Big Law Should Raise Partner Billing Rates 10+ Percent Now

It's critical to the long-term viability of Big Law that partners delegate more and that firms re-balance where margin is generated; raising partner rates aggressively will help with both

November 15, 2018 at 09:01 AM

5 minute read

We're close to a peak of the business cycle. Client businesses are performing strongly; they can afford aggressively-increased partner billing rates. But the logic for raising rates strongly now is more than just opportunism; it's about Big Law's long-term viability. For firms to remain prosperous two things must happen: partners must delegate more and firms must re-balance where they generate margin (i.e. profit) from more junior to more senior lawyers. Raising partner rates aggressively now will help on both these fronts.

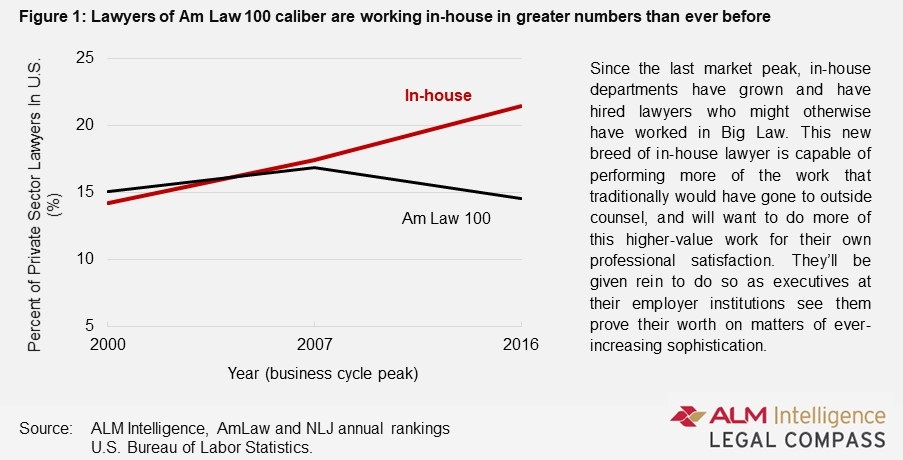

On delegation, let's start with two observations. First, clients have been taking work away from Big Law and doing it in-house (or through lower-cost providers) because so doing saves money. This shifting will intensify as the new breed of more-capable in-house lawyer (see Figure 1) takes not just more work, but more high-end work, away from outside counsel. Second, more than half the hours partners bill (in many cases, well more than half) are for work that could be done by a lawyer with a lower billing rate. These observations connect: getting partners to delegate more will lower total client charges which is vital to Big Law stemming the contraction of market demand. As an aside I use 'delegate' not 'leverage' here deliberately: when partners hear 'leverage' they think they have to add more associates to their matters; by using 'delegate' I hope for partners to hear that instead of their doing an hour's work, they have an associate do it.

The connection between delegation and partner billing rates isn't entirely obvious but it's real. Many partners recognize that much of the work they do is not true partner-level work. Hence, they are wary about charging full partner billing rates; but rather than delegating (as they should), they appease their conscience by shaving a little off their billing rates. Despite this back-pressure, the failure to delegate results in unnecessarily-increased client fees and also denies associates learning opportunities and disinclines partners from doing that which they should be doing, i.e. going out and finding more high-quality work. Raising partners' billing rates assertively will push back on this dynamic, increase delegation, lower fees, and thus help stem the contraction in market demand.

On the issue of re-balancing where margin is generated, let's again start with two observations. The first is that, over time, technology will continue to reduce the demand for junior lawyer time relative to that of senior lawyers. The second is that today's billing rates generate higher margin on junior lawyer time than on senior lawyer time. To see this latter, take a look at the amount by which billing rates exceed compensation (converted to an hourly equivalent) by lawyer cohort. What you'll find is that billing rates are 4.5 to 5.0 times compensation for junior associates and only 3.5 to 4.0 times compensation for senior associates and counsel. Again, linking the two observations: Big Law is on a path to see margins and profitability diminish as technology continues to erode the demand for junior lawyer time.

Big Law's margin structure is befuddling. It is inverted relative to all other businesses—all others charge a higher mark up on their higher-value products—e.g. in the rag trade, the mark up on haute couture is much higher than that on prêt-à-porter (ready-to-wear). The inversion is the cumulative effect of many years of raising associate rates more than partner rates while being careful not to let senior associate and counsel rates come too close to junior partner rates. Clients are instinctively aware of the nonsense that associate billing rates have become; that's why they say they see the value in partner billing rates but balk at the junior associate rates. The truly weird part is that Big Law's wacky billing rate structure is entirely of its own making. Clients care greatly about the total fee charged; they care little about how that total is arrived at in the law firm's billing system.

To change this profitability trajectory, Big Law needs to raise partner billing rates aggressively so that the billing rates of senior associates and counsel can rise so that, in turn, the greater margin earned on the time of these more senior lawyers can offset the loss of margin through diminished demand for junior lawyer time. This cannot be done overnight. But it must be done at a pace equivalent to that of technology's erosion of junior lawyer demand, and it must begin now as Big Law's billing rates are already behind the curve.

In a normal year, partner rates would go up around 5 or 6 percent. Continued increases at this rate won't fix the problem. Rates must go up more especially in years where client businesses are performing strongly. Thus, this year partner rates should go up by 8 to 10 percent, and by more for the most sought-after partners in the busiest practices.

It's rare in Big Law that opportunity aligns with pressing needs. But now is such a time. The opportunity is created by the business cycle; the needs are to increase delegation and re-balance where margin is generated. It's an opportunity not to be missed.

Hugh A. Simons, Ph.D., is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He writes about law firms as part of the ALM Intelligence Fellows Program. He welcomes readers' reactions at [email protected]

More information on the ALM Intelligence Fellows Program can be found here.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Are 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute read

Are Counsel Ranks Getting 'Squeezed' as Nonequity and Associate Pay Grows?

5 minute readTrending Stories

- 1Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 2Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 3Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

- 4Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

- 5Judge Grants TRO Blocking Federal Funding Freeze

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250