5 Hurricane Dorian Prep Ideas, for Annuity Professionals

As you protect clients against longevity risk, you can build in protection against other threats.

September 03, 2019 at 04:31 PM

3 minute read

Life InsuranceThe original version of this story was published on Law.com

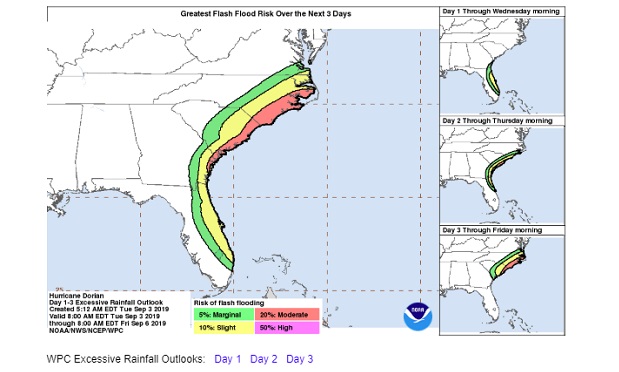

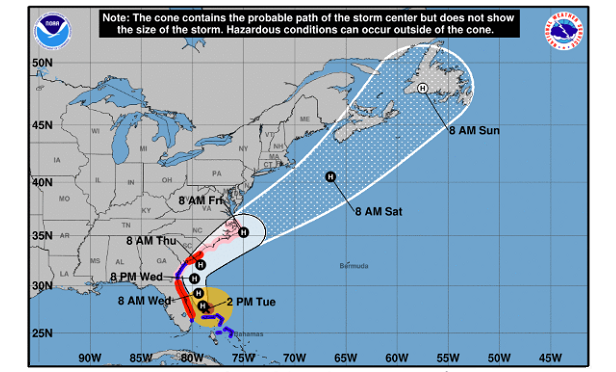

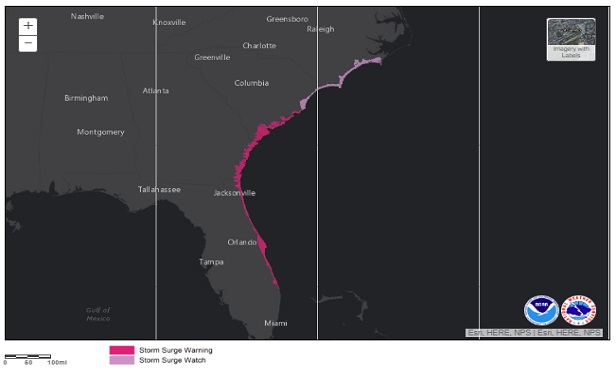

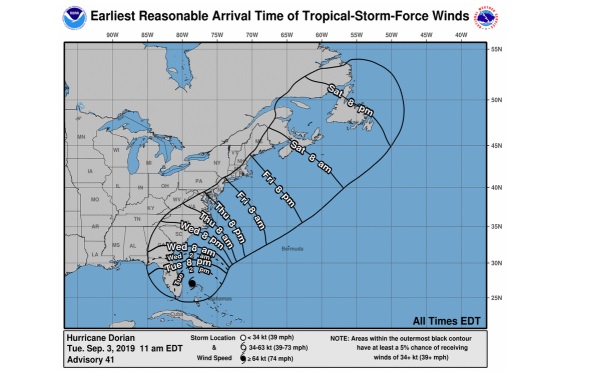

The weather is unpredictable. Hurricane Dorian could flood many areas near the East Coast, or it could just cause a few ordinary thunderstorms. But the hurricane has already caused terrible devastation for people in the northern Bahamas, and it has already served as a reminder of why people use insurance to manage risk. Financial professionals who focus on helping clients use annuities in retirement planning may see Dorian as a concern mainly for property and casualty insurance agents (Related: 3 Ways Harvey Is Touching the Life and Health Community Now) Here's a look at five ways annuity professionals can play a role in hardening prospects and clients against natural catastrophe risk, as well as against the risk of outliving retirement income.

1. You can help make holistic planning a habit.

You want employers, agents who sell term life insurance, and stockbrokers to remind clients that they might want to retire someday, and that an annuity can help provide a guaranteed source of lifetime income. You can repay the favor by reminding your retirement planning clients that one way to protect their retirement arrangements is to have solid protection against flood, fire and windstorm risk.

2. You can encourage good paperwork hygiene.

Some life insurers are now encouraging affiliated financial professionals to market services such as the EverPlans important papers vault, and the digital vault-based LegacyShield program. This might be a good time to test those kinds of services yourself, and encourage clients to try them.

3. You can set a good disaster prep example.

Your carriers probably offer great disaster prep webinars and guides. Groups for such as the National Association of Insurance Financial Advisors (NAIFA) also offer disaster prep tools. NAIFA, for example, has posted business disaster prep tips here.

4. You can communicate.

Many annuity professionals are using social media services to express their thoughts about Hurricane Dorian — and, possibly, to show how a live-human advisor is different from an AI bot. A number of financial professionals affiliated with Ameriprise Financial Services Inc. who are active on Twitter have already tweeted about Dorian. Jonathan Ingalls, an Ameriprise branch manager in Connecticut, tweeted today, "As Hurricane Dorian approaches, our thoughts are with everyone in the affected areas. Please stay safe."

5. You can find and sell more good annuities that suit your clients' needs.

Hurricanes and other natural disasters can affect anyone, but people who have their own source of retirement income may be able to reduce their risk, by choosing homes that meet the latest, toughest building codes; having cash they can use to buy airplane tickets and hotel rooms; and signing up for homeowners insurance or renters insurance policies that include strong disaster recovery benefits. Clients with adequate retirement income may also be able to make life, and death, a little less unfair, by opening their homes and wallets to help friends, relatives and neighbors who are in dire need. — Read LTCI Watch: Hell Planning, on ThinkAdvisor. — Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250