State Street Judge Has More Questions in $74.5M Fee Request

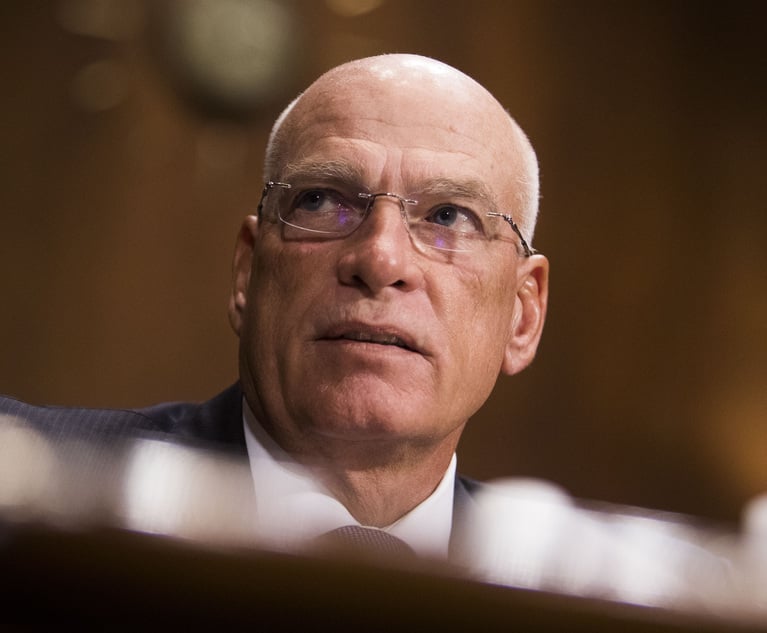

U.S. District Judge Mark Wolf has scheduled a June 24 hearing about Labaton Sucharow's $4.1 million payment to a Texas lawyer and overbilling by Lieff Cabraser Heimann & Bernstein and Thornton Law Firm.

June 10, 2019 at 03:10 PM

7 minute read

A federal judge reviewing a $74.5 million fee request in a case against State Street Corp. has ordered lawyers from three plaintiffs firms to appear in court later this month to answer more questions about their billing, including Labaton Sucharow's $4.1 million payment to a Texas lawyer.

Labaton, one of the three firms, reached an agreement last year with a special master who, while reviewing the fee request, uncovered what he called an undisclosed $4.1 million “referral payment” to Damon Chargois, a lawyer in Houston. Under the deal, Labaton said it would return more than $4.8 million, which also included its share of another $4.1 million in overbilling identified by the special master, Gerald Rosen. The two other plaintiffs firms in the case, San Francisco's Lieff Cabraser Heimann & Bernstein and Thornton Law Firm in Boston, have objected to the special master's findings.

But, instead of signing off on Labaton's agreement, or the fees, U.S. District Senior Judge Mark Wolf of the District of Massachusetts had more questions.

“I'm trying to find out whether the Chargois arrangement was unique in the history of Labaton or whether there were other agreements of this nature, essentially bare referral fees,” he told Labaton's lawyers at a Nov. 7 hearing. “Is this Chargois matter an isolated incident or not?”

In a May 31 order, Wolf scheduled a June 24 hearing on that question, among others. He told lawyers from all three firms to prepare for arguments and possible testimony and indicated that the hearing could last several days. He also ordered Labaton chairman Christopher Keller and Eric Belfi, a partner on the executive committee, to be there, as well as four lawyers from Thornton Law Firm, including chairman Michael Thornton and managing partner Garrett Bradley. Both firms have retained outside counsel in the matter, while Lieff Cabraser partner Richard Heimann has represented his own firm.

“We look forward to the upcoming hearing and arriving at a final resolution of any outstanding issues in the State Street case,” Labaton said in an emailed statement. “All the evidence has been diligently and extensively reviewed by special master Rosen, who agreed in the proposed settlement that Labaton helped achieve, resulting in a record recovery for the class.”

Heimann, in Lieff Cabraser's San Francisco office, did not respond to a request for comment. Thornton, Bradley and the other two partners at Thornton Law Firm, Evan Hoffman and Michael Lesser, also did not respond.

In addition to the Chargois matter, Wolf also had questions about potential overbilling that prompted him in 2017 to appoint Rosen, a retired federal judge from the Eastern District of Michigan. Among other things, he wanted to know whether the total number of billable hours was now accurate, after deducting $4.1 million for overbilling, whether the rate for staff attorneys was reasonable, and whether the firms should have counted their contract attorneys as expenses, not billable legal fees.

Wolf also wanted to know more about Rosen's recommendation to refer Garrett Bradley, of Thornton Law Firm, to the Massachusetts bar authorities for submitting a false fee declaration, and about why Michael Bradley, his brother, received $500 per hour as part of the firm's fee request despite doing little work on the case. (Michael Bradley, a lawyer in Quincy, Massachusetts, did not respond to a request for comment).

“You know, I think when somebody signs a document under oath and gives it to a federal judge, it's a consequential thing,” Wolf said at the Nov. 7 hearing.

In 2016, Wolf approved the State Street settlements and granted $74.5 million in attorney fees, which were about 25% of the settlement fund. But, soon afterward, Labaton filed a letter to the court admitting that, of their $41 million in billable hours, the three firms had inadvertently double-counted work done by staff attorneys, resulting in a $4.1 million overbilling error.

That prompted Wolf to appoint Rosen to look into the matter further. In a 2018 report and recommendation, Rosen recommended that each of the three firms return one-third of the $4.1 million overbilling error to the class.

Rosen also discovered what he called a referral payment that Labaton failed to disclose in the fee request. The special master insisted that the payment violated the Massachusetts Rules of Professional Conduct. He recommended that Labaton return the $4.1 million payment, to both class members and three additional plaintiffs firms, whose related cases under the federal Employee Retirement Income Security Act were included in the settlement.

In its Oct. 10 deal with the special master, Labaton said it would return more than $4.8 million to both the class and the ERISA firms and make several internal changes, such as switching its general counsel and bringing in a former federal judge to review its fee arrangements. Belfi and Keller filed declarations acknowledging that Chargois had worked with Labaton in at least three other litigation matters but, unlike the State Street case, actually did work on the cases—or planned to do so.

But Wolf wanted to know more. So, Labaton brought in Garrett Brown, a retired federal judge from the District of New Jersey, who spent two months interviewing attorneys about more than 300 cases the firm settled since 2007. In a Jan. 8 report, amended Feb. 6, Brown wrote that the payment to Chargois, who received 20% of the State Street settlement and other cases involving the client Arkansas Teacher Retirement System, was “unique in the history of the firm.”

The report “confirmed that Labaton was in compliance with ethical and professional requirements in those cases,” Labaton said in its statement.

Wolf plans to ask more questions about the report at this month's hearing.

|Billing Questions

Despite the special master's findings, all three firms continue to defend their $74.5 million fee request. Lieff Cabraser and Thornton Law Firm also still challenge the special master's recommendation that they return one-third of the $4.1 million in overbilling.

“Lieff Cabraser made an honest mistake,” Heimann wrote in a Dec. 18 objection. “The State Street action is the first time, and the only time, the firm has had to revise a fee petition and to withdraw inappropriately included lodestar. The firm requires no patronizing lectures or financial penalties to 'deter' it from making bookkeeping mistakes in the future.”

They also question the special master's insistence that both firms submit contract attorney work as expenses, not billable work—what Rosen called in court documents “one of the most far-reaching and significant issues” in his report.

“It is not simply a question of mathematical services and calculation of hours; it is an issue that goes directly to the integrity of the legal process and public confidence in how attorneys are compensated,” he wrote in a Nov. 20 revision to his report's findings regarding Lieff Cabraser. “Permitting law firms to mark-up contract attorney rates for the purposes of increasing profits goes against the very tenets of an employer-employee relationship.”

In that revision, he recommended that Lieff Cabraser return $2.2 million for improper billing related to contract attorneys and that Thornton Law Firm pay $1.3 million for the same reason.

Thornton Law Firm also is fighting what it called “draconian and unprecedented sanctions” against the firm of up to $1 million related to Garrett Bradley's fee declaration.

Lieff Cabraser's objection also notes that the three firms have already spent $4.8 million to fund the special master's investigation—more than enough of a penalty.

“The financial impact of the special master's investigation and recommended penalties against Lieff Cabraser are unjust and wildly disproportionate to the firm's conduct,” Heimann wrote.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Serious Disruptions'?: Federal Courts Brace for Government Shutdown Threat

3 minute read

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute read

Trending Stories

- 1Life, Liberty, and the Pursuit of Customers: Developments on ‘Conquesting’ from the Ninth Circuit

- 2Biden commutes sentences for 37 of 40 federal death row inmates, including two convicted of California murders

- 3Avoiding Franchisor Failures: Be Cautious and Do Your Research

- 4De-Mystifying the Ethics of the Attorney Transition Process, Part 1

- 5Alex Spiro Accuses Prosecutors of 'Unethical' Comments in Adams' Bribery Case

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250