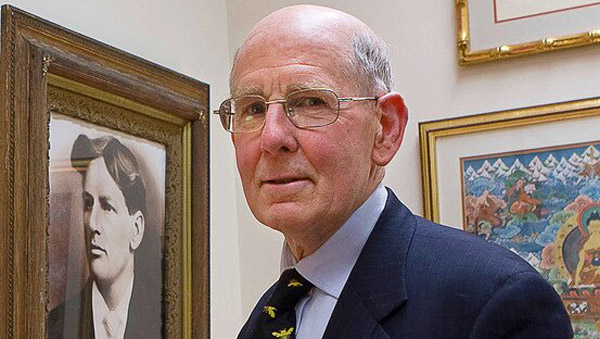

Gary Shilling

Gary Shilling Gary Shilling Sees 66% Chance of Recession in 2019

He recommends "defensive" stock sectors, long-term Treasuries and a "heavy cash position."

January 02, 2019 at 04:17 PM

3 minute read

Broad MarketThe original version of this story was published on Law.com

Money manager Gary Shilling, who correctly predicted the housing bubble that led to the 2008 Great Recession and the global inventory overhang that preceded the 1973-1974 recession, is now forecasting better than even odds of a U.S. recession later this year.

In his January 2019 Insight report, Shilling "puts the odds of a U.S. recession that could be global this year at about two-thirds. The other third would be an economic slowing but no sustained decline."

Shilling has become increasingly negative about his outlook for U.S. and global growth, writing in November that "the recent equity selloff raises the possibility of a full-blown bear market and recession, especially as the Fed continues to tighten credit."

Since then the Fed has raised interest rates once more, for a total of four hikes in 2018, and telegraphed two more hikes for 2019, and the stock market selloff deepened. The S&P 500 lost 9% in December alone, its worst performance for that month since 1931, and it ended 2018 with a 6.2% loss, its biggest decline in 10 years.

Now Shilling, an economist by training, has issued what he calls "a firm recession forecast," based on 13 "recession forerunners" that could conceivably "kill the economic session." They include a further stock market decline and central bank tightening along with declining housing activity, falling corporate profit growth, declining commodity prices and escalating U.S.-China trade war.

The other forerunners are a nearing yield curve inversion, widening yield spread between junk bonds and Treasuries, downward economic data revisions, mounting emerging market troubles, falling global leading indicators, output exceeding capacity and consumer optimism nearing a peak.

"Today, many forerunners of recessions are in place," writes Shilling, but two are missing: excessive Fed tightening and a financial crisis, either one of which helped precipitate all post World War II downturns, according to Shilling.

The Fed will have a harder time avoiding a recession because the central bank is not just raising rates but also selling off a $4 trillion-plus portfolio of Treasuries and mortgage-backed securities that were purchased as part of its quantitative easing strategy to end the last recession, writes Shilling.

A financial crisis may originate from one or several developments like a "death by a thousand cuts," writes Shilling. "At present … none of recession-spawning intensity are in sight although emerging market woes are a possibility … Contagion could escalate the financial woes of emerging markets like Turkey, Argentina and Venezuela to global significance."

In the meantime, Shilling recommends that investors sell emerging market stocks and bonds as well as U.S. stock market indexes. "The long bull market that commenced in March 2009 is over and a bear market is underway."

He recommends instead small equity positions in defensive sectors such as health care, consumer staples and utilities, owning long-term Treasury bonds and "a heavy cash position." Shilling also suggests that investors sell short bitcoin and commodities such as crude oil, whose supply exceeds demand for the foreseeable future, as well as copper.

— Check out Bob Rodriguez: Recent Market Turmoil a 'Preamble' to Bigger Crisis on ThinkAdvisor.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

- 1Family Law Practitioners Weigh In on Court System's New Joint Divorce Program

- 2State Bar Ethics Opinion Determines Texas Lawyers Can't Join a Firm With Non-Lawyer Partners

- 3'Don't Be Afraid:' AGs Push Against Trump's Immigration Policy

- 4State AG Hammers Homebuilder That Put $2,000-Per-day Non-Disparagement Penalty in Buyer Contracts

- 5Selendy Gay Files Lawsuit Challenging Trump's Workforce Reclassification EO

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250