The Reason Companies Aren't Buying Is How Lawyers Are Selling

Conventional business development methods ignore an important part of the legal services selling process: the legal services buying process.

February 14, 2019 at 09:55 AM

8 minute read

This article appeared in Marketing the Law Firm, an ALM/Law Journal Newsletters publication reporting on the latest, and most effective, strategies for Chief Marketing Officers, Managing Partners, Law Firm Marketing Directors, Administrators and Consultants.

Two companies have the same legal need. Both companies end up speaking to the same lawyer, although they came to that lawyer through two different paths. In the first situation, the company searches for the lawyer to solve its problem. It does an Internet search, finds the lawyer and retains her almost immediately to solve the problem.

In the second situation, the lawyer seeks out the company that has the problem that she can solve. She speaks to her connections and referral sources, gets an introduction to the company, secures a meeting and makes a very well-received presentation to the company's decision maker.

The first situation, in which the company seeks out the lawyer, results in a new engagement roughly 30% to 40% of the time. The latter situation, in which the lawyer searches out the company, results in a new engagement less than 10% of the time. The problem is the same, the needs are the same, the solution is the same and the lawyer is the same. Why does the success rate differ so much between these two situations? What does this tell us about what is wrong with selling legal services?

Conventional business development training programs follow a familiar path: Make connections; build relationships; identify needs; differentiate your service; overcome objections and close the engagement. The process begins and ends with the assumption that identified needs lead to engagements.

As popular as this process is, it can't explain fundamental challenges that we see so often in our business development pursuits. For instance:

- Why a prospect stalls or disengages from the selling process;

- Why lawyers with a strong company relationship are not always selected;

- Why some engagements are secured quickly and some take months; and

- Why some prospects recognize a legal need but don't solve their problem.

These situations are the source of frustration for anyone actively engaged in selling legal services. Without a good explanation for this seemingly erratic behavior, we conclude business services buyers are, at least sometimes, irrational — a characteristic of buyers of consumer goods, but not corporations. Businesses are anything but irrational.

Unknowingly, we have adopted certain assumptions that obscure the fact that our process, and not our lawyers, is fundamentally flawed or, more accurately, incomplete. We assume that:

- When companies recognize a legal need, they are inclined to find a solution.

- The selling process is linear (think sales funnel) and follows specific steps that, if followed skillfully, will advance a prospect to an engagement.

- Selling is a numbers game. The more contacts we make, the better our chances.

- Buyers do business with people they know and like. As such, relationships are a required context for the opportunity of new engagements.

- There is one decision maker. A key to success is gaining access to this person.

- There is a single sales method that works for all selling situations, practice areas, industries, buyer types, buying circumstances, etc.

Conventional business development methods ignore an important part of the legal services selling process: the legal services buying process.

Companies have buying processes just as we have selling processes. Moreover, those buying processes are the source of much of what frustrates us. It includes much more than simply the recognition of a problem and the selection of a provider. It includes a unique, internal process that prioritizes, builds consensus and projects outcomes for the array of possible solutions. This internal decision process happens before a company can find a solution or provider. And so far, we've ignored that part of the buying and selling transactional process.

We can't fully understand how buyers buy until we have insight into how buyers decide to buy. We think carefully about what we should do to persuade a prospect, differentiate our services and negotiate the best terms and yet nothing about the company's receptiveness to our proposed solutions.

If a company does not have internal consensus on a solution, no amount of selling, relationship building or negotiation skills will move it.

When a company is ready to buy and has decided on the provider, the only thing to do is to negotiate the terms of the engagement. If the buyer is ready to buy but not set on a particular provider, consultative selling skills can help you to identify needs, differentiate your service, and close the engagement. However, we currently don't have a way to know where the company is in its buying decision process and whether it will be receptive to lawyers educating it about a problem and selling it on their solution.

To illustrate this point further, consider when a company is served with a large, bet-the-company type lawsuit. In that situation, the company needs to solve its problem and the internal decision to proceed is made quickly. Companies typically know the best lawyers for these problems. The well-known lawyer that fixes those problems won't need to sell as much. The buyer knows what it needs and that the lawyer fits its needs. The lawyer simply has to negotiate the engagement terms and fee.

To illustrate this point further, consider when a company is served with a large, bet-the-company type lawsuit. In that situation, the company needs to solve its problem and the internal decision to proceed is made quickly. Companies typically know the best lawyers for these problems. The well-known lawyer that fixes those problems won't need to sell as much. The buyer knows what it needs and that the lawyer fits its needs. The lawyer simply has to negotiate the engagement terms and fee.

In other situations, the company recognizes that it has a need but hasn't yet determined the best solution or the best provider. Internally, it has decided on a course of action, it just hasn't yet determined the specific steps to take.

For example, think about a company that has undergone strategic planning and determined that it needs to find a company with whom to merge. The company has aligned behind the need but not the particular solution or provider. The lawyer in this situation can use consulting skills to influence the selection in her favor.

Lastly, let's imagine you are pitching a financial technology company to redraft contract language for new regulations. In order to be “ready to buy,” the bank will first need to answer a host of questions to determine the implications and impact of these changes and align internal (and sometimes external) stakeholders behind a solution. It has technology considerations, human resource issues, legal questions and budgets that all must be addressed in order to arrive at a “Go, No Go” decision. Without a decision on how to proceed, the lawyer is selling a solution before the bank is ready to buy.

It's not difficult to understand why addressing the internal buying decision process has been left out of the selling process. Your lawyers are on the outside of the company. They are not privy to the internal politics, the relationship dynamics, the cultural norms and values, the history and hard-fought lessons that determine how the company operates, how it makes decisions and how it selects providers. It's challenging to see how lawyers can influence decisions.

But they can help facilitate the decision process from outside by helping their contacts inside the company ask better questions, secure better information, understand all the stakeholders and more clearly understand the resistance to the changes some legal solutions will cause inside the company. As the example illustrates, not all legal selling situations require buying decision facilitation. So, a system to know which do and which don't will help you know the skills that are best for each situation.

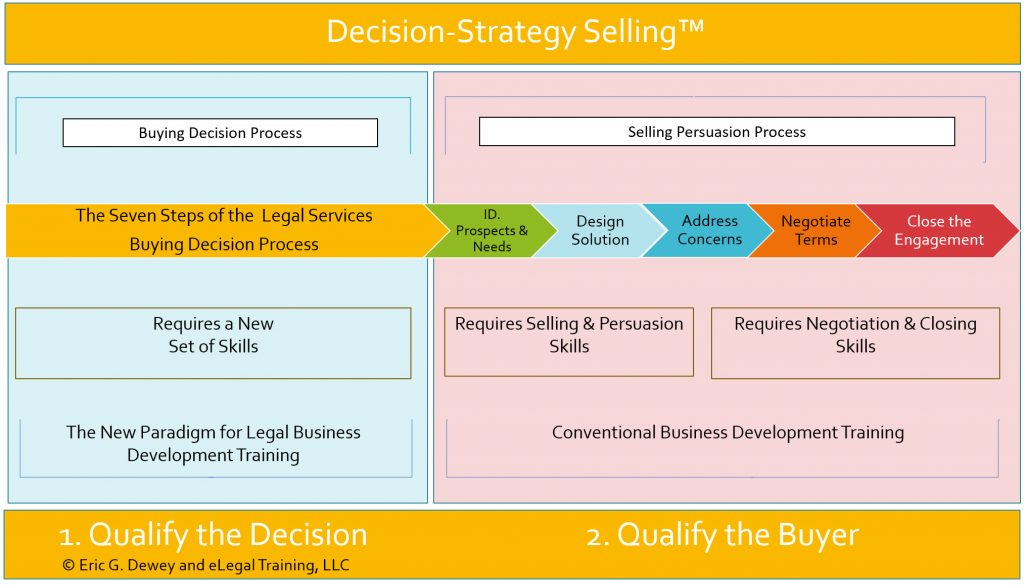

Expanding our definition of the selling process to include the company's buying-decision process sheds light on the internal dynamics, motivations and time frames companies have about solving their legal problems. This revelation led to a new business development process called Decision-Strategy Selling that provides lawyers with a framework to evaluate where the buyer is in their internal buying decision process and presents a new set of skills to help find the quickest path to an engagement decision. It complements existing sales training because it helps lawyers know the situations in which selling skills will be most effective and which opportunities are truly worth pursuing. And, it builds relationships more quickly because the lawyer starts the relationship as a trusted adviser and not a sales person.

It's time to begin thinking differently about what works and what doesn't work in legal sales. Most importantly, we should ask why our sales methods used on a qualified prospect with a specific legal need fails nine times out of 10. It's because we are not selling to where the buyer is going to be. We wouldn't accept such a low success rate in our legal work. And, we shouldn't accept such a low success rate in our business development efforts either.

*****

Eric Dewey, MBA, is the Founder of eLegal Training, which creates, produces, manages and hosts short form 'eLearning' courses for the legal services industry. He is the creator of Decision – Strategy Selling TM, a pre-sale, non-selling process designed for business lawyers that complements existing sales training. Contact [email protected] or visit www.elegaltraining.com.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Law Firm Disrupted: With KPMG's Proposed Entry, Arizona's Liberalized Legal Market is Getting Interesting

Big Company Insiders See Tech-Related Disputes Teed Up for 2025

Trending Stories

- 1On the Move and After Hours: Meyner and Landis; Cooper Levenson; Ogletree Deakins; Saiber

- 2State Budget Proposal Includes More Money for Courts—for Now

- 3$5 Million Settlement Reached With Stone Academy

- 4$15K Family Vacation Turned 'Colossal Nightmare': Lawsuit Filed Against Vail Ski Resorts

- 5Prepare Your Entries! The California Legal Awards Have a New, February Deadline

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250