The Power of Just Getting Better at What You Already Do

Investing in existing, rather than new, practices builds sustainability and drives improved profitability

January 08, 2019 at 09:29 AM

8 minute read

It's conventional wisdom that the way for a firm to build its stature is to broaden its set of practice offerings. I hear partners say things like “All the top firms have a New York corporate practice; we should have one too” or “Great firms like Latham have tons of practices; we need to be like those guys”.

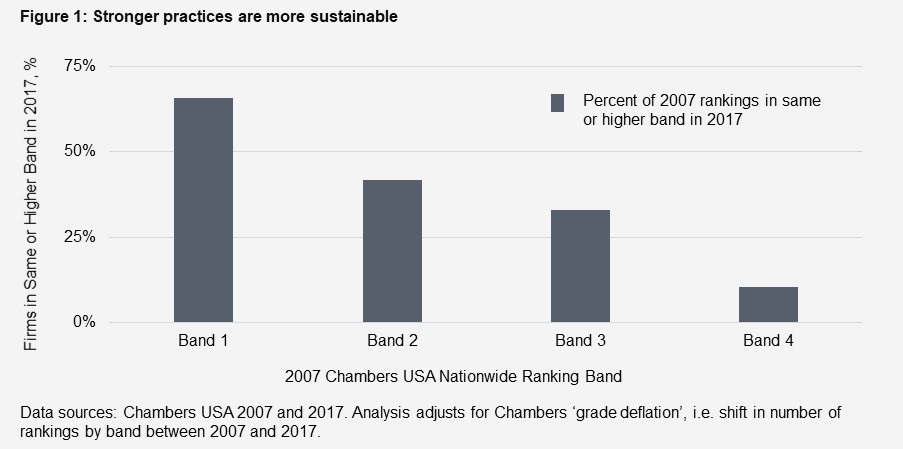

This is nuts. Or, to be polite, this is counter to what the data show. Take a look at Figure 1. It examines 2007 Chambers rankings and shows, for each ranking band, the percent of firm rankings that were in the same or higher band a decade later, i.e. the percent that sustained or improved their band ranking from 2007 to 2017, (details of the calculation in “About the analysis” below). The data show that stronger practices are more sustainable: the higher the band, the greater the probability of a firm's ranking holding or improving. For example: while two-thirds of Band 1 rankings were held, barely one-in-ten Band 4 rankings were held or rose, (i.e. 90 percent of practices in Band 4 had descended to Band 5, or were no longer ranked, a decade later). Although the analysis here looks at practice strength for those achieving Chambers USA Nationwide status, the same dynamics likely hold in other domains: the stronger the practice, the more likely it is to sustain or gain in strength.

These dynamics have important implications for how firms should think about investing to augment their stature. Broadly, a firm has two options: add breadth (build new practices) or add depth (push existing practices up the ranking bands). If a firm chooses to add breadth, they'll start with something like a Band 4 position. But such positions are precarious; there's a 90 percent chance the position will be lost in 10 years. You can picture how this plays out in the real world: a firm makes a splash by hiring partners laterally in the new practice area. But integrating laterals and cementing them to their new firms is tricky. Firm management often expects the laterals to port more business, more quickly, than they do; laterals expect management to invest more, more quickly, than the firm does. Disappointment abounds; momentum is lost; the new laterals move on—half of all laterals stay barely five years at their new firms; the move-on rate is doubtlessly higher for those in add-on practices.

The 'add depth' option has more promise. Practically, it takes the form of bolstering existing practices by having leaders spend more time focusing on the needs of the partners spearheading their growth, promoting more partners, bringing partners in laterally around the positions of proven strength, adding to the senior associate and counsel cohorts, and (crucially) investing in business development and practice support professionals. It's not sexy, it doesn't give rein to leaders to act like I-bankers, but it works: bolstering the status of an existing practice makes the practice more sustainable.

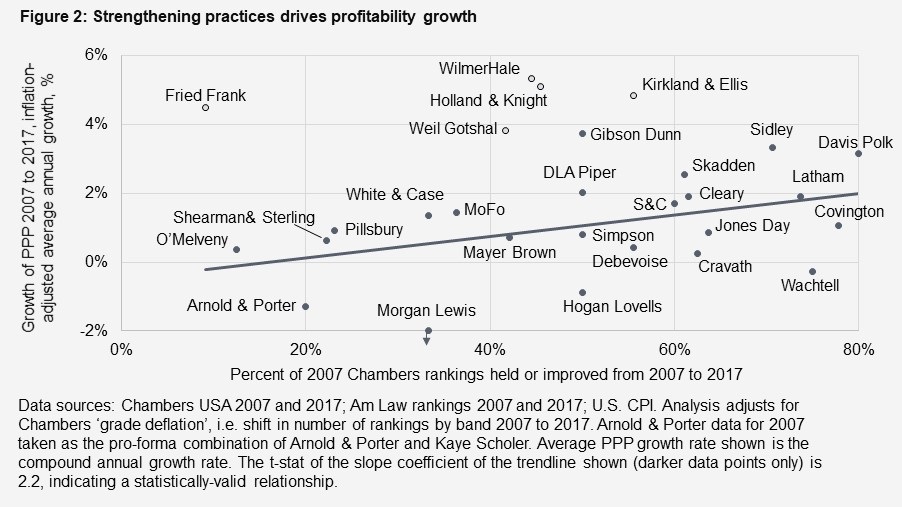

Importantly, strengthening existing practices has a benefit more compelling even than improved stability: it drives higher profitability growth. Figure 2 shows the percent of 'hold-or-rise' rankings by firm (on the horizontal axis) and growth rate of profit-per-equity partner, PPP, (on the vertical axis) for firms with ten or more practice rankings in 2007. There are 23 firms that evidence a clear trend of increasing PPP growth with growing 'hold or rise' percent, and a group of 5 outliers above the trend-line. It's never easy to identify what distinguishes outliers in macro analyses like this. That said, Kirkland can be argued to have redefined how a law firm can grow and increase profits, and it's noteworthy that Fried Frank, Wilmer, Weil, and Holland & Knight reduced their equity partner headcount over the period by 24, 20, 14, and 8 percent, respectively; this would facilitate their per-equity-partner profitability outpacing the effect of band rankings alone.

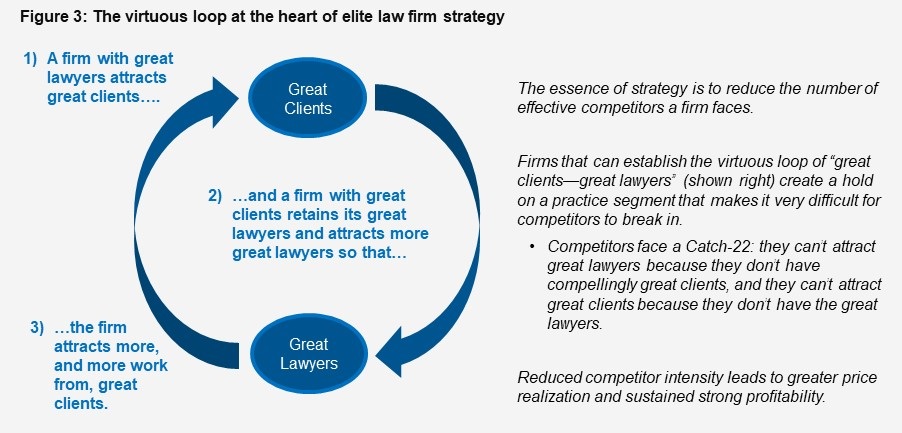

This picture of stronger practices leading to greater sustainability which in turn leads to higher profit growth is evidence of the “great lawyers – great clients” dynamic that is the core of law firm strategy (see Figure 3): great lawyers attract great clients to a firm; having great clients retains, and attracts even more, great lawyers; having more great lawyers in turn attracts yet more (and more work from) great clients; and so it repeats—a self-reinforcing loop. It's the same dynamic as at the heart of eBay: the buyers come because they know that is where the sellers are; the sellers come because they know that is where the buyers are. This dynamic keeps competitors out through a Catch-22: they don't have the lawyers to attract the great clients; and they don't have the clients to attract the great lawyers. Making it hard for would-be competitors enhances sustainability, augments price realization and drives superior profit growth.

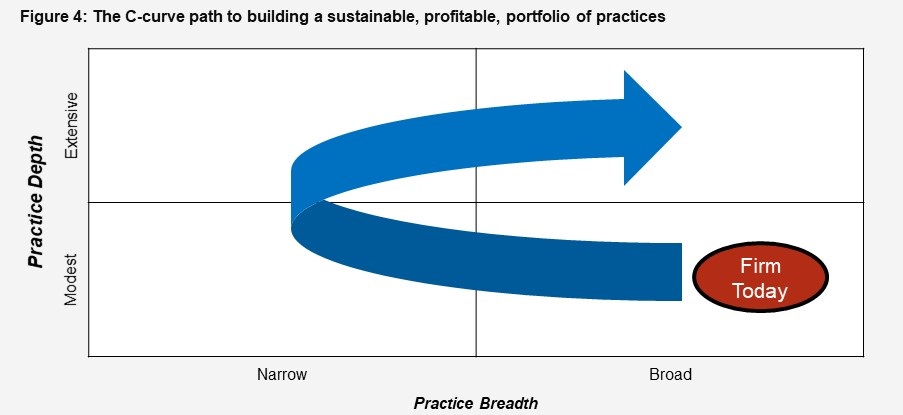

Clearly the higher return option in terms of stability and profit growth is to invest for practice depth not breadth. But what's a firm to do if it starts with a portfolio of practices that has extensive breadth without commensurate depth, such as in the bottom right quadrant of the matrix in Figure 4? Many firms try to strengthen such portfolios by building practice depth across all practices simultaneously, i.e. to climb vertically from the bottom right cell to the top right cell in the matrix. This is a tall order. The prospect for an investment initiative paying off increases with the amount invested; hence, for a given capacity to invest, the narrower the set of initiatives invested in, the higher the prospects for success. Thus, the way for most firms to build sustainable, high profit-growth, practices is first to narrow their set of practices (move to bottom left) and then to invest for depth in the more-focused portfolio of practices (move to top left). Only once a set of deep practices has been established should that set be expanded (more to top right). Thus, the path to increased firm stature is to follow the “C-curve” shown.

Closing thought

The next few years will be challenging for Big Law. The coming recession will exacerbate the disruption caused by the secular increase in client in-sourcing and technology evolution. It's more important than ever to be thoughtful, even circumspect, about a firm's portfolio of practices. On this, the evidence is clear: narrow and deep triumphs over broad and shallow.

About the analysis

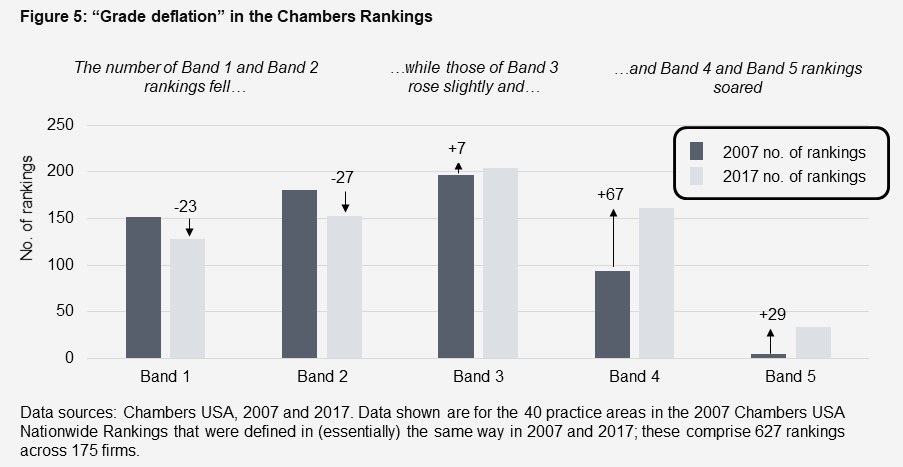

The analysis examined the 40 practice areas in the 2007 Chambers USA Nationwide Rankings that were defined in (essentially) the same way in 2007 and 2017. These comprise 627 rankings across 175 firms. A complication in the 'hold or rise' calculation stems from grade deflation in the Chambers rankings during this time period. As Figure 5 shows, the number of firms ranked in Bands 1 and 2 fell over the period, that in Band 3 rose slightly, while those in Bands 4 and 5 rose substantially. The analysis backs out this deflation by adjusting the number of surviving firms by a factor equal to the inverse of the ratio of new-to-old firms in the relevant bands. For example, there were 151 Band 1 rankings in 2007; of these, 84 were also Band 1 in 2017. However, over the period, the total number of Band 1 rankings fell to 128, a decline to 84.8 percent of the 2007 number (151). To adjust for this decline, the number of maintained Band 1 rankings in 2017 (84) is augmented by a factor of 1/0.848 to yield the grade deflation-adjusted number of 2017 rankings (99), which in turn yields a 65.6 'hold or rise' (99/151) percentage. The same adjustment is applied to lower bands by looking at the cumulative number of rankings from Band 1 down.

Hugh A. Simons, Ph.D., is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He writes about law firms as part of the ALM Intelligence Fellows Program. He welcomes readers' reactions at [email protected]

More information on the ALM Intelligence Fellows Program can be found here.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Big Law Sidelined as Asian IPOs in New York Are Dominated by Small Cap Listings

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250