Compliance Hot Spots: Skadden Watches, And Testifies, At Greg Craig Trial | CFTC Yanks Press Releases Amid Companies' Complaints | New IRS Warning Letters | Davis Polk Snags SEC Cyber Lawyer

Who's testifying at the Greg Craig trial in Washington? Plus: the CFTC yanked down press releases in the Kraft and Mondelez settlement, as a judge weighs the two companies' complaints. Scroll down for all the new moves, and thanks for reading!

August 20, 2019 at 09:00 PM

11 minute read

Welcome to Compliance Hot Spots—and good evening from Washington. We’re smack in the middle of the Greg Craig trial in D.C.—and we’ve got a snapshot below of some of the action. Plus, the U.S. Commodity Futures Trading Commission pulled down three news releases after companies complained—and now a judge will investigate possible sanctions. Scroll down for all the new moves, and Who Got the Work.

Tips, feedback and thoughts on your practices are always appreciated. I’m C. Ryan Barber, and you can reach me at [email protected] and 202-828-0315, or follow me on Twitter @cryanbarber. Thanks for reading!

Skadden’s Not on Trial, But Its Lawyers Are Key in Craig Case

The Greg Craig trial has offered a peek inside Skadden, Arps, Slate, Meagher & Flom, with emails and live testimony detailing how the law firm approached a sensitive project for Ukraine and grappled with scrutiny from the Justice Department.

Three current or former Skadden lawyers, so far, have been called to the stand at Craig’s trial in Washington. Their testimony has taken jurors back to 2012, when Craig agreed to prepare a report for Ukraine on its case against Yulia Tymoshenko, a former prime minister whose prosecution was widely-criticized as being politically motivated.

Craig was charged in April with misleading the U.S. Justice Department about his role in the public rollout of the report, in part, prosecutors allege, to avoid registering as a foreign agent of Ukraine. His role in the report’s release to the media is key to the question of whether he needed to disclose his Ukraine work under the Foreign Agents Registration Act, or FARA.

Craig (at left) resigned from the firm last year, months before Skadden agreed to pay $4.6 million to resolve allegations that it failed to register as a foreign agent of Ukraine. Skadden retroactively registered under FARA as part of the January settlement. Craig is not charged with failing to register, but his case is seen nonetheless as an early test of the Justice Department’s stepped-up enforcement of FARA. Law firms are watching his trial closely.

Craig (at left) resigned from the firm last year, months before Skadden agreed to pay $4.6 million to resolve allegations that it failed to register as a foreign agent of Ukraine. Skadden retroactively registered under FARA as part of the January settlement. Craig is not charged with failing to register, but his case is seen nonetheless as an early test of the Justice Department’s stepped-up enforcement of FARA. Law firms are watching his trial closely.

“FARA is not taking a backseat at DOJ anymore,” Joshua Rosenstein, a partner at Sandler Reiff Lamb Rosenstein & Birkenstock told me. “What the Craig trial shows is FARA is not going away.”

With their first witness, Skadden partner Michael Loucks, prosecutors underscored how the Ukrainian government was aware of how criticism of the Tymshenko prosecution was hampering the country’s bid to join the European Union. Loucks recalled accepting Craig’s assertion at the time that the deal with Ukraine was structured to steer clear of public relations and other activities that would trigger a need to register under FARA. A pair of former Skadden associates, Alex Haskell and Allon Kedem, testified about being asked to research FARA and concluding that the law did not apply to the firm’s Ukraine work—at least as it was outlined.

Prosecutors want to show that Craig departed from the initial plan and participated in the report’s release, then misled colleagues at Skadden and the Justice Department about his involvement in Ukraine’s public relations strategy. Craig’s defense lawyers at Zuckerman Spaeder—including William Taylor III and William Murphy—have argued he was entirely truthful with the Justice Department and dismissed claims he was an agent of Ukraine. Craig’s contacts with the media, his lawyers have argued, were intended to protect his own reputation and counter the Ukrainian government’s efforts to spin Skadden’s report.

Skadden is sure to remain in the middle of Craig’s case. Prosecutors are expected to call Skadden’s general counsel, Lawrence Spiegel, and Kenneth Gross, a partner at the firm with FARA expertise. Cliff Sloan, a former partner at the firm who worked on the Tymoshenko report, and Craig’s former secretary are among the other expected witnesses with Skadden ties.

More reading: Judge and Defense Clash at Greg Craig Trial (Politico); Greg Craig Is Warned: Cut the Chumminess With Former Skadden Colleagues at Trial (Law.com); At Greg Craig’s Trial, Skadden Arps Is Watching—And Testifying (Law.com)

CFTC Faces Chicago Judge’s Scrutiny Over Media Statements

The chairman of the U.S. Commodity Futures Trading Commission and two commissioners must appear in court next month in Chicago as a judge weighs whether to sanction the agency for media statements that two major food producers contend went outside the scope of what enforcers were allowed to say.

Lawyers for the two companies—Kraft Foods Group Inc. and Mondelēz Global LLC—argue in court papers that a provision in a $16 million settlement announced last week put a clamp on what agency officials could say publicly. Teams of lawyers from Jenner & Block and Eversheds Sutherland want a Chicago judge to sanction the agency for its media statements.

Dean Panos, a Jenner partner in Chicago, said the two companies “have already incurred significant reputational damage because of the CFTC’s premeditated media strategy in violation of the consent order.”

The whole thing is a rare dustup, caused by an unusual provision that said none of the parties were allowed to make “any public statement about this case other than to refer to the terms of this settlement agreement or public documents filed in this case.”

CFTC lawyers contend the agency’s press statements were in line with the settlement, which resolved claims of alleged price manipulation in the wheat market. The agency disputed that any statements from the agency and commissioners hurt the companies any more than “the bare fact of having been sued for manipulation and other violations of the Commodity Exchange Act and having settled for a substantial penalty.”

U.S. District Judge John Robert Blakey has set an evidentiary hearing for Sept. 12, and three CFTC officials—Chairman Heath Tarbert, and Commissioners Dan Berkovitz and Rostin Behnam—are required to attend. Mike Scarcella’s got a full run-down about the action over at Law.com.

Who Got the Work

>> Covington & Burling partner David Kornblau represented the broker BMO Capital Markets Corp. in a settlement with the Securities and Exchange Commission. BMO agreed to pay $3.9 million to resolve allegations that it mishandled pre-released American Depository Receipts, or ADRs, U.S. securities that represent foreign shares in a foreign company. A second broker, Cantor Fitzgerald & Co, was represented by Shearman & Sterling partner Adam Hakki as it paid $647,000 to resolve similar claims.

>> King & Spalding partner Alec Koch, a former senior enforcement attorney at the SEC, advised TherapeuticsMD as the Boca Raton-based pharmaceutical company resolved charges relating to information it shared with research analysts about its dealings with the Food and Drug Administration. The SEC alleged that the company, in failing to also disclose those details to the general public, violated a securities regulation prohibiting the selective release of information to certain professionals and shareholders. TherapeuticsMD paid a $200,000 penalty to resolve the SEC’s claims.

Compliance Reading Corner

Enforcement

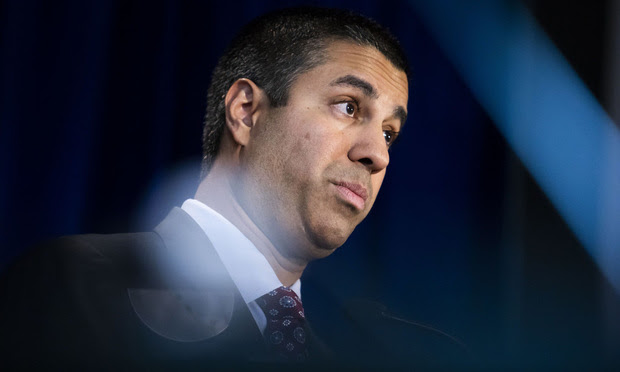

Small Companies Play Big Role in Robocall Scourge, But Remedies Are Elusive. “U.S. regulators have conflicting interpretations of their ability to take the companies to court, however. And carriers aren’t explicitly required to try to differentiate between legal and illegal robocalls, further clouding enforcement.” FCC Chairman Ajit Pai (above) said enforcers would continue our efforts to ensure that every tool is available to end the scourge of robocalls.” [WSJ]

New IRS Warning Letters Target Crypto Investors Who Misreported Trades. “The U.S. Internal Revenue Service (IRS) is sending another round of warning letters to cryptocurrency users, this time to taxpayers it believes to have misreported income from exchange transactions. In addition to the three letters sent last month to crypto traders advising them they may have incorrectly filed their taxes, the IRS is now also telling certain investors that they did, in fact, report the wrong amount of income from crypto transactions.” [CoinDesk]

Amazon.com Defeats IRS Appeal in U.S. Tax Dispute. “Amazon.com Inc on Friday defeated an appeal by the U.S. Internal Revenue Service in what the online retailer has called a $1.5 billion dispute over its tax treatment of transactions with a Luxembourg subsidiary.” [Reuters]

States to Move Forward With Antitrust Probe of Big Tech Firms. “The political makeup of the multistate group isn’t set. A bipartisan probe could give the investigation broader leverage and help insulate GOP officials from questions over whether their actions are motivated by political concerns, such as how online platforms treat conservative speech.” [WSJ]

Law firm culture

How I Made Partner: Davis Polk White-Collar Partner Fiona Moran. “Our clients expect top-notch legal representation, so a critical component of business development is putting forward the firm’s absolute best work product and providing the firm’s absolute best advice. But I think you most successfully serve a client when you take the time to understand their business motivations beyond the narrow confines of one legal matter.”[Law.com]

Accounting

General Electric Renews Defense Against Charges of Bogus Accounting. “General Electric Co further defended itself on Monday against fraud investigators who said last week the Boston-based conglomerate had failed to put aside money to cover $29 billion in potential insurance losses and had improperly counted profit from subsidiary Baker Hughes as its own.” [Reuters] The Wall Street Journal has more here.

Notable Moves & More

• Matthew Biben, a white-collar partner at Debevoise & Plimpton who co-led the firm’s banking industry group, has moved to Gibson, Dunn & Crutcher, the new firm announced Monday, my colleague Jack Newsham reports. Gibson Dunn said Biben would continue to focus his practice on helping financial institutions with complex regulatory and litigation matters. He will also co-chair its financial institutions practice group, which is currently co-chaired by Stephanie Brooker and Arthur Long, according to the firm’s website.

• Robert Cohen, the former chief of the Securities and Exchange Commission’s cyber unit, has joined Davis, Polk & Wardwell as a partner in the firm’s white-collar defense and government investigations group, my colleague Ryan Lovelace reports. “Rob brings deep, multidisciplinary SEC enforcement experience and is held in the highest regard for his judgment and integrity, both by senior SEC staff around the country and the white-collar bar,” said Neil MacBride, a leader of Davis Polk’s white-collar defense group. As the first-ever chief of the SEC’s cyber unit, Cohen oversaw investigations involving cryptocurrencies and data security.

• Revlon executive vice president and general counsel Cari Robinson succeeds Mitra Hormozi, who will remain a consultant to the Manhattan-based cosmetics and fragrance giant. Robinson oversees Revlon’s legal affairs worldwide, including board of directors issues, corporate governance and compliance. Robinson spent nearly 19 years at IBM, most recently as vice president and assistant GC for investigations and cybersecurity, where she oversaw internal investigations, regulatory matters, cybersecurity incidents and data breaches.

• Axinn has hired Leslie Overton (at left) as an antitrust partner in the firm’s Washington office. “Leslie’s deep experience in government and private practice will be a significant asset to our firm and our Antitrust Group,” John Harkrider, oo-chair of the firm’s antitrust group and a founding partner of the firm. “Her multifaceted perspective will help our clients navigate the evolving competition landscape.” Overton formerly was an associate at Gray Cary Ware & Freidenrich, and she was a partner at Jones Day and Alston & Bird. Additionally, Overton previously held senior positions in the Justice Department’s Antitrust Division across administrations.

• Axinn has hired Leslie Overton (at left) as an antitrust partner in the firm’s Washington office. “Leslie’s deep experience in government and private practice will be a significant asset to our firm and our Antitrust Group,” John Harkrider, oo-chair of the firm’s antitrust group and a founding partner of the firm. “Her multifaceted perspective will help our clients navigate the evolving competition landscape.” Overton formerly was an associate at Gray Cary Ware & Freidenrich, and she was a partner at Jones Day and Alston & Bird. Additionally, Overton previously held senior positions in the Justice Department’s Antitrust Division across administrations.

• A Baltimore-based financial services company has made an experienced industry attorney its next senior vice president and general counsel. Karyn Polak will start her new role at Transamerica on Sept. 9. As general counsel, she will oversee a legal department of over 275 legal and compliance professionals and be responsible for the legal, compliance, ethics and corporate secretary functions. Most recently, Polak served as the deputy general counsel of PNC Bank in Philadelphia.

• Montgomery McCracken Walker & Rhoads said Fabiana Pierre-Louis, a former assistant U.S. attorney and supervisor for the U.S. Attorney’s Office for the District of New Jersey, is returning to the firm in its Cherry Hill, New Jersey, office as a partner in the firm’s white-collar and government investigations practice group.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Compliance Hot Spots: GOP Eyes ESG as an Antitrust Issue + Another DOJ Crypto Seizure + Sidley Partner Jumps to Main Justice

9 minute read

Compliance Hot Spots: Lessons from Lafarge + Fraud Section Chief Talks Compliance + Cravath Lands FTC Commissioner

11 minute readTrending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250