Securities Class Action Settlements Amounted to $5 Billion in 2018, Report Says

Cornerstone Research's annual report also found that average settlement values rose, with many of them landing between $10 million and $48 million last year.

March 26, 2019 at 06:25 PM

3 minute read

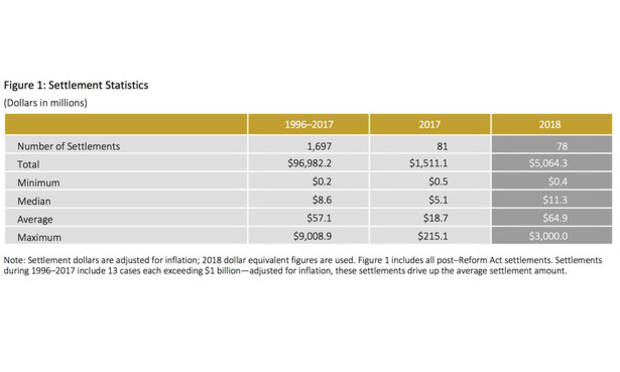

Chart from Cornerstone Research's new report on trends in securities class action litigation settlements: “Securities Class Action Settlements–2018 Review and Analysis.” Photo: Cornerstone Research.

Chart from Cornerstone Research's new report on trends in securities class action litigation settlements: “Securities Class Action Settlements–2018 Review and Analysis.” Photo: Cornerstone Research.

Corporations paid $5 billion to settle shareholder class actions last year, a sum more than triple that of 2017, and more of them are resolving for larger amounts, according to a report by Cornerstone Research.

The annual report found that there were 78 securities class action settlements in 2018, three fewer than in 2017, but five surpassed $100 million, including the $3 billion deal with Brazilian energy giant Petrobras. More significantly, the average settlement tripled to $64.9 million, when compared to 2017, exceeding the average over the past nine years and reflecting a trend toward larger settlements overall. In fact, the report found that 32 cases settled between $10 million and $49 million in 2018.

“These higher dollars aren't just driven by a small number of very large cases,” said Laura Simmons, senior adviser of Cornerstone Research, which teamed up with Stanford Law School Securities Class Action Clearinghouse on the report. “In this case, we actually had an upward shift in the size of the typical case.”

Not only was the average higher, the median settlement value more than doubled from 2017 to $11.3 million, according to the report. Also, the number of settlements valued at less than $5 million declined by nearly 40 percent from 2017.

“It was the first year since 2010 in which more than half of the settlements exceeded $10 million,” Simmons said. “We really had a shift towards larger cases.”

The report also looked at the settlement values as a percentage of alleged shareholder damages, referred to as “simplified tiered damages.” In 2018, the median settlement as a percentage of “simplified tiered damages” increased to 6 percent, compared to a 5.1 percent median for the past nine years.

That had less to do with the strength of the cases and depended more on the size of the defendants, Simmons said. The corporate defendants settling the cases were 50 percent larger than in 2017, according to the report.

“Probably plaintiffs are targeting larger firms,” Simmons said. “Plaintiffs' lawyer firms choose who they target, and it's a business for them, so they're focusing on larger cases with larger settlement amounts. They generally receive a larger payout.”

The top five plaintiffs firms leading the number of last year's settlements were The Rosen Law Firm in New York; San Diego's Robbins Geller Rudman & Dowd; New York's Bernstein Litowitz Berger & Grossmann; Glancy Prongay & Murray in Los Angeles; and Pomerantz in New York.

As part of a new collaboration with Stanford Securities Litigation Analytics, Cornerstone Research added data on what stage the case was at when it settled. From 2014 to 2018, the highest median settlement value—$36.5 million—came after a motion for summary judgment had been filed but not ruled on.

In 2018, 21 percent of the cases settled within two years, according to the report. Those cases also had the highest attorney fees as a percentage of the settlement.

The report mirrors the findings of NERA Economic Consulting's research on securities class action settlements in 2018 and comes as filings of securities class actions hit record highs.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trump Administration Faces Legal Challenge Over EO Impacting Federal Workers

3 minute read

US Judge Cannon Blocks DOJ From Releasing Final Report in Trump Documents Probe

3 minute read

The Right Amount?: Federal Judge Weighs $1.8M Attorney Fee Request with Strip Club's $15K Award

Skadden and Steptoe, Defending Amex GBT, Blasts Biden DOJ's Antitrust Lawsuit Over Merger Proposal

4 minute readTrending Stories

- 1‘Catholic Charities v. Wisconsin Labor and Industry Review Commission’: Another Consequence of 'Hobby Lobby'?

- 2With DEI Rollbacks, Employment Lawyers See Potential For Targeting Corporate Commitment to Equality

- 3In-House Legal Network The L Suite Acquires Legal E-Learning Platform Luminate+

- 4In Police Shooting Case, Kavanaugh Bleeds Blue and Jackson ‘Very Very Confused’

- 5Trump RTO Mandates Won’t Disrupt Big Law Policies—But Client Expectations Might

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250