U.S. Securities and Exchange Commission building. Photo: Diego M. Radzinschi/ALM

U.S. Securities and Exchange Commission building. Photo: Diego M. Radzinschi/ALM Alleged Cryptocurrency Scammers Agree to Pay $2.7M to Settle SEC Case

Jared Rice Sr. and Stanley Ford, who served as CEO and COO of the Dallas-based AriseBank, respectively, also have been barred for life from serving as officers and directors of public companies and participating in digital securities offerings.

December 13, 2018 at 02:50 PM

4 minute read

The original version of this story was published on Corporate Counsel

The U.S. Securities and Exchange Commission has delivered potential knockout punches to a pair of now-former executives who used an endorsement from boxing legend Evander Holyfield as part of an effort to promote an allegedly fraudulent initial coin offering, or ICO.

Jared Rice Sr. and Stanley Ford, who served as CEO and COO respectively of the Dallas-based AriseBank, have been barred for life from serving as officers and directors of public companies and from participating in digital securities offerings as part of a settlement with the SEC.

The case marks the first time that the SEC has sought the appointment of a receiver to help retrieve investors' money in an ICO fraud action, according to Steven Peikin, co-director of the SEC's enforcement division.

AriseBank was billed as a “first-of-its-kind decentralized bank,” but it turned out to be a sham, according to the SEC, which announced the settlement Wednesday. Under the arrangement, Rice and Ford, who did not admit to any wrongdoing, must pay nearly $2.7 million in penalties. The payment includes more than $2.2 million in disgorgement and $68,000 in prejudgment interest.

AriseBank allegedly failed to file a registration with the SEC ahead of the ICO, which made the offering illegal, according to the complaint. The SEC also alleged that AriseBank lied to potential investors by claiming that it could offer Federal Deposit Insurance Corp.-insured accounts and transactions because it had bought a 100-year-old bank. In reality, AriseBank and the established bank it claimed to have bought were never insured depositories under the Federal Deposit Insurance Act, according to the SEC's complaint.

The agency further alleged that AriseBank misled investors about offering an AriseBank-branded VISA card and failed to disclose to investors that Rice was on probation for felony theft and tampering with government records.

Attorneys with Brown & Hofmeister in Richardson, Texas, and Garland, Samuel & Loeb in Atlanta represented AriseBank and Rice, respectively. Attempts to reach the attorneys were not successful.

Rice revealed in an accounting affidavit that he'd spent $55,000 in bitcoin on marketing AriseBank and its ICO. He also stated that he'd transferred $2.1 million in cryptocurrency to a man named Richard Smith Jr. Smith of Syracuse, New York, is named alongside Palm Beach, Florida, resident Kurt Matthew Jr. in a federal complaint that AriseBank's court-appointed neutral receiver, Mark Rasmussen, filed in Dallas. Smith and Matthew's attorney, John Teakell of Dallas, could not be reached for comment Thursday.

In a news release, Stephanie Avakian, co-director of the SEC's enforcement division, described AriseBank's ICO, which the SEC halted earlier this year, as an “outright scam.”

Shamoil Shipchandler, director of the SEC's regional office in Fort Worth, Texas, warned that scheming to “conceal what we alleged to be fraudulent securities offerings under the veneer of technological terms like 'ICO' or 'cryptocurrency' will not escape the Commission's oversight or its efforts to protect investors.”

In January, the SEC filed a complaint against AriseBank, Rice and Ford in U.S. District Court for the Northern District of Texas, Dallas Division. The suit alleged that AriseBank began promoting its dubious ICO late last year, when it offered the public sale of an eponymous digital currency and claimed to have raised more than $600 million on the way to achieving a goal of $1 billion.

Chief Judge Barbara M.G. Lynn of the U.S. District Court for the Northern District of Texas ordered the sanctions Dec. 11.

While the SEC case has settled, Rice's troubles are far from over. The FBI arrested him last month after he was indicted by the U.S. Attorney's office Nov. 28 on three counts each of criminal securities fraud and wire fraud. The Dallas Morning News reported that he could face up to 120 years in federal prison if convicted on all counts.

Read more:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

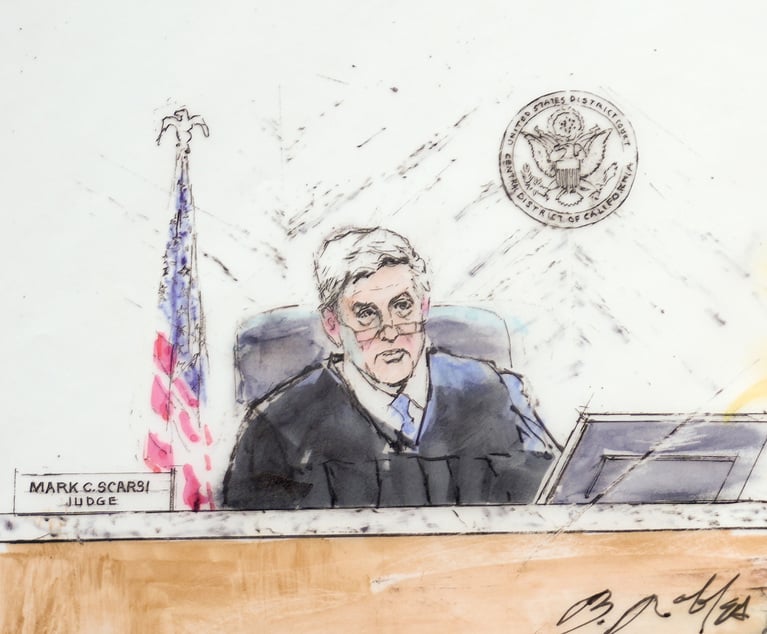

Federal Judge Named in Lawsuit Over Underage Drinking Party at His California Home

2 minute read

Financial Watchdog Alleges Walmart Forced Army of Gig-Worker Drivers to Receive Pay Through High-Fee Accounts

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250