Higher Law: Getting SEC 'Yes' on Marijuana | Cannabis Banking Bill OK'd | Marijuana & Wrongful Termination

What's next after today's big US House committee vote on marijuana banking? Plus: inside Fox Rothschild's SEC engagement on a mutual fund investing in the cannabis industry. There's a new medical marijuana court ruling in New Jersey. Thanks for reading!

March 28, 2019 at 04:00 PM

7 minute read

Welcome back to Higher Law, our weekly briefing on all things cannabis. I'm Cheryl Miller, reporting for Law.com from Sacramento.

This week, we've got a look at the historic vote in Congress on marijuana banking. Plus, Fox Rothschild's Joshua Horn gives us some insight on his work to get the SEC to OK a cannabis growth fund. And employers are having a hard time hiring, and firing, workers in the era of legal medical marijuana.

Thank you ,Higher Lawyers, for your continued tips and feedback. Keep them coming at [email protected]. Or you can call me at 916-448-2935. Follow me on Twitter at @capitalaccounts.

A Historic House Vote on Cannabis Banking

It took three days of hearings and votes but House Democrats on Thursday finally succeeded in advancing legislation to give cannabis businesses greater access to banking.

The Secure and Fair Enforcement Banking Act would offer legal safe harbor for banks and credit unions that open their doors state-approved marijuana-related businesses if they comply with a set of reporting requirements. The bill, approved by the House Financial Services Committee, marked Colorado Democrat Rep. Ed Perlmutter's first success in passing the bank-protection legislation in six years of trying.

“What we've done is draft a piece of legislation that is narrowly confined to the financial services industry so that … businesses that are legitimate in their states can get legitimate banking services—credit cards, payroll, checking accounts, lending,” Perlmutter said during a markup hearing Wednesday. “Because we've seen across the country, huge piles of cash are developed by these businesses and particularly create real public safety hazards.”

The committee hearing, which started Tuesday but stretched over three days as Republicans floated hostile amendments, drew a number of industry observers, including former Rep. Barney Frank. The one-time chair of the Financial Services Committee is now working with Beantown Greentown, a Massachusetts collective of cannabis professionals.

The bill has the support of the American Bankers Association and the powerful chairman of the Rules Committee, Massachusetts Rep. Jim McGovern. But many Republicans still oppose the legislation and its fate in the Senate, if it gets there, is unclear. And not everyone is convinced the bill's protections would go far enough to entice a lot of banks to serve the cannabis industry.

“Banks like certainty,” Joseph Lynyak, a partner at Dorsey & Whitney, told Roll Call. “My concern is if a bank says: 'Are we completely in the clear?' The answer, under this legislation, is: 'You've got less legal risk, but…”

Getting the SEC to 'Yes' on Marijuana

A couple of weeks ago I wrote about a Fox Rothschild team whose legal opinion assured the Securities and Exchange Commission that a proposed cannabis-related mutual fund won't violate federal drug laws. This week I checked in with the leader of that team, the firm's cannabis law practice co-chair, Joshua Horn, about that work.

“It's not uncommon for the SEC to ask a fund for additional information” about a proposed investment vehicle, said Horn, who also co-chairs Fox Rothschild's securities industry practice. “This was unique because the fund was investing in the cannabis industry.”

The prospectus for Foothill Capital Management's Cannabis Growth Fund says managers will place at least 80 percent of investments in companies “engaged in legal cannabis-related businesses.” The document specifically mentions producers of consumption devices, CBD-infused goods, lighting systems and industrial hemp. It specifically excludes any United States businesses that touch marijuana flower.

The fund appears to be the only actively managed cannabis growth investment vehicle in the nation.

“It's always neat to be the first guy on the block,” Horn said, acknowledging that, with the growth of the cannabis industry—and the ancillary market—there is plenty of investment legal work on the horizon.

After scrutinizing the fund portfolio, the Fox Rothschild team, retained by Foothill Capital Management, produced a 12-page legal opinion for the SEC. The agency “had no questions after we sent them the letter,” Horn noted. The cannabis fundlaunched last month.

Who Got the Work

• Rhode Island has retained Colorado consulting firm Freedman & Koski for help with Gov. Gina Raimondo's budget proposal to create a recreational cannabis program, Providence station WPRI reports. Firm co-founder Andrew Freedman, a Harvard Law alum, was the state of Colorado's first director of cannabis coordination. Rhode Island will pay the firm $90,000.

• Scott Lever, a Maine deputy health commissioner, will run the state's still-developing recreational marijuana program, the Portland Press Herald reports. As part of his role as deputy commissioner Lever oversaw the Maine Center for Disease Control and Prevention, the former home of the state medical marijuana program. Maine voters approved recreational marijuana in 2016, although state leaders have not yet approved rules for adult-use sales.

In the Weeds…

>> A New Jersey appellate court has revived a medical marijuana user's wrongful termination claim. My colleague Charles Toutant writes that funeral home director Justin Wild's original suit against Feeney Funeral Home was blocked by a trial court judge who found the Compassionate Use Act does not require employers to accommodate medical marijuana use. An appellate panel held Wednesday that “because the Compassionate Use Act declared it should not be construed to 'require' an accommodation does not mean such a requirement might not be imposed by other legislation.” [Law.com]

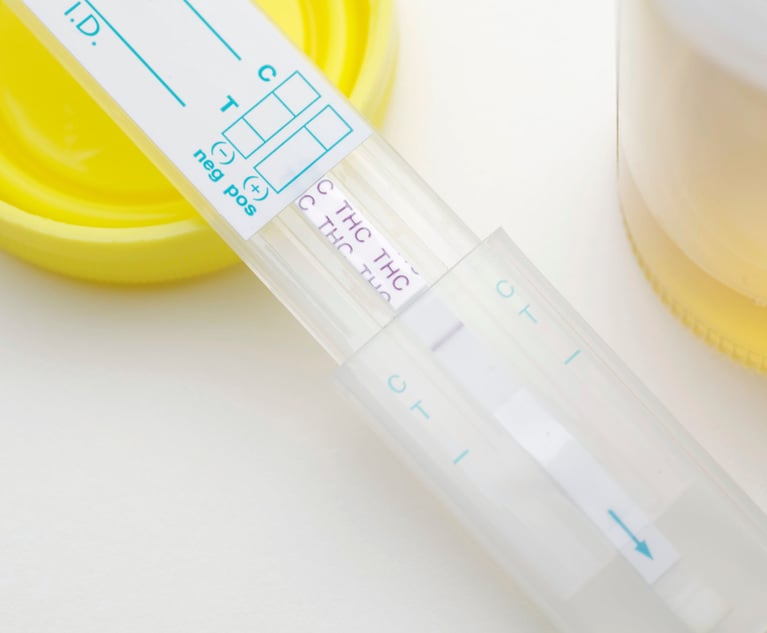

>> Speaking of weed in the workplace, legalized marijuana is giving hiring managers a headache. “Companies facing a shortage of employees from health-care workers to forklift operators are confronting a new challenge: finding candidates who can pass drug tests in states that have legalized marijuana.” [WSJ]

>> Another marijuana group lost its bank access. SunTrust Bank told the Medical Marijuana Business Association of Florida that it would close its accounts on April 16. “They are on the wrong side of #Florida voters for #MedicalMarijuana trying to stop us but we WON'T stop fighting for YOU: the Patients, the Industry,” the MMBA tweeted.[Florida Politics]

>> MedMen is taking on Miami Beach over the city's restrictions on dispensary locations. In a lawsuit filed in Miami-Dade Circuit Court, Los Angeles-based MedMen says a new ordinance that requires at least 1,200 feet between dispensaries effectively, and illegally, caps the number of outlets that can open in the city. Akerman litigation partner Alexandra Mora represents MedMen in the case. [Miami Herald]

>> New Jersey and New York hit the pause button on legalization. Legislative leaders in Trenton pulled the plug on a scheduled Monday vote when the whip count came up short. [New Jersey Law Journal] New York Gov. Andrew Cuomo will not include recreational plans in the state budget due April 1. [The Hill] Cuomo says he and lawmakers need more time to reach an agreement. Maybe Pennsylvania will beatboth states? Gov. Phil Murphy is also shelving plans to expand the state's medical marijuana program. [NJ.com]

The Calendar: What's Next

March 29-30: The NoCo Hemp Expo takes place in Denver. Legal speakers include Vicente Sederberg partner Shawn Hauser; Rod Kight of Kight Law Office; and patent and trademark attorney Robert Jondle of Jondle & Associates.

April 1-2: CannaTech Tel Aviv runs for two days. Scheduled speakers include Branch & Branch partner Shabnam Malek; Bob Hoban, president & CEO of the Hoban Law Group; and Garfinkle Biderman partner Shimmy Posen. The National Cannabis Bar Association and the American Israeli Cannabis Association host a networking get-together at the event on April 2.

April 2: McDermott Will & Emery hosts the webinar ”The State of the Cannabis and the Hemp Industries.” Speakers include firm partner Marc Sorini, senior legislative advisor James Moran and associate Vanessa Burrows.

April 2: Reed Smith hosts a one-hour webinar, “CANN101 : Introduction to Insurance Coverage.” Partner Michael Sampson will lead the discussion

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

NY Cannabis Marketing Rulings / Rescheduling Effects / Honigman's Work on Trademark Suit / Goodbye

9 minute read

Workplace Weed and Labor Pacts / State AGs and Hemp / Maryland Licensing Suit / Vicente Sues Recruiter

9 minute readTrending Stories

- 1Decision of the Day: Judge Reduces $287M Jury Verdict Against Harley-Davidson in Wrongful Death Suit

- 2Kirkland to Covington: 2024's International Chart Toppers and Award Winners

- 3Decision of the Day: Judge Denies Summary Judgment Motions in Suit by Runner Injured in Brooklyn Bridge Park

- 4KISS, Profit Motive and Foreign Currency Contracts

- 512 Days of … Web Analytics

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250