How Does Profit Margin Behave In The Short Term?

Analyzing changes in magnitude and direction of profit margin shows interesting behavioral trends for individual firms. These factors appear unrelated.

June 11, 2019 at 09:16 PM

8 minute read

In the previous three articles, we analyzed profit margin (defined as operating income divided by revenue) trends in the AmLaw 100. Here we will analyze behavior at one level below, that is, at the individual firm. Specifically, we examine both magnitude and direction of profit margin changes from one year to the next. We also dig into the relationship between profit margin and differential in rates of growth in RPL and CPL.

Profit Margin and Growth Rates in RPL and CPL

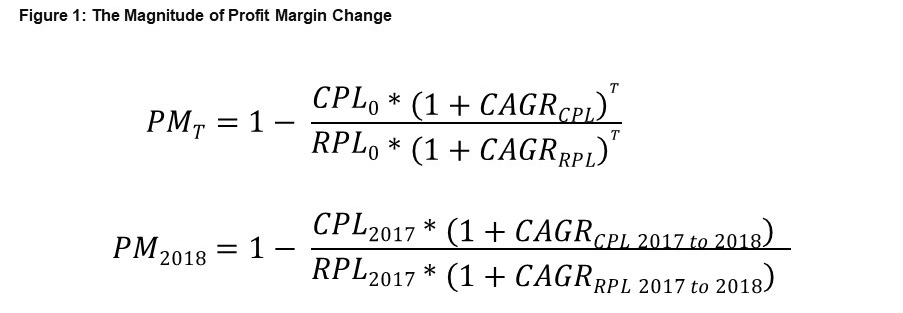

In prior articles, we proposed a formula to express future profit margin for any future year, say T years from this current year 0, in terms of current RPL and CPL, and their cumulative average annual growth rate (CAGR). This formula shows future profit margin is directly proportional to current level of profit margin; as also the differential between the growth rates of RPL and CPL. Profit margin rises when RPL growth rate exceeds CPL growth rate. Conversely profit margin falls when CPL growth rate exceeds RPL growth rate. The magnitude of profit margin change is driven by the differential between growth rates of RPL and CPL. Specifically, we look into two historical years, 2017 and 2018 for the Am Law 100, and the profit margin changes for each of the 100 firms using this formula:

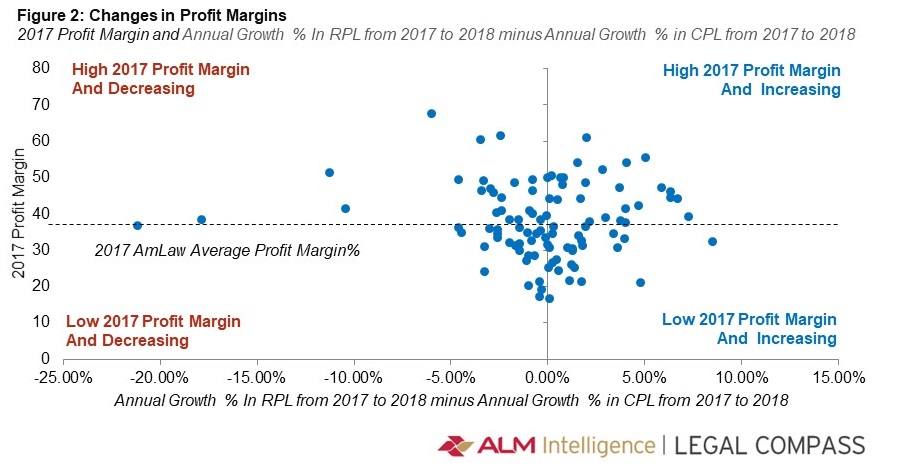

Since we have access to the historical Am Law 100 data set, we see the Am Law 100 combined profit margin increased from 39.80% in 2017 to 40.03% in 2018. What more insights can we get by looking at individual firms? We can get an interesting picture by plotting each firm along two dimensions (see figure 2). The vertical axis is the 2017 profit margin, which indicates current level of profitability. The horizontal axis is the differential in the growth rates between RPL and CPL from 2017 to 2018, which indicates direction of profit movement from 2017 to 2018. To align to the Am Law 100, we set the vertical axis at the average Am Law 100 growth rate differential of 0.4%; and the horizontal axis at the average profit margin of the Am Law 100 at 39.80%.

As we can see from this random scatter of 100 points in Figure 1, there is no evident pattern, thus no specific correlation between the axes. In other words, current profitability and direction of future profitability appear to be unrelated. This means that firms, regardless of their current profit margin, can experience an increase or decrease their profit margin from one year to the next. A high profit margin does not necessarily mean it will increase to a higher level next year, as a drop in profit margin is also quite likely. Similarly, a low profit margin does not necessarily mean it will decrease to a lower level next year, as a rise in profit margin is also quite likely.

An important thing to note is while the direction may be unrelated, the magnitude of the increase or decrease in profit margin is related to the current level of profit margin. In other words, for the same differential in growth rates between RPL and CPL, a firm with a lower margin will experience a relatively higher increase in margin from one year to the next as compared to a firm with a higher profit margin. Said differently, a firm with higher profit margin will require a relatively higher growth rate differential to realize the same increase from one year to the next as compared to a firm with a lower profit margin.

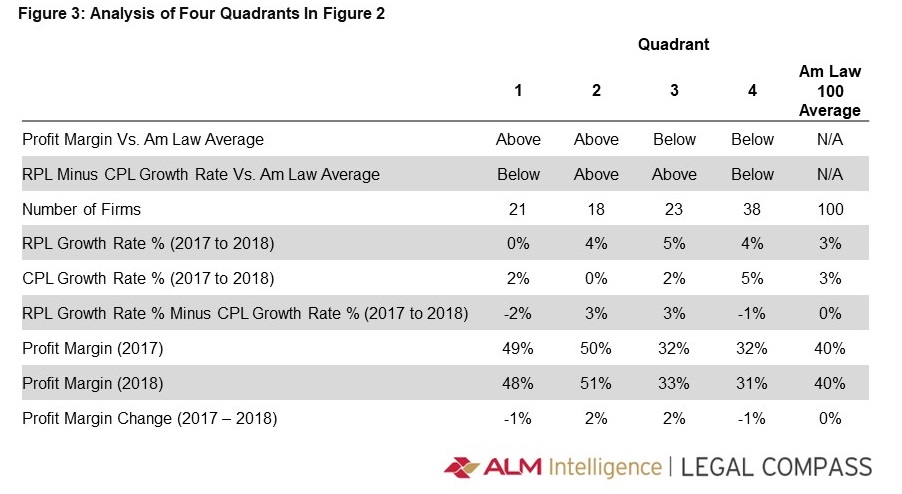

We have chosen the axes to be the Am Law 100 averages, so this naturally separates the 100 firms into four quadrants, each with very different characteristics (see Figure 3):

Quadrant 1 – High Profit Margin and Decreasing: 21 firms with an average 2017 profit margin 9.5% higher than Am Law 100 average, 2017 to 2018 RPL minus CPL growth rate 2.9% lower than Am Law 100 average, and a 1.3% decrease in profit margin from 2017 to 2018

Quadrant 2 – High Profit Margin and Increasing: 18 firms with an average 2017 profit margin 9.7% higher than Am Law 100 average, 2017 to 2018 RPL minus CPL growth rate 3.0% higher than Am Law 100 average, and a 1.7% increase in profit margin from 2017 to 2018

Quadrant 3 – Low Profit Margin and Increasing: 23 firms with an average 2017 profit margin 8.3% lower than Am Law 100 average, 2017 to 2018 RPL minus CPL growth rate 2.5% higher than Am Law 100 average, and a 1.9% increase in profit margin from 2017 to 2018

Quadrant 4 – Low Profit Margin and Decreasing: 38 firms with an average 2017 profit margin 8.1% lower than Am Law 100 average, 2017 to 2018 RPL minus CPL growth rate 1.7% lower than Am Law 100 average, and a 0.9% decrease in profit margin from 2017 to 2018

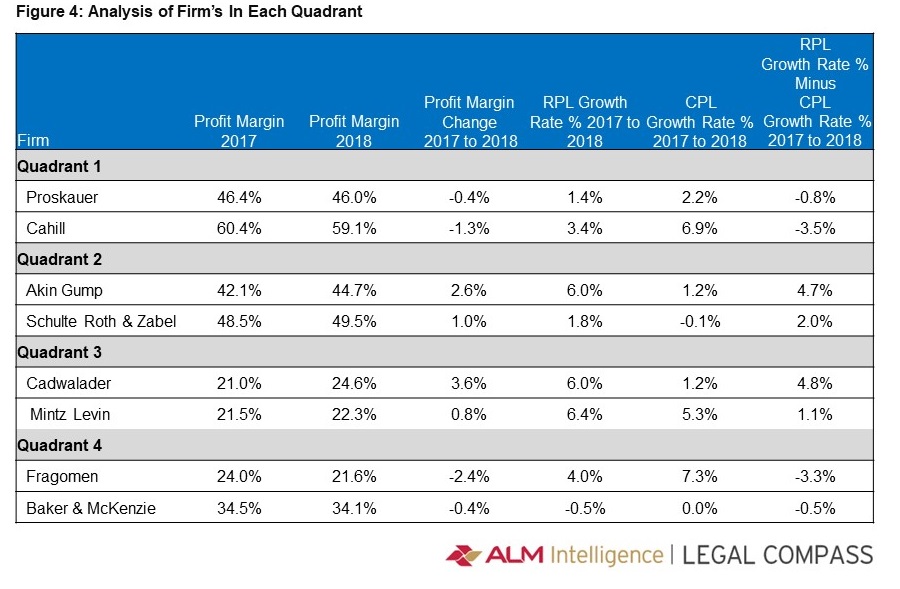

Figure 4 provides some examples of firms in each quadrant

Some Interesting Observations

If we dig deeper into these numbers in Table 1, there are some noteworthy findings:

Similarities and differences among quadrants: Firms in quadrant 1 and 2 have same average profit margin of 49%, about 9.6% higher than the Am Law 100 average, yet from this same starting point they go opposite directions in terms of changes in profit margin. Similarly, for firms in quadrant 3 and 4, at 31% profit margin, are equally 8.2% lower than the Am Law profit margin average, but go different directions from 2017 to 2018.

Widening profit margin gaps between quadrants: The magnitude of the differential in growth rates of RPL minus CPL is higher for quadrants 1 versus 2 as compared to quadrants 3 versus 4. Thus, for firms in quadrant 1 versus 2, the profit margin gap widens from 0.2% in 2017 to 3.2% in 2018, owing to the 5.9% differential in growth rates of RPL minus CPL. Conversely, for firms in quadrant 3 versus 4, the profit margin gap widens from 0.2% in 2017 to 2.6% in 2018, owing to the lower 4.2% differential in growth rates of RPL minus CPL.

Large variation in RPL and CPL growth rates: While looking at RPL and CPL growth rates across quadrants, we can see very different RPL and CPL growth rates and these are quite distinct from the Am Law 100 average. As an example, Quadrant 2 and 4 have nearly identical level of RPL growth rates, but very different CPL growth rates.

Firms with lower profit margins benefit more for the same differential: Firms which have relatively lower profit margin experience a higher increase in profit margin from one year to the next for the same differential in RPL and CPL growth rates. This becomes evident when comparing quadrant 2 and quadrant 3. Firms in quadrant 2 have a profit margin of 49.5%, a differential between RPL and CPL growth rates of 3.4%, and a (higher) profit margin increase of 1.7%. Firms in quadrant 3 have a profit margin of 31.5%, a differential between RPL and CPL growth rates of 2.9%, and a profit margin increase of 1.9%. In quadrant 2, a lower differential in growth rate drives a higher profit margin change. Why is this so? Quadrant 2 has a lower profit margin starting point, thus experiences a higher magnitude of change in profit margin.

Profit margins are declining at a majority of firms: Finally, we see that Am Law 100 average has increased by 0.2% from 39.8% in 2017 to 40.0% in 2018; but only a minority of 41 firms (41% in quadrant 2 and 3) are increasing their profit margin, but a majority of 59 firms (59% in quadrant 1 and 4), are decreasing their profit margin. How can this be explained? We have to consider carefully the magnitude of change from 2017 to 2018 – 41 firms increased by 1.8% while 59% decreased by 1.1%. The weighted average of these 100 firms comes to 0.2%. In other words, fewer firms are increasing their profit margin, but by a higher magnitude which offsets a smaller decrease in a larger number of firms.

Summary

We analyzed here one year of change between 2017 and 2018, so these observations are specific only to this data set. However, this proposed framework of demarcating firms into four distinct quadrants can be applied to adjoining or even disconnected years to understand magnitude and direction of profit margin at individual firms; and their interaction with RPL and CPL growth rates. Indeed, a quick analysis of early 2019 results for 42 Am Law 100 firms shows the same general pattern.

Madhav Srinivasan is the Chief Financial Officer at Hunton Andrews Kurth LLP, leading the global finance and pricing competencies. Madhav is an ALM Intelligence Fellow and also an adjunct faculty at Columbia Law School in New York and University of Texas at Austin School of Law.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

ALM Market Analysis Report Series: Nashville's Rapid Growth Brings Increased Competition for Law Firms

Trending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250