The Impact Of A Potential Recession On 2020 Am Law 100 Profit Margin

There could a US recession of unknown magnitude potentially soon. We project 2020 Am Law 100 profit margin for five possible recessionary scenarios.

May 14, 2019 at 09:20 AM

6 minute read

In a previous article 2, we projected a 2019 Am Law 100 profit margin (defined as operating income divided by revenue) of 40.23%, an increase of 0.20% from 40.03% in 2018. Our projection was validated by early results of 42 firms in the 2018 Am Law 100. We continue our analysis with a follow on question: can we project profit margin for the 2020 Am Law year (which is calendar 2019)?

In late calendar 2018 and early calendar 2019, there were indications of weakening economic conditions and sharp downtrends in global stock markets, which pointed to a potential impending US recession, but whose occurrence, timing, and magnitude were unknown. Article 1 demonstrated that Am Law 100 profit margin decreases with US recessions. Am Law profit margin is likely to similarly decrease in the next recession, but due to the uncertainty of the incidence, length and depth of such a recession, we need to project 2020 profit margin for multiple scenarios.

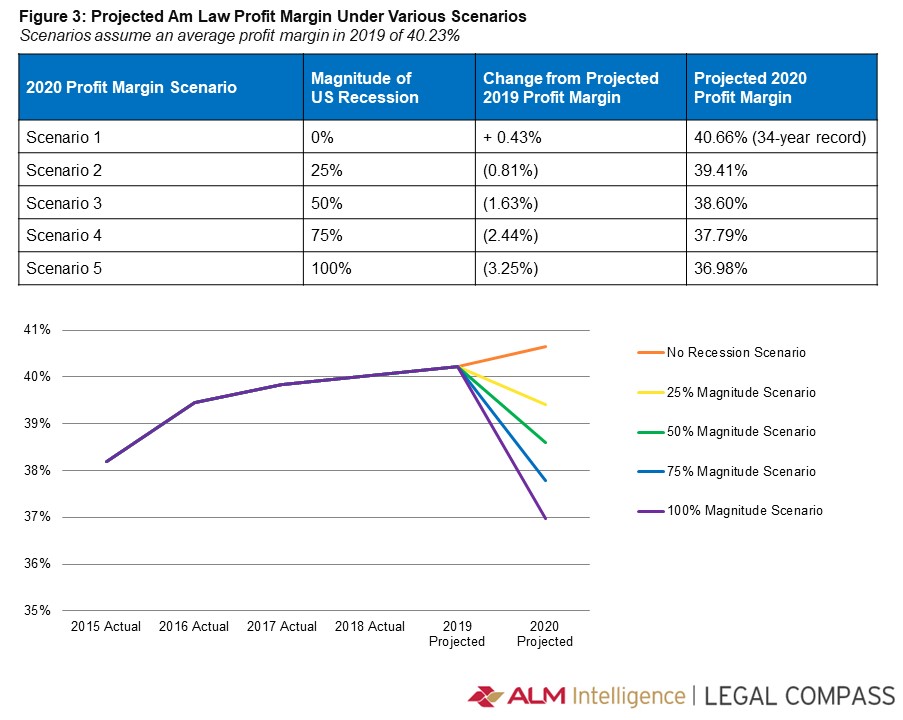

In particular, we look at 5 scenarios for projecting 2020 profit margin: (1) no recession; (2) a 25% magnitude recession; (3) a 50% magnitude recession; (4) a 75% magnitude recession; and (5) a 100% magnitude recession. For simplicity, these scenarios assume the US recession will span a 12-month period from January 2019 to December 2019. Clearly, this very specific situation is very unlikely to occur. So this article should be considered as a general framework to understand the impact of a potential recession on future profit margin.

Scenario 1: No Recession.

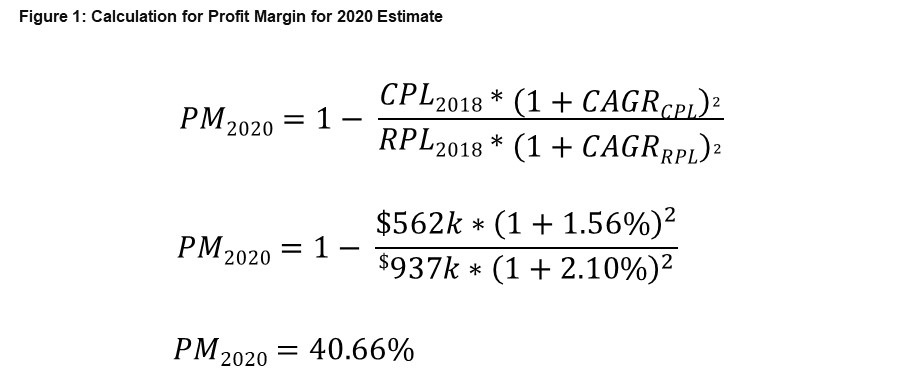

As in article 2, we project 2020 profit margin by using 2018 average RPL of $936,666 and average CPL of $561,748 as a starting point. For growth rates in RPL and CPL, we use in our formula Am Law 100 historical cumulative average growth rate from 2013 to 2018 for RPL of 2.10%; and for CPL of 1.56% for two consecutive years:

2020 profit margins projections calculate to 40.66%, which is 0.43% higher than 2019 projection of 40.23%; 0.63% higher than 2018 actual; and 0.52% higher than 40.14% in 1987. Indeed, if there is no recession in calendar 2019, 2020 profit margin could set another record and be highest level recorded in the 34 year Am Law survey history.

Scenarios 2 to 5: Recession Of Varying Magnitude

Now, what if there is a recession? This is a complicated situation which needs an elegant solution. We start by projecting the anticipated decrease from 2019 to 2020 profit margin arising from a recession of 100% magnitude. We then assume that decreases in profit margin are directly proportional to the magnitude of the recession, an approach which is certainly simplistic, but quite reasonable. We can then project 2020 profit margin for scenarios 2 to 5.

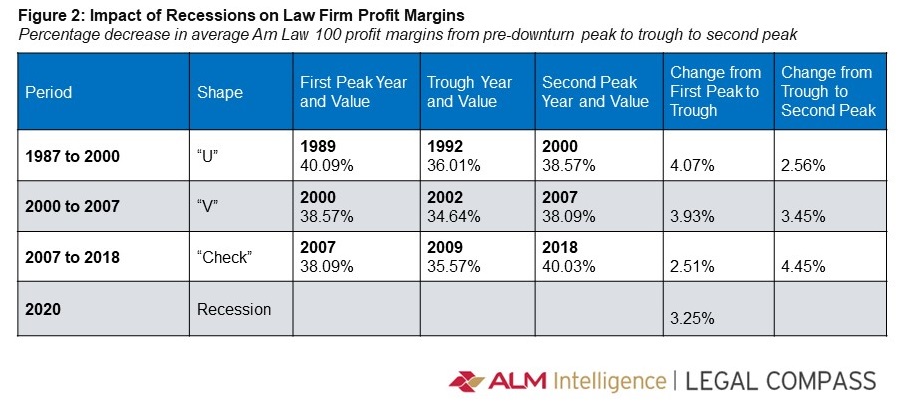

Article 1 showed profit margin falls from peak to trough contemporaneously with US recessions. We look at decreases in the three previous recessions of 1990, 2001 and 2007 to project the recession-impacted decrease in 2020 profit margin. Specifically, we use a weighted average approach, giving higher weights to more recent recessions. We assign a 50% weight to the 2.51% drop in the 2007 recession; a 30% weight to the 3.93% drop in the 2001 recession; and a 20% weight to the 4.07% drop in the 1990 recession. This weighted average of 3.25% would be the projected decrease in profit margin from 2019 to 2020 for a 100% magnitude recession (see Table 1). Said differently, a 100% recession in Am Law year 2020 would lead to a decrease of 3.25% from the 2019 Am Law 100 projected margin of 40.23%, leading to a 2020 projection of 36.98%.

Why would 2020 profit margin decrease due to a US recession in calendar 2019? At the onset of recession, there will likely be a sharp drop in law firm demand, which would make RPL decelerate faster than CPL, and lead to a rapid drop in 2020 profit margin.

Assuming the decrease in profit margin is directly proportional to the recession magnitude %, we can derive profit margin levels for multiple scenarios. We have shown a 100% magnitude recession would lead to a 3.25% decrease in profit margin from the 2019 level of 40.23%; or 36.98%. Correspondingly a 75% magnitude recession would lead to a 2.44% decrease in profit margin (2.44% = 75% of 3.25%) from 2019; a 50% magnitude recession would lead to a 1.63% drop in profit margin; and finally, a 25% magnitude recession would lead to 0.81% drop in profit margin.

We can project 2020 profit margin under for scenarios 2 to 5 (see Table 2) by adding the projected decrease in 2020 profit margin to the projected 2019 projected margin of 40.23%.

If there is indeed a recession, 2020 profit margin would mark a trough and would not be able to surpass the 1987 record level. It may take a few more years for profit margin to rise after that recession ends.

Can we get early indications of 2020 profit margins? Fortunately, RPL and CPL growth rates are reported by leading banks in quarterly surveys of 2019 law firm performance. If RPL growth rate continues to remain higher than CPL growth rate, 2020 profit margin should increase from 2019. If we observe the reverse, that is we start to see RPL growth rate below CPL growth rate, then we should be expecting a potential decline in 2020 profit margin.

Summary

Our 2019 profit margin projections are validated by early firm results, and 2019 could be a new Am Law record. Projecting 2020 profit margin is challenge. A potential recession will cause a decrease in the profit margin level, but its magnitude remains unknown. We have to develop a range of profit margin under multiple scenarios. 2020 could either set a new Am Law record or mark a new recessionary trough, all being dependent on the occurrence and depth of a US recession.

Madhav Srinivasan is the Chief Financial Officer at Hunton Andrews Kurth LLP, leading the global finance and pricing competencies. Madhav is an ALM Intelligence Fellow and also an adjunct faculty at Columbia Law School in New York and University of Texas at Austin School of Law.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Big Law Sidelined as Asian IPOs in New York Are Dominated by Small Cap Listings

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute readTrending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250