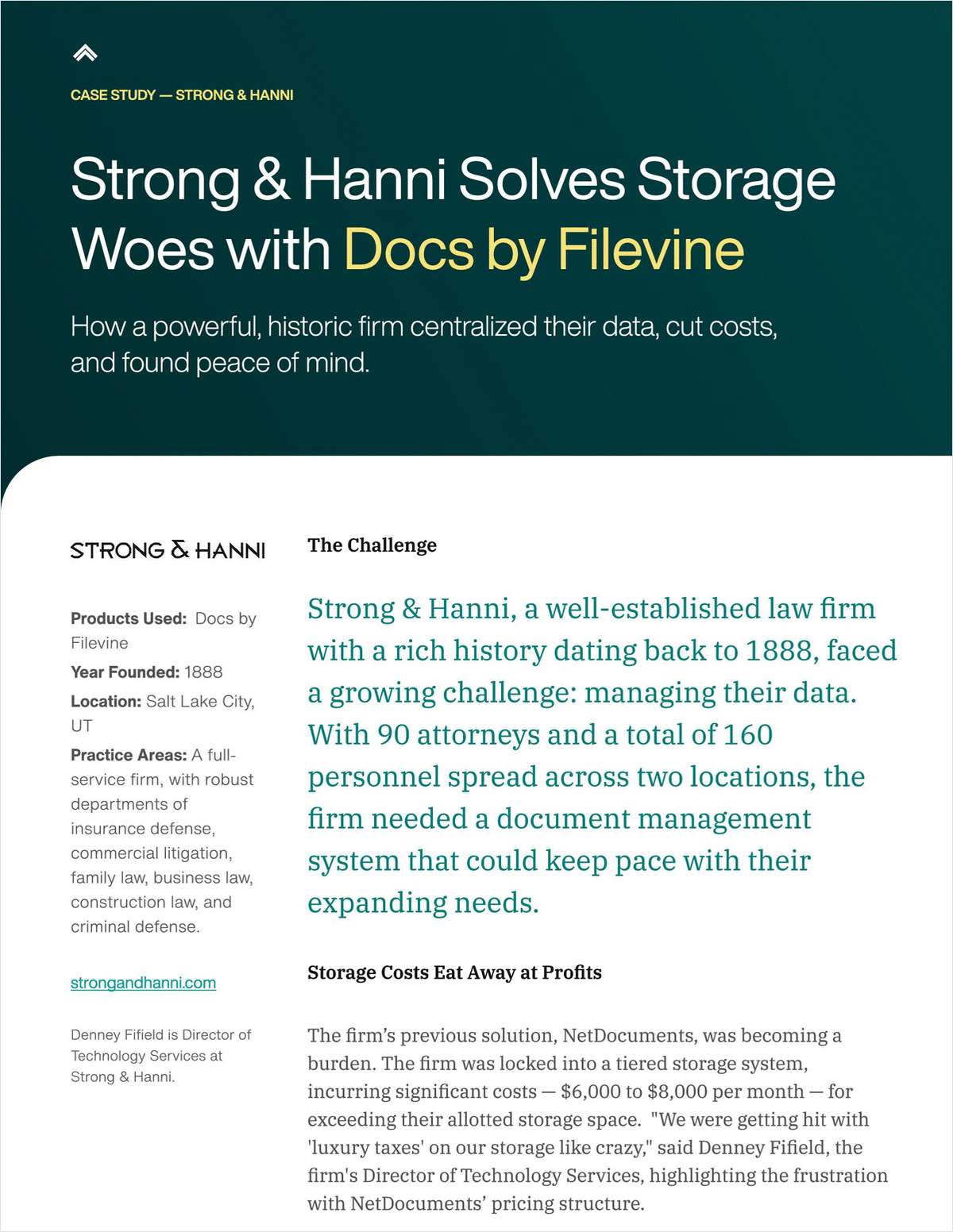

Neal Manne (from left) of Susman Godfrey, Jason Peltz of Bartlit Beck and John B. Quinn, of Quinn Emanuel. (Courtesy photos)

Neal Manne (from left) of Susman Godfrey, Jason Peltz of Bartlit Beck and John B. Quinn, of Quinn Emanuel. (Courtesy photos)Kirkland's Push Into Contingency Fee Litigation Not Threatening, Firm Leaders Say

Trial lawyers said Kirkland, for all its resources, comes into a contingency fee practice with some disadvantages.

July 14, 2019 at 07:00 PM

5 minute read

The original version of this story was published on The American Lawyer

In the wake of Kirkland & Ellis' announcement that it is “doubling down” on contingency-fee litigation, you might expect lawyers who take on such matters to worry about competing for clients with Big Law's 600-pound gorilla.

But in interviews, leading litigators at other firms said they're not sweating the news. They said there's enough work for everyone and that Kirkland's big client base and full-service offering could work against the firm in some ways.

“We don't view it as threatening in any way,” said Neal Manne, the Houston-based managing partner of Susman Godfrey. He said Susman Godfrey has a good brand, runs cases efficiently and his firm is already comfortable with alternative fees—less than 20% of its revenue comes from billable hours, he said. “We don't view [Kirkland] as a competitor in any way that would affect our business model or our approach,” he said.

Jason Peltz, whose trial-oriented firm Bartlit Beck was started by former Kirkland litigators with a distaste for the billable hour, said Kirkland's announcement “doesn't worry me at all.” He said Kirkland is more associate-heavy than his firm and staffs matters differently.

“I think there are enough cases for the best lawyers out there,” Peltz added.

For some, the Kirkland announcement was seen more as a marketing play rather than a new strategic direction.

“I don't think this is an event,” John Quinn, the managing partner of Quinn Emanuel Urquhart & Sullivan, said in an email. “I very much doubt that this means that [Kirkland & Ellis] would now accept a good [contingency fee] case that they wouldn't have accepted six months ago.”

Trial lawyers contacted for this article said they welcome the competition, but noted that Kirkland—for all its resources—has some disadvantages. One is the risk of conflicts; Kirkland represents a wide array of the biggest businesses in America on litigation and corporate matters and can't turn around and sue them.

Also, both Peltz and Manne noted that their own firms benefit from referrals from other law firms that don't have to worry about losing a client for other legal services. In other words, firms may be wary of sending a client to a full-service firm like Kirkland for a litigation matter, fearful of losing the entire client relationship.

|Eyeing Profitability

Regardless of how the firm's news was received, it's now clear that Kirkland—known for mounting huge defense cases for the likes of BP in the aftermath of the Deepwater Horizon disaster and General Motors after its faulty ignition switches led to numerous deaths—wants the market of potential plaintiffs to know that it is open to going to bat for them.

Kirkland's announcement this month comes less than three years after ALM reported a partner profit reallocation hurt the pay of some Kirkland litigators, as their peers in private equity and M&A contribute a growing share to the firm's bottom line.

In recent years, there has been an industrywide drop in demand for litigation. It's not clear how demand for Kirkland's litigators has fared, but Kent Zimmermann, a law firm consultant with the Zeughauser Group, noted that going after more plaintiffs' cases could mean more work for the firm's litigators. He said taking on more contingency cases was a high-risk, high-reward strategy, but said the firm has probably checked its data and has been satisfied with the results.

“They already have a record of success [with] some big plaintiffs-side wins at their back, and it's unsurprising that they want more,” he said.

Former Kirkland lawyers said firm leaders have eyed the profitability of plaintiffs' firms like Quinn Emanuel with some jealousy. (Quinn Emanuel's profit margin last year was 61%, compared with Kirkland's at 58%, according to ALM data.) And the ex-Kirklanders note that the Chicago-founded firm has had great success taking the plaintiffs' side in the past.

Just take the case of bankrupt chemical company Tronox. Kirkland represented a litigation trust that sued Kerr McGee for dumping its environmental liabilities on Tronox before spinning it off, freeing itself of the toxic burden and setting up its corporate offspring to fail. The case ended in a $5 billion settlement, and Kirkland got paid $93 million; $70 million of that was a contingency fee.

Reed Oslan, who leads Kirkland's special fee arrangement committee, said at a conference earlier this year that alternative-fee matters were “the most profitable part of our firm, by a large margin,” although he noted that it was a small portion of the firm's business.

Kirkland has declined to say how much of its revenue comes from alternative fee arrangements and declined to comment for this article. The firm was the highest grossing of the entire Am Law 200 last year, generating $3.757 billion.

Still, former Kirkland partners said alternative fees have ebbed and flowed. They praised Oslan, saying his support for contingency fees, hybrid fees and arrangements blending fees from a portfolio of cases has resulted in major successes.

But only time will tell how far Kirkland pushes the contingency fee practice. One source said there was a concern among some litigators inside Kirkland that the entire firm was watching a lawyer's contingency fee matters and a worry that large risk-taking wouldn't be rewarded.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

This Law Firm Aims to Have 100 International Offices by 2026

A&O Shearman to Cut Equity Partnership, Close in South Africa and End Consulting Division in Post-Merger Drive

5 minute readTrending Stories

- 1The Law Firm Disrupted: Playing the Talent Game to Win

- 2A&O Shearman Adopts 3-Level Lockstep Pay Model Amid Shift to All-Equity Partnership

- 3Preparing Your Law Firm for 2025: Smart Ways to Embrace AI & Other Technologies

- 4BD Settles Thousands of Bard Hernia Mesh Lawsuits

- 5A RICO Surge Is Underway: Here's How the Allstate Push Might Play Out

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250