Trump Files Emergency Papers Seeking to Prevent Disclosure of State Tax Returns

The filing comes one day after Trump filed a federal lawsuit in the U.S. District Court for the District of Columbia seeking to have the New York state law struck down as unconstitutional.

July 24, 2019 at 05:06 PM

5 minute read

The original version of this story was published on New York Law Journal

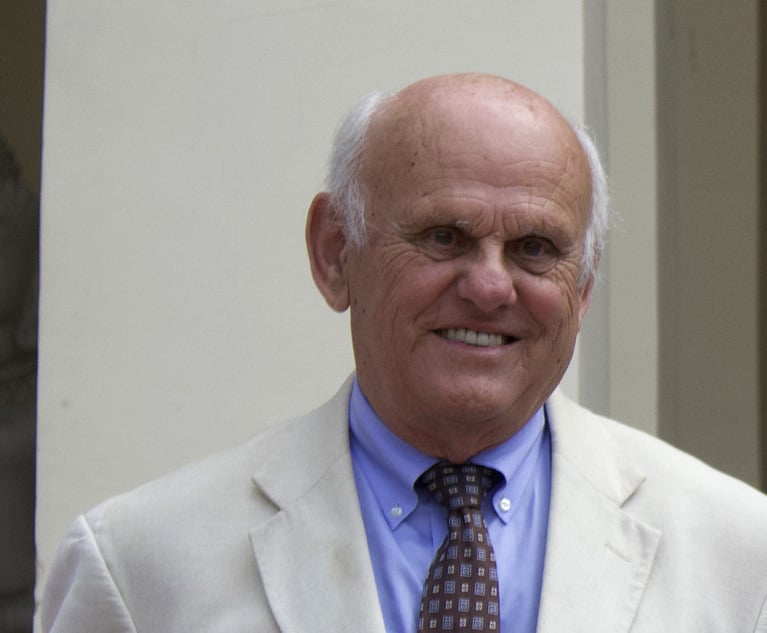

President Donald Trump. Photo courtesy of The White House

President Donald Trump. Photo courtesy of The White House

President Donald Trump asked a federal judge in Washington, D.C., on Wednesday to immediately enjoin the U.S. House Ways and Means Committee from utilizing a New York state law to obtain copies of his state tax returns.

The filing comes one day after Trump filed a federal lawsuit in the U.S. District Court for the District of Columbia seeking to have the New York state law struck down as unconstitutional.

Attorneys for Trump wrote in the filing that the court should bar federal lawmakers from using the state law to request copies of his state tax returns until the legal challenge has been afforded judicial review. The court has the power to do so under the All Writs Act, they argued.

“The president is in an intolerable situation: If he seeks relief after the chairman requests his state tax returns, the returns might be disclosed before he can be heard in court,” the filing said. “At the same time, immediate judicial review could force the court to prematurely decide constitutional issues that might otherwise be avoided.”

Trump is represented by William Consovoy and Patrick Strawbridge of Consovoy McCarthy.

They argued in the filing that federal lawmakers could use the New York state law, called the TRUST Act, to obtain copies of his state tax returns at any time, including before the lawsuit is resolved.

That's true; House Ways and Means Chairman Richard Neal, D-Massachusetts, could use the law to ask the state Department of Taxation and Finance for Trump's state filings. Neal hasn't said whether he plans to do so. Trump's attorneys argued that he shouldn't have the option while the litigation is ongoing.

“For its part, the committee has not made a binding commitment to refrain from using this mechanism to obtain the president's state returns, and all available evidence suggests it will request them before the 2020 election,” the filing said.

If their request isn't granted, Trump's attorneys wrote, the lawsuit could become moot if federal lawmakers decide to use the TRUST Act before it's undergone judicial review. You can't unring a bell, so to speak.

But if the court is rushed to evaluate the law without more review, Trump's attorneys said they would have less time to make their case. That would, consequently, give the court less time to consider the constitutionality of the TRUST Act, they wrote.

Either option could result in federal lawmakers obtaining copies of Trump's state tax filings, the attorneys argued. They asked the court to pump the brakes so the TRUST Act could be evaluated more closely without any risk to Trump.

“The irreparable harm that the president will suffer from this disclosure of his tax records underscores the propriety of equitable intervention to preserve judicial review,” the filing said.

The TRUST Act allows the chairpersons of three congressional committees to request copies of Trump's state tax filings from the state Department of Taxation and Finance in New York. It also allows the tax filings of most other elected or appointed officials in New York to be requested, though the law was inspired by Trump.

There are limits to when those tax filings can be requested, and for what purpose. Federal lawmakers can only ask the state agency for someone's tax documents if the U.S. Treasury Department has already rejected such a request. In the case of Trump, that's already happened.

A request for someone's state tax filings also has to be “related to, and in furtherance of, a legitimate task of the Congress.”

Trump's attorneys argued in the lawsuit filed Tuesday that members of Congress couldn't possibly have a purpose for obtaining his state tax filings because they're tasked with overseeing federal laws, not state tax laws.

“No legitimate legislative purpose exists to request the president's state tax returns,” the lawsuit said. “The primary purpose of any request under the TRUST Act would be exposure for the sake of exposure, law enforcement, or some other wholly impermissible goal—not pursuing valid federal legislation.”

A spokesman for the House Ways and Means Committee did not immediately respond to a request for comment. The committee is named as a defendant in the suit, as are New York Attorney General Letitia James and New York State Tax Commissioner Michael Schmidt.

The case is before U.S. District Judge Trevor McFadden of the District of Columbia.

READ MORE:

Cuomo Signs Legislation Allowing Congress to Request Trump's NY State Tax Returns

NY Legislature OKs Bill to Release Trump's State Tax Returns to US Congress

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Landlord Must Pay Prevailing Tenants' $21K Attorney Fees in Commercial Lease Dispute, Appellate Court Rules

4 minute read

Federal Laws Also Preempt State's Swipe Fee Law on Out-of-State Banks, Judge Rules

3 minute read

Judge Accuses Trump of Constitutional End Run, Blocks Citizenship Order

3 minute readTrending Stories

- 1'Translate Across Disciplines': Paul Hastings’ New Tech Transactions Leader

- 2Milbank’s Revenue and Profits Surge Following Demand Increases Across the Board

- 3Fourth Quarter Growth in Demand and Worked Rates Coincided with Countercyclical Dip, New Report Indicates

- 4Public Notices/Calendars

- 5Monday Newspaper

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250