The Law Firm Disrupted: Within the Am Law 100, a Market in Four Acts

In the most recent Am Law 100 financials, growth was more evenly shared between the top and bottom segments of the list. Does that mean the size advantage has been overstated?

April 25, 2019 at 09:00 PM

7 minute read

In this week's Law Firm Disrupted, we look at how the Am Law 100 performed as four distinct groups and ask a question: Is stratification happening?

I'm Roy Strom, the author of this weekly briefing on the changing legal market, and you can reach me here or sign up to receive this newsletter here.

The Am Law 100: A Market in Four Acts

It's a big week for anybody interested in law firm financials. The American Lawyer rolled out the 2019 Am Law 100 on Tuesday.

It is worth taking a second to reflect on what that really means. If we were writing about the stock market instead of Big Law, it would be like if the S&P 500 first got rid of quarterly earnings reports and then, instead of the 500 biggest companies staggering the releases of their annual financial performance, they dumped them all on the same day. It would be a lot to take in!

The American Lawyer comes prepared, having spent the past few months compiling this information and reporting on it. Even so, comparing the year-long fortunes of 100 law firms is a lot.

So how to make it more manageable? One handy way to analyze the numerous markets within the Am Law 100 is to split it into four groups that each account for 25 percent of the total group's revenue.

As my colleague Dan Packel writes, last year the 10 largest firms accounted for 26 percent of the Am Law 100's revenue. The next 17 firms accounted for the next 25 percent of revenue. Firms No. 28 thru 53 accounted for another quarter of the revenue. And the final 47 firms generated the final 24 percent of the Am Law 100 pie.

When I did the same analysis for the 2018 Am Law 100, the quartiles included the same firms: 1-10; 11-27; 28-53; and 54-100. But the story of how those groups compared to one another in the 2018 report was much different.

This year, the growth was much more evenly shared. The top group accounted for 27 percent of revenue gains. The remaining three quartiles accounted for 24 percent, 27 percent and 23 percent, respectively.

The year prior, the 10 largest firms that year accounted for 38 percent of the growth in the Am Law 100. The next group, firms 11 through 27, accounted for 25 percent of the growth. The third quartile accounted for 20 percent. And the bottom quartile, nearly half of the firms on the survey, split among themselves just 17 percent of the growth last year.

The outsize growth enjoyed by the largest firms in the 2018 report may have been an anomaly. In the 2017 report, the four groups also split the growth among them almost evenly. And the same can be said for profitability. In the 2018 report, the top 10 firms largely outperformed the other groups in terms of growth in profits per equity partner. This year and in the 2017 report, the 10 largest firms didn't even lead the four groups in PEP growth.

This analysis throws at least some cold water on the narrative that the largest firms are quickly pulling away from their peers; that stratification within the Am Law 100 is the prevailing trend in most recent years. That was not the case last year. The top half of the Am Law 100 performed slightly better than the bottom half. And yes, that has been happening for a while, but we have only seen a significantly top-heavy year of growth once during the past three years.

ALM Intelligence Fellow Hugh Simons makes this point another way, by graphically showing that there was not a trend in 2018 of the largest firms outperforming the rest of the market. He says that stratification did not happen among the most profitable of firms last year, and it has not happened over a longer time horizon. He concludes, “There is no trend to be seen.”

Simons writes: “It's hard to avoid the conclusion that we're being misled by our prior convictions into believing in market stratification that simply isn't happening. For smaller and less profitable firms this has an important implication: position is not destiny. You can grow profits irrespective of your starting position. The insight is important too for larger and more profitable firms: Don't kid yourself into believing your strength today guarantees growing prosperity.”

Programming Note: The Law Firm Disrupted will be off next week.

Roy's Reading Corner

On Discounts: As far as innovative pricing strategies go, the discounted billable hour still often stands in the way. But what is the impact of those discounts on Big Law's financials? I looked into that question for a feature at The American Lawyer, and we found that discounts provided to clients by the Am Law 100 last year likely amounted to something near $4.4 billion. That equates to $200,000 per equity partner in the Am Law 100.

Despite that level of discounting, the article says there is reason to believe that law firms and clients are finding a reasonable price for those services: Big Law take-home rates have risen in-line with inflation over the past 11 years. The article details efforts by pricing directors at law firms to move beyond the discount, which is something some clients profess to want to do.

From the article: “As I tell my clients who are proud of getting a 15 percent discount from their firms: 15 percent of infinity is still infinity,” says Ken Callander, a consultant to in-house legal departments who advocates value-based pricing structures. “Discounted rates don't stop firms from billing more hours.”

On The Richest of the Rich: My colleague Christine Simmons wrote about how Wachtell and Cravath remain dedicated to their lock-step compensation models. The story is worth reading in full, but I found this section in which Cravath's leading partner Faiza Saeed discusses an “arm's race” in compensation that she says has been created as a result of increased lateral activity.

From the story: “What used to be a focus on rainmaker comp associated with an actual book of business has turned into comp for journeymen partners,” Saeed said.

After longtime Cravath partner Scott Barshay left in 2016 for Paul, Weiss, Rifkind, Wharton & Garrison, his new firm, which paid him at least $10 million last year, handled one of 2018's largest announced deals, IBM's acquisition of software firm Red Hat. IBM has long been a Cravath client.

When asked about these circumstances, Saeed says, “Any time a partner leaves, there's always going to be the potential that a relationship that they were given while they worked here is also going to be a personal relationship. We aim to help our young partners build those relationships.”

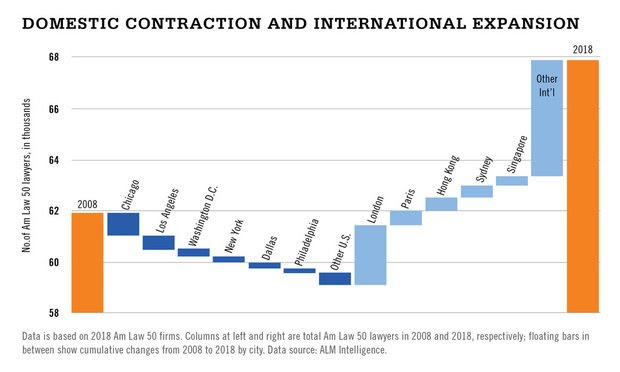

On Big Law Geographic Changes: Hugh Simons and ALM Intelligence's Nicholas Bruch analyze where lawyer head count changes have occurred inside the Am Law 100 from 2008 to 2018. Below is what they find. Not necessarily good news for a guy who covers Big Law out of Chicago.

That's it for this week! Thanks again for reading, and please feel free to reach out to me at [email protected]. Sign up here to receive The Law Firm Disrupted as a weekly email.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Law Firm Disrupted: Big Law Profits Vs. Political Values

The Law Firm Disrupted: Quality Partner Training—The Exception or the Rule?

Trending Stories

- 1Decision of the Day: Judge Dismisses Defamation Suit by New York Philharmonic Oboist Accused of Sexual Misconduct

- 2California Court Denies Apple's Motion to Strike Allegations in Gender Bias Class Action

- 3US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 4Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 5African Law Firm Investigated Over ‘AI-Generated’ Case References

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250