to the overlap between technology and law. The repurposing of lawyers to other areas is the too most commonly-used by firms looking to reduce capacity in a particular practice; it's ineffective when it comes to IP. The aggregate impact of these factors is that the IP lawyer excess has simply gone unaddressed.

With demand contracting structurally in its two major segments, and firms failing to address the lawyer excess, we would expect price levels to drop. As the market pricing data in Table 1 shows, this is indeed what has happened: prices of prosecution offerings have fallen 17 to 37 percent over the last decade; litigation prices have fallen by a half.

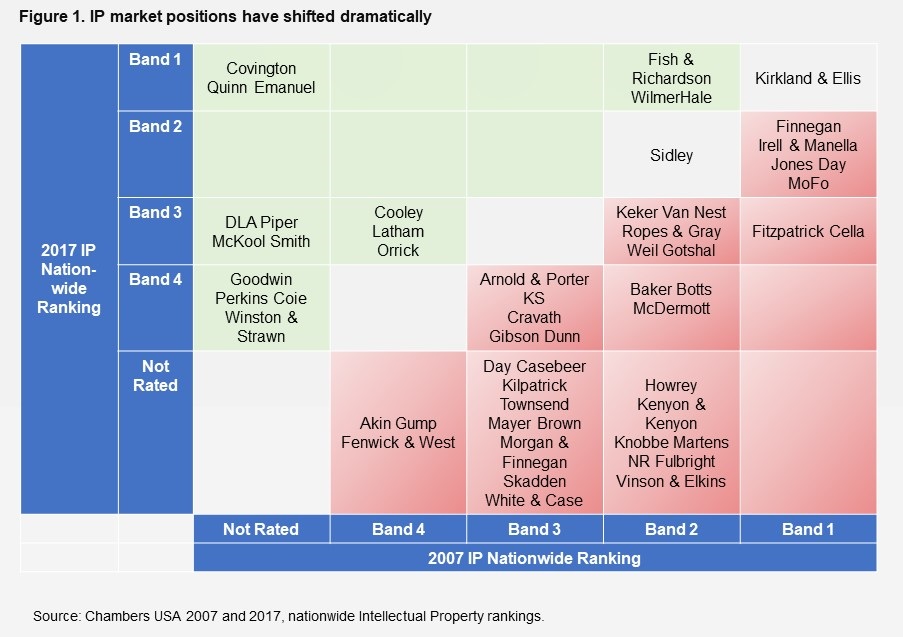

There's also been a major shakeup in the relative standing of the firms in the IP market. Figure 1 shows the 2007 and 2017 Chambers USA Nationwide rankings for IP. The columns are the 2007 rankings by band, and the rows are the 2017 rankings by band. Thus, the firms in the shaded diagonal cells are those who have not changed band; those above this diagonal have risen in band (green cells), and those below it have fallen (red cells).

If we look at the six firms ranked in Band 1 in 2007 (i.e. the rightmost column), only one (Kirkland & Ellis) is so ranked a decade later; of the four other firms in Band 1 in 2017 (i.e. the top row), two ascended from Band 2 (Fish & Richardson, WilmerHale), and two were unranked in 2007 (Covington, Quinn & Emanuel). As is typical when you look at these changes in rankings, the churn in the bands below Band 1 is even greater: of the thirteen Band 2 firms in 2007, two went up, one held, and an astounding ten have fallen in band; of the nine Band 3 firms in 2007, all have fallen. Such high levels of instability are not normal. In fact, IP has been Big Law's least stable practice: of the 31 practices (with 10+ ranked firms) defined consistently by Chambers USA Nationwide in 2007 and 2017, IP has the lowest percentage of firms in the same band then and now.

Implications for other markets

What happened in IP will be mirrored in other markets as clients take more and more work away from Big Law and either execute it in house or use lower cost providers. What does the IP case study suggest for how firms can best position themselves for the coming shake up?

One observation is that the super elite litigation firms (Kirkland, Quinn Emanuel, and WilmerHale) have done well, see Figure 1 again. It's interesting to note that these firms have positioned themselves more as expert trial lawyers than as technology or IP experts. Trial skills are those needed most when a matter truly is bet-the-company; thus, these firms are positioned in a premium subsegment of IP, one contiguous to other of their positions of strength. The implication for other markets: firms with established positions in premium subsegments, reinforced with precise value propositions (e.g. “we're trial lawyers”) rather than broad competence (e.g. “we do everything in IP”) will prosper through the turmoil ahead.

Figure 1 also shows that firms which have held themselves out as offering both prosecution and litigation have generally performed poorly, (Fish & Richardson being an exception). At one level this isn't surprising. The supposed synergy whereby patent prosecution feeds work to IP litigators has long been suspect. Clients choose a patent prosecution counsel because they believe they'll get a clean patent; if the patent ends up being litigated, they're unlikely to return to the firm who obtained it to straighten out the mess. The lesson here: dodgy strategies will be exposed. Firms that articulate their strategy as “we do the most important work for leading-edge clients”, “we are an elite global law firm”, or similar cliché, need to focus in on what truly will endure in an environment of excess capacity and intensified competition.

I suspect that some of the firms that declined in the rankings shown in Figure 1 did so deliberately. Having identified IP as a market undergoing structural change, and believing it not to be central to the bundle of offerings their firm makes to its core clients, these firms will have stopped investing, or even effectuated some degree of retreat. This can be a wise move. Undifferentiated positions will become increasingly problematic; investing to reinforce differentiated positions elsewhere will yield stronger returns. The implication for other markets: many firms will do well to retreat from their undifferentiated market positions and look to build enduringly-defensible positions in other segments.

Figure 1 also shows that the market has attracted some firms that are essentially new comers. Some of the new comers seem strange; IP is not a practice related to their areas of strength. There may well be some thinking of the “let's be a big broad-based firm like the other guys” variety going on. This is not an articulation of strategy. These firms are holding positions in the high-churn lower Bands; they'll have churned out of these in a decade from now and will have nothing to show for the investment. The implication: a changing market may open possibilities (as, for example, partners at other firms look for new homes) but you should resist the temptation to diversify. As has been proven over and over: unrelated diversification doesn't pay.

A closing thought

Big Law had a great defense against action by clients who were unhappy with the value provided because when it came to raising price, resisting streamlining of processes, and investing in service-delivery technology, all of Big Law behaved the same. Thus, clients had no viable alternatives. This is changing, and the change is proceeding practice by practice with IP being in the vanguard. Clients, especially large, sophisticated, companies, are taking more and more work in-house and either executing it themselves or passing it off to lower cost providers. The consequent contraction in demand will put enormous pressure on the non-elite practices at elite firms, and on all parts of non-elite firms. Getting a firm's portfolio of practices restructured for sustainability has never been more urgent.

Hugh A. Simons, Ph.D., is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He writes about law firms as part of the ALM Intelligence Fellows Program. He welcomes readers' reactions at [email protected]

More information on the ALM Intelligence Fellows Program can be found here.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Arizona Supreme Court Presses Pause on KPMG's Bid to Deliver Legal Services

After Breakaway From FisherBroyles, Pierson Ferdinand Bills $75M in First Year

5 minute read

Big Law Practice Leaders Gearing Up for State AG Litigation Under Trump

4 minute readTrending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250