(Photo: Shutterstock)

(Photo: Shutterstock) How Much Money Do You Need to Retire?

Schwab asked 401(k) plan participants this question — and showed how most are not on track to achieve that goal.

June 11, 2019 at 03:27 PM

4 minute read

Saving for RetirementThe original version of this story was published on Law.com

$1.7 million. That's how much Americans believe they should save in order to retire, according to a Schwab survey of 1,000 401(k) plan participants between the ages of 25 and 70. Unfortunately, few are likely to attain that goal.

Almost 60% of survey respondents said their 401(k) plan was their only or largest source of retirement savings, and 51% are contributing less than 10% of their salary to their 401(k), with the average annual contribution totaling $8,788."

"The people we surveyed have a realistic target for retirement, but many likely aren't on track to get where they want to go," said Steve Anderson, president of Schwab Retirement Plan Services in a statement. Only 23% of respondents reported contributing the maximum allowed in their 401(k) plans, which is currently $19,000 annually for employees under 50 and $25,000 for those 50 and older.

Yet close to 90% of survey respondents consider a 401(k) account a "must-have benefit," almost as important as health insurance coverage.

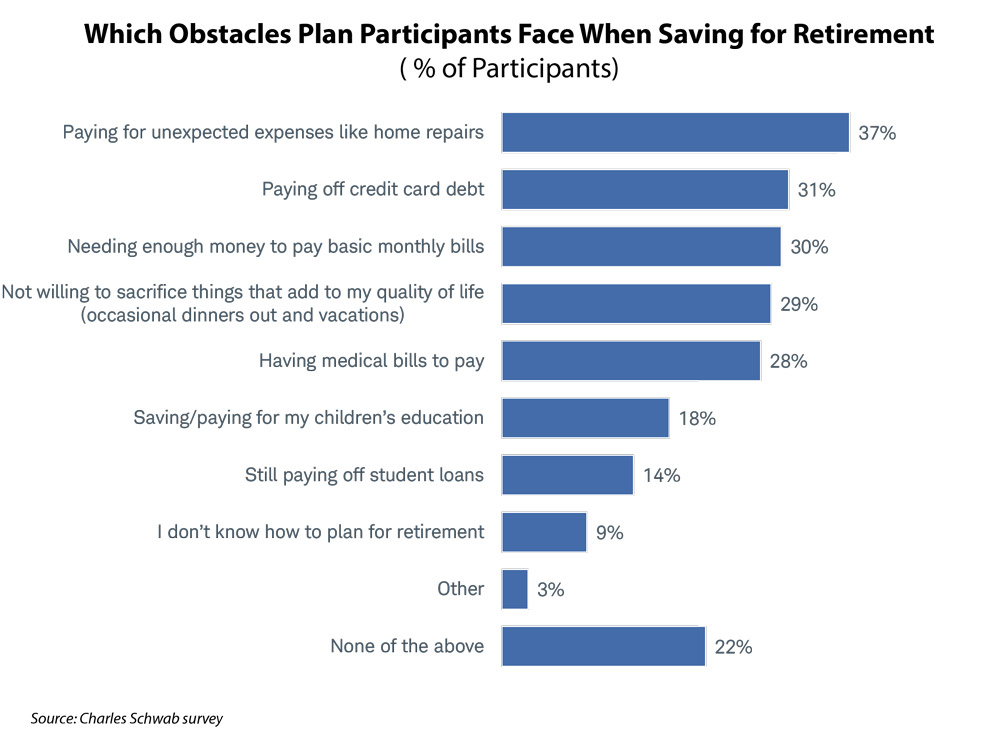

There are multiple reasons that employees aren't saving enough for retirement, according to the Schwab survey.

Many start too late in life, which makes it almost impossible to reach $1.7 million in assets. Schwab found that if employees start saving at age 45, they need to invest as much as 35% of their salary to reach that goal, but if they start saving in their 20s, a 10% to 15% salary contribution should suffice.

The respondents' initial contribution rates did not reflect their retirement goals but rather the percentages respondents are comfortable with, qualify for their company's contribution match, or are set by their employers for auto-enrollment.

Afterward, one-third of auto-enrollees reported they never increased their contribution level and 44% said they never changed their investment choices, indicating that they never rebalanced their accounts. Less than half of all survey respondents reported increasing their contribution rate in the past two years.

Perhaps the primary reason that retirement plan participants don't sock away more money in those accounts is that they don't have the money to do so. Survey participants cited a range of obstacles to contributing more, with roughly 30% noting the need to pay unexpected expenses, credit card debt, basic monthly bills and medical bills.

Despite these obstacles, late starts and shortcomings, there are behaviors that plan participants can adopt to help boost their retirement account assets, according to the Schwab survey:

- Shift their mindset from "saving for retirement" toward "investing for retirement" (64% view themselves as savers rather than investors when using a 401(k) plan)

- Use an online retirement calculator to learn how big a nest egg they need for a comfortable retirement (roughly half of survey participants reported using one and 48% of them increased their 401(k) contributions, while close to 30% changed their spending habits and/or accessed online financial advice)

A little over half of survey respondents felt their financial situation would be helped by receiving financial advice, and 95% said they would feel confident in their financial decisions if they had some professional help. Among the issues they want help with are:

- Determining the age to retire (41%)

- Calculating how much they need to save (40%)

- Receiving advice on how to invest their 401(k) (37%)

- Figuring out expenses in retirement (35%)

"We believe everyone can benefit from professional financial advice, and by offering it at work, employers can help move their employees from saving to investing to true financial ownership," said Catherine Golladay, chief operating officer at Schwab Retirement Plan Services in a statement.

Plan sponsors should be thoughtful about how they design 401(k) plan matches and auto features, Golladay tells ThinkAdvisor. "Plan design plays a big role."

But plan participants, in turn, need to take advantage of all the tools available within their plan's design, whether it be advice in managed accounts or online tools like retirement calculators.

"We know from studies that if participants have advice available to them and take advantage of it, that can help them figure out how much to save, what to invest in, what their needs will be in retirement," says Golladay.

— Check out 10 Barriers to Retirement Preparedness on ThinkAdvisor.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250