Three Transactions – Which Might Happen in 2019 – That Would Reshape the Legal Market

The legal market has changed significantly over the past decade. These three transactions would significantly alter the landscape even more.

January 09, 2019 at 02:35 PM

9 minute read

As in years past, the legal market has seen a significant number of mergers and acquisitions in 2018. This past year, however, there was a bit of a twist, and possibly, the beginning of a new trend. Beyond notable law firm mergers involving Bryan Cave, Hunton & Williams, Clark Hill, and more, there were some mergers that raised a variety of eyebrows. Riverview was bought by EY. UnitedLex, which did deals with LeClairRyan and GE, was sold to CVC Capital Partners. Deloitte and EY formed partnerships with boutique immigration powerhouses Fragomen and Berry Appleman, respectively. All of this activity raises an obvious question – what might we expect for 2019?

More mergers between law firms is likely (Side note: the LegalCompass Merger Tool is a neat way to assess different merger scenarios). The 2018 calendar year was one of the busiest on record for law firm combinations. There are good reasons to think the coming year will be just as active. However, beyond law firm mergers there are a range of interesting possibilities to ponder that could have a profound impact on the legal market. Below is a list of transactions that could reshape the legal industry.

A Law Firm Buys an Alternative Legal Service Provider

Up to now, law firms have largely ignored the alternative legal service provider (ASPs) market. Law firm's lack of concern for their new competitors is somewhat understandable, as ASPs account for 1-2% of the legal market, depending on the classification of e-Discovery as an ASP. More importantly, ASPs tend to focus on lower value work, making their threat to law firms seem less worrisome.

Several recent events are forcing law firms to rethink the threat ASPs pose. The first reason for the re-evaluation is the size of today's largest ASPs. Axiom is reported to have earned $360 million in global revenue in 2018, which would be enough for inclusion into the 2018 Am Law 100. UnitedLex, the next biggest ASP, is said to have grossed $100 million, which would have placed them in the Am Law 200. While these numbers are a far cry from the biggest law firms, ASPs have become big enough for firms to begin taking notice.

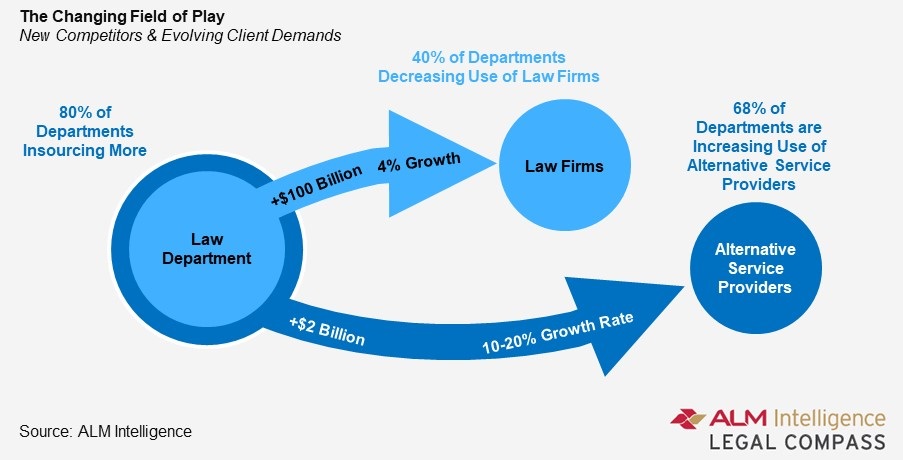

The next force causing firms to rethink their stance on ASPs is clients. Corporate clients have consistently reported that they are considering handing more work to ASPs. An ALM Intelligence report found that 68% of law departments plan to increase their use of ASPs. The same report found that 40% were planning on decreasing their use of law firms (see figure below). These trends provide strong justification for law firms to take ASPs more seriously.

The last reason is a threat posed by a specific alternative provider – the Big Four. Law firm leaders consistently report unease with the Big Four's expansion into the legal market. Their recent moves, which include the purchase of an ASP and partnerships with two immigration law firms, are causing firms to rethink the entire 'alternative' market.

All of this leads to the possibility in the coming year that a law firm acquires an ASP. While the likelihood of this may seem remote initially, the rationale is clear. Law firms which inhabit the mid-market are being squeezed by client insourcing and encroachment from the ASPs. To combat these forces, law firms need to get better at technology and process management. The ASP model, which is honed on these two key attributes, provides an obvious solution to this problem.

Will a law firm purchase an ASP in 2019? Maybe. There are rumors that some prominent ASPs could be acquired for the price. That creates the possibility of a transaction taking place. There are two problems which could stymie such a deal. The first is practicality. Buying an ASP, especially a larger organization, would be difficult for many law firm partnerships. Typically, law firms do not carry a significant cash on their balance sheet. Finding the tens of millions of dollars to purchase a smaller ASP could be difficult for many law firms, let alone the hundreds of millions needed to purchase larger, more established ASPs. Only the biggest law firms could accomplish such a feat. The second problem would be cultural. ASPs and law firms are very different organizations. They have different business models and, importantly, different cultures. It's not clear how these two very different organizations would work together. There would, undoubtedly, be growing pains.

The law firms most likely to do such a deal are the global firms, likely with a verein structure. They stand to be the most negatively affected from the growth of ASPs and the expansion of the Big Four. Conversely, they also stand to gain the most from merging with an ASP. Their scale, brands, and global platforms would make them an ideal home for an ASP. Whether one of these firms is willing to make such a big move in 2019 is an open question.

The Big Four Buy a Law Firm

A second transaction worth considering is the purchase of a law firm by the Big Four. To some degree, this has already happened.

In 2018, Deloitte and PwC signed agreements with immigration boutiques. In both cases the Big Four firms acquired the boutique's non-US offices and signed alliances with their US offices. Why alliances and not full-blown acquisitions? The US alliances could be seen as a way to side step US regulations which limit the Big Four's ability to provide legal advice in the United States, and represent a workaround (see the ALM Intelligence report on The Big Four for an overview of the regulatory issues accountancy firms face in the legal industry).

These deals could be seen as a harbinger of things to come. The structure of the Big Four's agreements with the immigration boutiques could provide a framework for future deals. There is much talk about the difficulty the Big Four would face in absorbing law firms with large US businesses or large litigation practices – neither of which the Big Four would be interested in, at least this point. The deals the Big Four signed last year showed there are ways around these problems. The Big Four could sign similar alliances with the US offices of law firms they want to acquire. They could also spin-off litigation practices and keep the corporate practices. These kinds of maneuvers could make it much easier for the Big Four to acquire law firms.

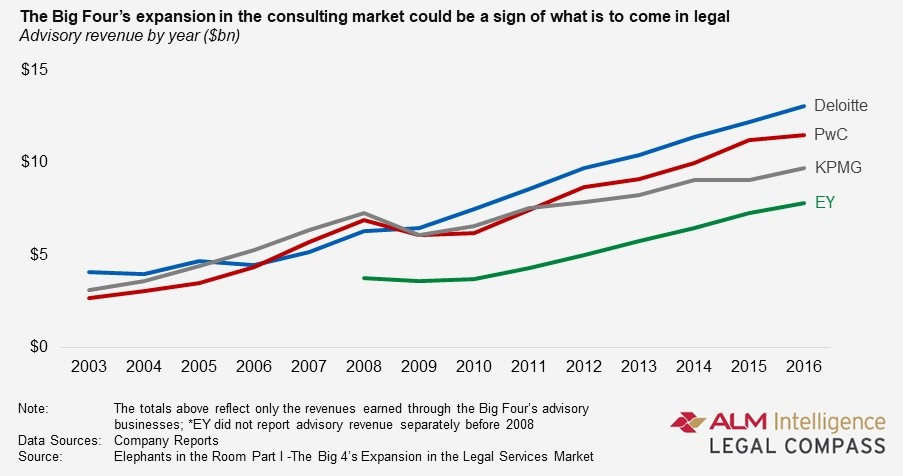

What types of law firms could the Big Four acquire with such tactics? A deal with a large global verein is interesting to ponder. The logic behind such a deal is fairly straightforward. The global vereins face a crowded market with strong competition (see a comparison of their revenue per lawyer and revenue growth in Legal Compass), and a deal with a Big Four firm would create differentiation. For a Big Four firm, this type of deal would instantly make them a major player in the legal market. That said, such a deal seems unlikely. The Big Four's early expansion into the consulting market involved a series of small and mid-sized acquisitions, and their recent moves indicate they are likely to follow a similar strategy in legal (see graph below). Beyond that, a big merger might attract too much attention from regulators. Smaller deals are much more likely. An acquisition of mid-market European, or an emerging market firm, seems more likely. Such a deal would sidestep thorny questions about US regulations. It would also allow the Big Four to test new service models at a more manageable scale.

There is another benefit that is worth considering as well. The acquisition of a mid-market UK law firm, for example, would put pressure on US regulators and the American Bar Association to rethink their current approach to the Big Four's involvement in the US legal market. If the Big Four could show that an integrated professional service firm, offering accounting, consulting, and legal services provided significant value to clients, US regulators would have to consider modifying regulations. This would be a big win for the Big Four.

A Corporation Spins Off Part of Its Law Department

A third transaction worth considering is a spin-off. Many corporations have developed highly sophisticated services within their law departments. Why not spin these off into standalone businesses? There is much talk about law departments becoming “profit centers” for corporates. What better way to earn profit for your corporate parent than to sell the department?

This idea might seem ridiculous at first glance as, after all, legal departments just “overhead” and a “cost center”. What service do they perform that would justify a spin-off? Consider a possibility floated by Hugh Simons, a former senior partner and executive committee member at The Boston Consulting Group and former chief operating officer at Ropes & Gray. What if a global pharmaceutical company spun off their IP portfolio management group? The IP team at GSK, a large global pharmaceutical company, has more than 200 members across a dozen countries. If that group was transformed into a standalone law firm, or an ASP, they would be a powerful force in the highly fragmented patent prosecution sector of the legal market. They would have scale, global reach, deep experience, and a strong anchor client – GSK. That is more than many patent prosecution firms can currently boast. Similar spin-offs could happen in insurance, immigration, or other areas of the legal industry.

The Coming Year

Are these deals probable in 2019? It's safe to say that all three probably won't happen. That said, the strategic rationale behind each of these transactions is strong and each has been openly discussed before. These deals will happen eventually. The question is when, not if.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Law Firm Disrupted: Tech Investment Is Necessary Yet Expensive. The Big Four Have a Leg Up

Arizona Board Gives Thumbs Up to KPMG's Bid To Deliver Legal Services

KPMG Wants to Provide Legal Services in the US. Now All Eyes Are on Their Big Four Peers

The Law Firm Disrupted: With KPMG's Proposed Entry, Arizona's Liberalized Legal Market is Getting Interesting

Trending Stories

- 1Optimizing Legal Services: The Shift Toward Digital Document Centers

- 2Charlie Javice Fraud Trial Delayed as Judge Denies Motion to Sever

- 3Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

- 4With DEI Rollbacks, Employment Attorneys See Potential for Targeting Corporate Commitment to Equality

- 5Trump Signs Executive Order Creating Strategic Digital Asset Reserve

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250