The State of Law Firm Innovation 2018

A recent survey shows law firms understand the importance of innovation but are not supporting it enough

January 23, 2019 at 10:31 AM

13 minute read

Toward the end of 2018, I conducted an industry-wide survey to better assess where the legal market stands on the subject of innovation in the law firm. Comprising 18 questions (written with much help and support from my colleague Patrick McKenna) I set out to understand how firms generally think about, set their cultures around and invest in innovation. Surveying those ranging in size from the global elites all the way down to regionals with 50 attorneys or less, I collected 176 responses from at least 52 firms (I say “at least” as only 52 respondents voluntarily provided their firm's name in what is otherwise an anonymous survey). While I can't cover all of the questions due to bandwidth constraints, the following are my most enlightening findings.

So, Just What is “Innovation”?

As a precursor, I didn't want to define “innovation” for those being surveyed. Choosing one area to focus on – e.g., technology, real estate, practice portfolios, human resources, etc. – may have overly limited the scope of coverage and degrade the overall value of the survey. I did, however, include the following question: “What is the one innovation that you are most proud that your firm has executed/achieved over the past two years?” Here, I hoped to (i) get some interesting feedback (of course), and (ii) afford those surveyed the ability to, in a roundabout way, show us how they define innovation. After all, I think it reasonable to assume that what one is most proud of will be indicative of where one's values and resources will be concentrated.

As expected, I received some great tech-based answers:

- “Easy to configure client extranet that can be quickly configured according to various client needs with an analytic report to view client usage.”

- “Reliable fast-connecting secure remote desktop capabilities so we can work from anywhere efficiently and immediately.”

- “Artificial intelligence.” (After all, what would an innovation survey be if it didn't include AI?)

I also received some great “operational” answers, which, I am using as a blanket term for all of the answers that are not tech-based:

- “An industry-based organization; all lawyers belong to one of six industries. While some lawyers do not fit neatly into an industry, many do, and it's great for gaining client confidence. I do not know of any other firms that have this model.”

- “We hired a marketing firm and began organized marketing for the first time in our 37-year history.”

- “Collaboration with the operations team.”

Most interesting (at least to me) was the concentration of the answers: Only 57% are tech-based while 43% are operational. This surprised me, as tech-based advances are what dominate the media. Maybe it's just me, but until I received these answers I considered “innovation” to be synonymous with “tech” and assumed that the market did, as well. Perhaps hiring a marketing firm isn't newsworthy, but in an industry that still has significant room to maneuver for competitive advantage before leveraging technology, it was a pleasant surprise.

How Firms Think About Innovation

What one thinks should be done or is desirable is not necessarily, by a long shot, what one actually does. I think that I want to learn another language; I think that I want to avoid chocolate; I think that I want to throw gum in the hair of the person incessantly talking in the movie theatre… Do I actually do these things, though? Sometimes and sometimes not. With that in mind, I included questions to elicit how the firms are thinking about innovation, specifically.

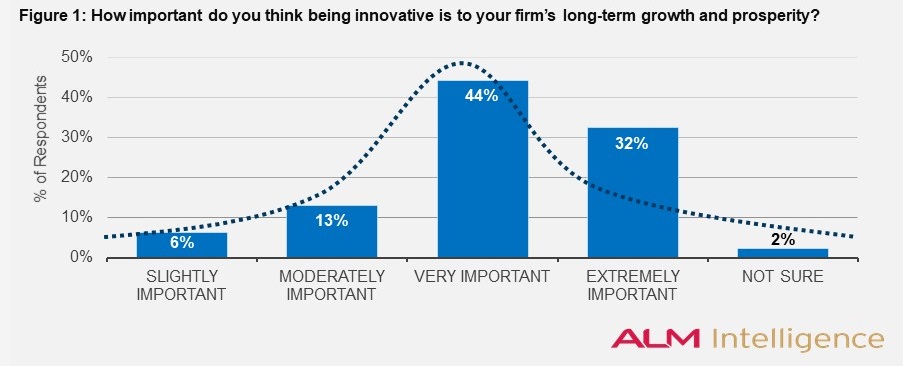

Question 1: “How important do you think being innovative is to your firm's long-term growth and prosperity?”

Here, you can see the concentration skews right, with ~44% and ~32% concentrating around “very important” to “extremely important” (a total of ~77%). A much smaller portion voted for “slightly important” or “moderately important” (~19% in total). This sets what I believe is an obvious tone: innovation is well worth investing in.

Question 2: “How at risk do you think your firm is to disruption by emerging technologies and competitive forces?” Potential answers were “Not-at-all at risk”, “Slightly at risk”, “Moderately at risk”, “Very at risk,” “Extremely at risk” and “Not sure.” Here, we see a bit of a departure from the previous mindset. If we think about the reasons why innovation would be important to a firm's long-term growth, certainly creating competitive advantage – i.e., superseding and/or at least holding at bay one's competition – is one of them. You'd think that we should see a commensurate concentration between “Extremely important” from the previous question and “Extremely at risk”. But that wasn't the case, as those answers received ~32% and ~7%, respectively. In what is a bit of a reduction in criticality, the highest concentration was in “moderately at risk” and “very risky”, with ~44% and ~23%, respectively. (See a recent report on the Law Firms and Artificial Intelligence for some examples on how emerging technologies are disrupting law firms)

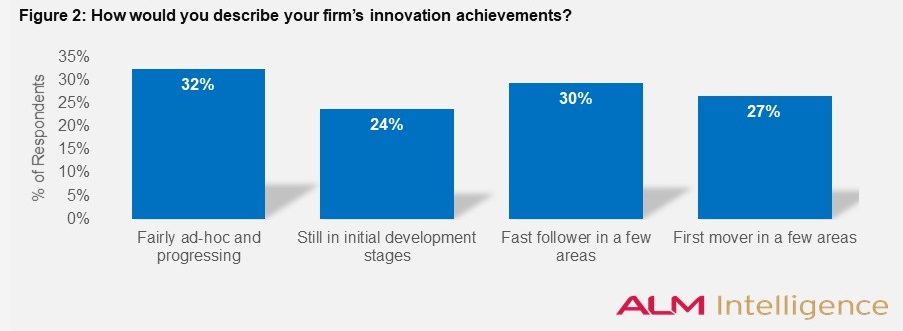

Question 3: “How would you describe your firm's innovation achievements?” Potential answers were “Fairly ad hoc and progressing,” “Still in initial development states,” “Fast follower in a few areas,” and “First mover in a few areas.”

Again, based on the answers to the initial question regarding the importance of innovation in their firm's further growth and prosperity, I expected a sizeable concentration in one or both of “Fast follower” and/or “First mover.” After all, if it is important, wouldn't you be pushing to actually innovate as a first mover or at least as a fast follower? This wasn't the case. We can see that the highest combined concentration is in “Fairly ad hoc” and “Still in initial development” with ~56% (cumulatively).

On the whole, we can see that there is a bit of cognitive dissonance within the firms: their thoughts on innovation seem to harbor a level of incongruence. But how do they mesh up with their cultures and actions?

How Firms Integrate Innovation into their Culture.

Here I looked to assess how the firms are integrating innovation into their overall psychology and general methods of operation, i.e., their “culture.” In other words, how are firms working to turn innovation into an automatically occurring event – an assumption or attitude – within their ranks?

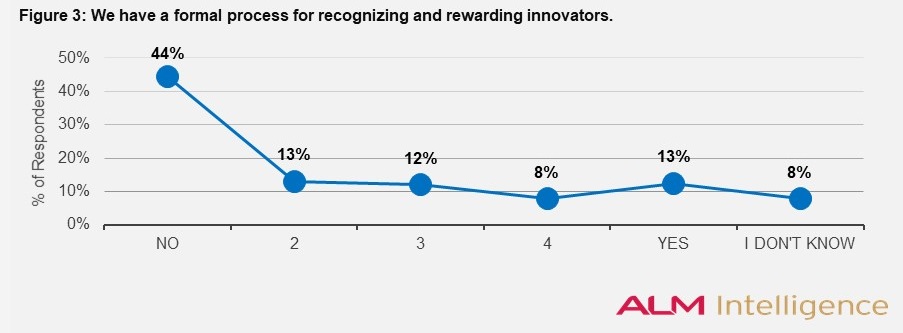

Question 1: “We have a formal process for recognizing and rewarding innovators.” This question is an agreement-based question (as are many of the questions that follow); i.e., “No” (1), “Yes” (5), “I don't know”, and 2, 3 or 4, which leaves the respondents a bit of room to maneuver in-between. Obvious, but still worth explicitly pointing out: answers 2, 3 and 4 are more of a “Kind of” than an “I don't know”, which we offered as an actual answer. In figure 3, we have a high concentration in “No” (~44%), a low concentration in “Yes” (~13%) and a relatively low concentration in “Kind of” (~33%).

Question 2: “Innovation is a recognized part of my job.” This one is a bit fuzzier as it is possible that firms might recognize innovation informally; it is also possible that some attorneys might simply see themselves as being innovative and/or recognized innovators when the rest of their partnership begs to differ – any of which potentially giving us a “Kind of” situation. So, it isn't surprising that there is a large concentration in the middle with 55% voting 2, 3 or 4. Pleasantly, only ~15% said “No” and ~28% said “Yes”.

Question 3: “There is support for partners taking risks. In other words, it is OK – both in policy and in practice – to try new ideas and fail.” Again, this one leaves some wiggle room for judgment, giving us another high concentration in 2, 3 and 4. Specifically, #4, which is closer to “Yes”, has a much higher concentration than #2, which is closer to “No.” This, combined with “Yes”, which netted ~15%, gives us a general skewing to the right. At a minimum, I think the respondents see value in affording the firm a bit of latitude to try some new things. At the same time, we can see considerable room for firms to loosen the reins so that their attorneys might get outside of the box.

(*Note: While this is reading the tea leaves a bit, I assert that the “Kind of” answers can be an indication of guilt or embarrassment or some other aversive state of mind – particularly in questions whose answers should be a digital “yes” or “no”, much like question 1. In truth, either your firm has a formal process – “yes” or “no” – or you “don't know.” So, in questions with high concentrations in the middle, or a high concentration in 2 or 4 specifically – i.e., one that is close to “Yes” or “No” – you might be able to draw some reasonable conclusions of your own.)

How Firms Actually Invest in Innovation.

Here, we are concerned with what resources firms are putting on the ground so as to actually support innovation initiatives. This includes things like time, money, strategy, human resources, etc. In other words, “Here's what our actual investment says about innovation.”

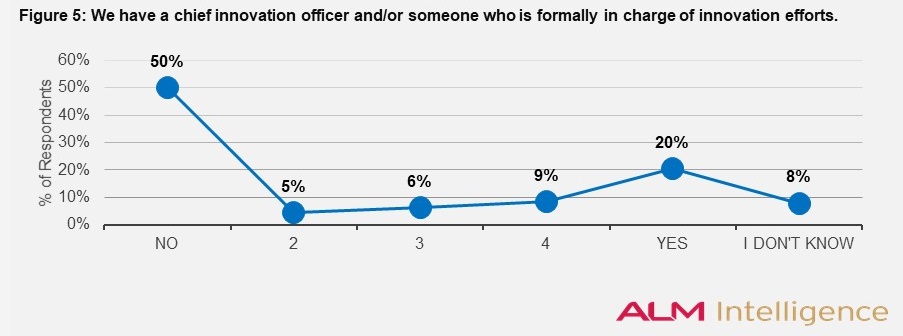

Question 1: “We have a chief innovation officer and/or someone that is formally in charge of our innovation efforts.” Bear in mind, this asks about either a CIO or someone that is formally in charge, giving them a bit of rope to work with. Nevertheless, we have 50% saying “No” and only ~20% saying “Yes.” This flies in the face of how our respondents think about the general importance of innovation – previously, the concentration was around “Very important” to “Extremely important.” We have a lower “Kind of” at ~19% (thankfully) and only ~8% tell us “I don't know.”

Question 2: “Our firm has a formally articulated innovation strategy.” This is a relatively low-cost investment to make, but it's an investment nevertheless. The bulk of the concentration is in the “Kind of” category at ~52% with only ~19% saying “Yes.” This shows (in my opinion) that there is a guilt factor here. The word “formally” is what corners them: either you do or you don't; either you know or you don't. We shouldn't see such a sizeable concentration in the middle, yet we do. The concentration might be translated as their knowledge that they should have a formal strategy, but they don't. Perhaps they have something loose and informal, so they don't want to just say “No.” Either way, I think we can agree that there is some room for improvement, here.

Question 3: “Has your firm established a formal, well-defined innovation process for phases such as idea generation, development and commercialization/marketing?” With this, I am drilling down a bit further to see if they have invested in some infrastructure and direction to support the development of innovative ideas. Unfortunately, we see an extremely high concentration in “There are no formal processes” (~47%) and “Not yet…” (~22%). So, complimenting the general lack of an innovation strategy is an even greater lack of formal processes to support the deployment of innovation-based initiatives.

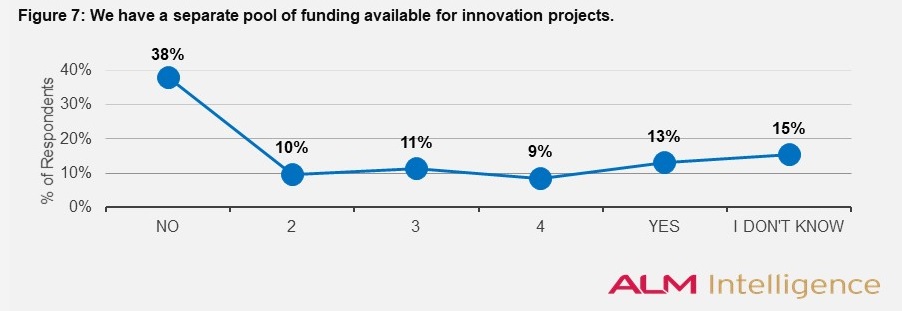

Question 4: Lastly, I asked the respondents if their firms are putting their money where their mouths are – “We have a separate pool of funding available for innovation projects.” – and sadly, it looks as though they are not. Only ~13% said “Yes” while ~38% said “No” and ~30% chose 2, 3 or 4 (i.e., “Kind of”). Again, you either have a separate pool of funding or you don't, or, you don't know if the pool exists. Here, certainly “Kind of” means varying degrees of “No”, possibly indicating that they know their firms should, but don't. It is also possible that, for some, they believe if they went looking for the money, they might be able to find it.

Question 5: “In what way is innovation quantitatively measured in your firm?” Here, I didn't offer predefined answers so that the respondents had some latitude to answer as they saw fit. And I received some quality answers: “An increase in lateral hiring”, “By the amount of business generated”, “Cost savings”, “Remuneration of partners”, etc. But, in contrast to the previous notions that innovation is Important-to-Extremely-important are all of the versions of a “No measurement” answer – 55% of them, to be exact, relayed that their firms did not measure innovation at all.

Summary

While it seems as though firms understand the importance of innovation and have done some work to incorporate it into their cultures and strategies, when it comes to full-scale support and investment, we still have some ground to cover. So, what are we to make of this? Though there are several angles to consider, I wonder if it is simply a barometric measurement of the pressure on today's legal market. Despite the continued reminders that growth has slowed or is non-existent, perhaps things are actually pretty good.

Here's how I see it. Innovation is an inevitable phenomenon in any competitive environment. And I think it is fair to say that the more competitive an environment, the quicker and more dramatic are the innovations that occur. To be direct, law firms are competitive. Law firms that have gained critical mass are very competitive. And where innovation is a tool to gain competitive advantage, its lukewarm reception by the legal industry is unlikely to be a mistake or rooted in ignorance. Sure, some attorneys in any firm are feeling significant pressure – perhaps it is leadership, those who are looking at a longer time horizon or junior partners trying to get a foothold – but by-and-large, the partnerships are doing very well. I've heard that attorneys don't like change; but is that really just relegated to attorneys? In my experience – and if you believe the significant amounts of research and data arising from the various fields of psychology – people don't like change and it is usually driven by coercion rather than temptation. I've found attorneys to be an adaptive lot, however, and I am confident that as the market pressures increase from “dull pain” to “acute burn”, we'll see much deeper investment from the firms.

David J. Parnell is an author and speaker, co-founder of the Legal Institute for Forward Thinking and founder of legal search and placement boutique True North Partner Management.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

ALM Market Analysis Report Series: Nashville's Rapid Growth Brings Increased Competition for Law Firms

Trending Stories

- 1Big Law Partner Co-Launches Startup Aiming to Transform Fund Formation Process

- 2How the Court of Public Opinion Should Factor Into Litigation Strategy

- 3Debevoise Lures Another SDNY Alum, Adding Criminal Division Chief

- 4Cooley Promotes NY Office Leader to Global Litigation Department Chair

- 5What Happens When Lateral Partners’ Guaranteed Compensation Ends?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250