Analyzing Trajectories Of Future Profit Margins

Future profit margins can be projected for firms using estimates for RPL and CPL growth rates. 2019 projections match favorably with actual results.

June 13, 2019 at 09:35 AM

9 minute read

In article 4, we analyzed direction and magnitude of profit margin (defined as operating income divided by revenue) from one year to the next for individual firms in the Am Law 100 using a short-term oriented framework. Here, we analyze profit margin behavior over longer time frames i.e. over multiple future years.

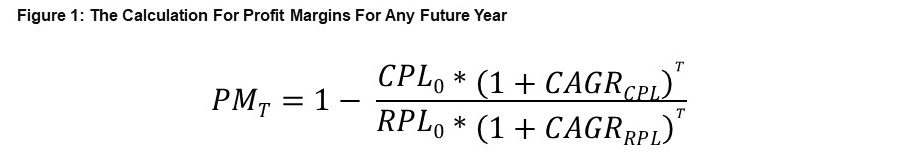

To do so, we return to the formula expressing profit margins for any future year, T years from this current year 0, in terms of current RPL and CPL, as also their cumulative average annual growth rate % (CAGR).

Analyzing Future Profit Margin

This formula shows future profit margin is directly impacted by two factors:

Differential between RPL and CPL growth rates: Profit margin rises when RPL growth rate exceeds the CPL growth rate. Conversely profit margin falls when CPL growth rate exceeds RPL growth rate. The increase in profit margin is directly proportional to the magnitude of differential between growth rates of RPL and CPL. A larger positive differential between RPL and CPL growth rates will lead to a higher increase in future profit margin. Conversely, a larger negative differential between RPL and CPL growth rates will lead to a higher decrease in future profit margin.

Current level of profit margin: Interestingly, the shape of future trajectory of profit margin is influenced by the level of current profit margin. The trajectory turns out be flatter for firms with higher profit margin; and steeper for firms with lower profit margin. Why is this so? Let's think of profit margin as 1 – (CPL/RPL). This indicates that it is driven by the gap (or distance) between RPL and CPL. A firm with higher profit margin has a larger gap (CPL is far from RPL); and a firm with lower profit margin has a smaller gap (CPL is close to RPL). Increasing future profit margin, or widening the gap, is relatively easier for a firm with lower profit margin than for a firm with higher profit margin. Given the same positive differential between RPL and CPL growth rates, a firm with lower profit margin will experience larger increases in future profit margin than a firm with a higher profit margin. Said differently, to achieve the same increase in profit margin in a future year, a firm with high profit margin requires a relatively higher differential.

Future Profit Margin in Two Scenarios

These two impacts are best illustrated by projecting future profit margin for 5 selected firms in two hypothetical scenarios. We select five different firms to represent the wide range of profit margin in the 2018 Am Law 100 set:

- Cahill Gordon: 2018 profit margin of about 60% (20% over Am Law 100 average)

- Paul Weiss: 2018 profit margin of about 50% (10% over Am Law 100 average)

- Cooley: 2018 profit margin of about 40% (at Am Law 100 average)

- Holland and Knight: 2018 profit margin of about 30% (10% below Am Law 100 average

- Polsinelli: 2018 profit margin of about 20% (20% below Am Law 100 average)

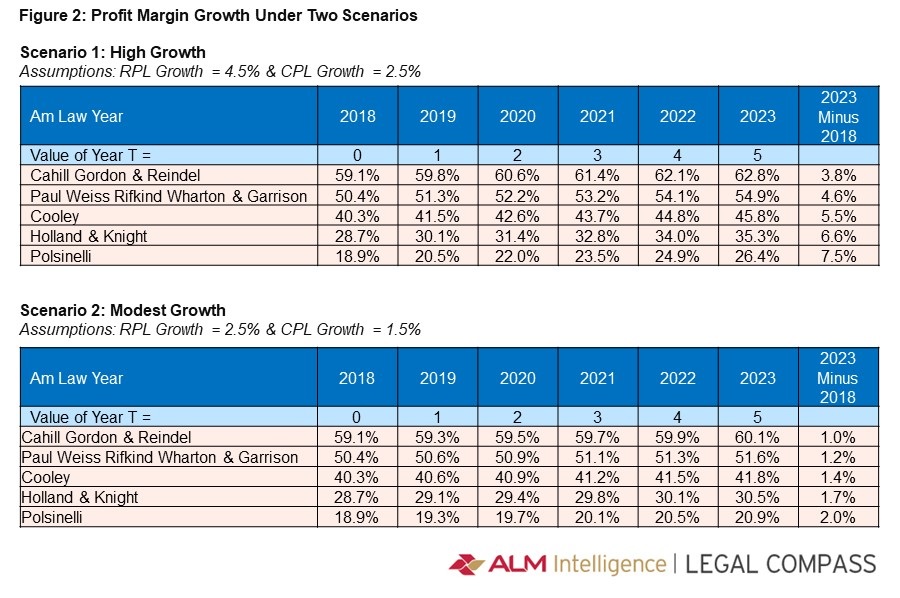

The first optimistic growth scenario has high RPL growth rate and high differential over CPL growth rate. The second moderate growth scenario has moderate RPL growth rate and modest differential over CPL growth rate. These two scenarios reflect the wide variety seen in the 100 Am Law firms. We further assume that the same RPL and CPL growth rate exists for all years from 2018 to 2023:

- Scenario 1: RPL growth rate of 4.5% and CPL growth rate of 2.5%, differential of 2.0%

- Scenario 2: RPL growth rate of 2.0% and CPL growth rate of 1.5%, differential of 0.5%

The results of applying this formula to each firm for each year after T = 0 (year 2018), from T=1 to T=5, that is 2019 to 2023, is shown in Figure 2.

Intuitively, we would expect two outcomes. First, future profit margins should increase faster in the first scenario. And second, the trajectory for firms with lower profit margins would be much steeper. Our focus is on the difference between 2023 profit margin and the 2018 profit margin for all firms. We see that these numerical results do prove out our mathematical analysis. Indeed, two critical observations arise from the data analysis:

A higher RPL to CPL differential leads to higher increases in future profit margin: We note that for all firms, the difference between 2023 profit margin and 2018 profit margin is higher in scenario 1 than in scenario 2. Why is this so? Scenario 1 had a RPL to CPL growth rate differential of 2.0% and scenario 2 had a differential of 0.5%. This higher differential in Scenario 1 leads to higher increases in future profit margin. In other words, the gap between RPL and CPL is widening relatively more in Scenario 1 than in Scenario 2. Consider Paul Weiss. Profit margin increases 4.6% in the high-growth scenario 1, much more than the 1.2% in moderate-growth scenario 2.

Firms with lower profit margins experience a steeper future trajectory: If we look within each scenario, profit margin increase is higher for firms with lower 2018 profit margin than for firms with higher 2018 profit margin. The trajectory for lower profit margin firms is steeper while the trajectory for higher profit margin firms is shallower. In other words, the gap between RPL and CPL is widening more for firms which have a lower profit margin as the starting point. Consider Polsinelli and Cahill Gordon within scenario 1. Polsinelli's 2018 profit margin is 18.9%, which is far lower than Cahill Gordon's 2018 profit margin of 59.1%. But when we look at 2023, we can see Polsinelli profit margin increased by 7.5%, much more than the increase of 3.8% at Cahill Gordon. Polsinelli's future trajectory is steeper than Cahill Gordon's.

Profit Margin Trajectories for Individual Firms

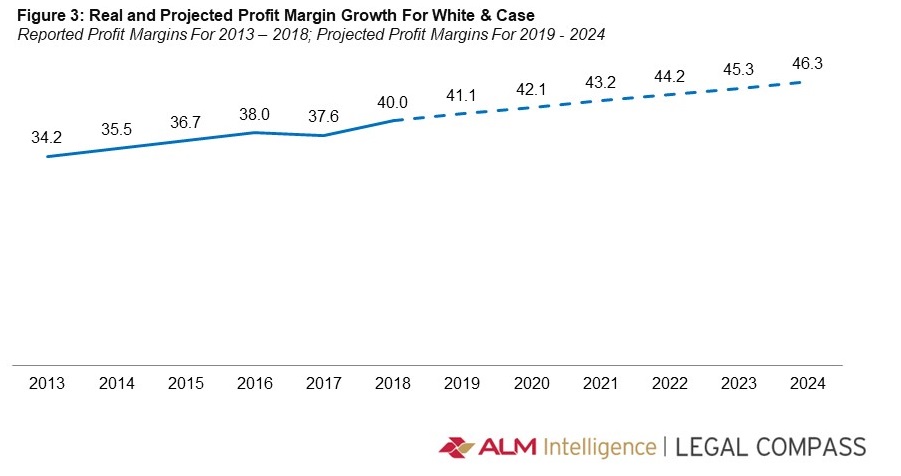

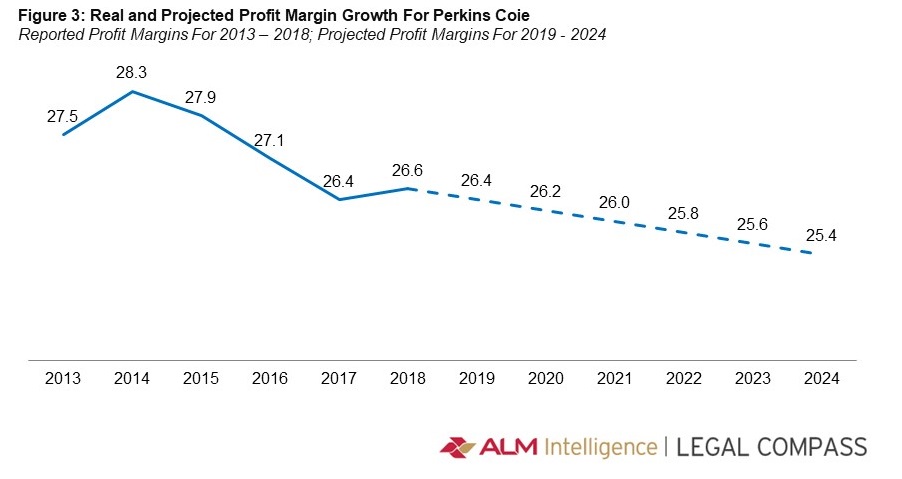

These two scenarios are only illustrative, but we can get more specific by using actual data for individual firms. Indeed, we can project future profit margin for any law firm using estimates for future RPL and CPL growth; either by considering a variety of scenarios or from a single number from recent history. As an example, for two firms, White & Case and Perkins Coie, we calculated the historical CAGR for RPL and CPL from 2013 to 2018 using the Am Law 100 data set and then assumed these levels held for all future years 2019 to 2024. The future hypothetical profit margin trajectories are analyzed in detail below.

For White & Case we expect future profit margins to increase. Why? Historical 2013 to 2018 cumulative average growth rate for RPL of 3.97% is higher than CPL of 2.07% by a positive differential of 1.90%. As an example, our projection for 2019 profit margin turns out to be 41.07% , 1.10% higher than the 2018 actual of 39.97%. Fortunately, we can compare against early 2019 results which shows an RPL increase of 7.8%, CPL increase of 7.7% and profit margin of 40.03%, up 0.06% from 39.97% in 2018. Our projection varied from actuals in two ways – in level and in the difference. Our estimated RPL and CPL growth rates were lower than actuals; but estimated RPL minus CPL differential was higher than actuals. Since it is the differential which is the key driver of profit margin, projected 2019 profit margin turned out higher than actual 2019 profit margin.

For Perkins Coie we expect future profit margins to decrease. Why? Historical 2013 to 2018 cumulative average growth rate for RPL of 2.42% is lower than CPL of 2.69% by a negative differential of 0.27%. As an example, our projection for 2019 profit margin turns out to be 26.39% , 0.19% lower than the 2018 actual of 26.58%. Fortunately, we can compare against early 2019 results which shows an RPL increase of 6.4%, CPL increase of 7.0% (thus a negative differential of 0.60%) and profit margin of 26.14%, down 0.44% from 26.58% in 2018. Our projection varied from actuals in two ways – in level and in the difference. Our estimated RPL and CPL growth rates were lower than actuals; but estimated RPL minus CPL negative differential was lower than actual negative differential. Since it is the differential which is the key driver of profit margin, projected 2019 profit margin also turned out higher than actual 2019 profit margin.

Summary

Projecting future profit margin turns out to be a very interesting exercise. We can create multiple trajectories for a single law firm using a variety of estimates for RPL and CPL growth rates. If comparing across firms, the shape of future profit margin trajectory is influenced both by current level of profit margin and the differential between RPL and CPL growth rates. Indeed, we can match projections against actual numbers, which leads to further insights into initial assumptions and deeper understanding of firm performance.

Madhav Srinivasan is the Chief Financial Officer at Hunton Andrews Kurth LLP, leading the global finance and pricing competencies. Madhav is an ALM Intelligence Fellow and also an adjunct faculty at Columbia Law School in New York and University of Texas at Austin School of Law.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

ALM Market Analysis Report Series: Nashville's Rapid Growth Brings Increased Competition for Law Firms

Trending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250