Ahead of the Curve: All in the Family (Offices). Plus Justices on Campus and Conquering Harvard Law … With Disabilities

A new program at Indiana University Maurer School of Law will prepare students to advise very wealthy families in sophisticated financial transactions. And in other law school news, the average score on the Multistage Bar Exam ticked up and Emory University is investigating whether law school faculty members used racial slurs in the classroom—again.

September 16, 2019 at 09:02 PM

7 minute read

Welcome back to Ahead of the Curve. I'm Karen Sloan, legal education editor at Law.com, and I'll be your host for this weekly look at innovation and notable developments in legal education.

This week, I'm checking in on a new program at Indiana University Maurer School of Law—Bloomington that will prepare students for law careers in family offices. Don't know what that means? No problem, I've got you covered with a primer. Next up, I'm keeping tabs on the busy SCOTUS justices, who have been spending lots of time on law campuses of late.

Please share your thoughts and feedback with me at [email protected] or on Twitter: @KarenSloanNLJ

Family Offices: A New Career Path for Law Students?

An interesting message landed in my inbox last week: It was from Indiana University Maurer School of Law—Bloomington, announcing its Family Office Practice Program, which it billed as the first of its kind at a U.S. law school. Part of what intrigued me is that I had no clue what a family office is or why a law student would aspire to work in one. It was clear to me that this program isn't about family law, but something else entirely. Fortunately Dean Austen Parrish hopped on the phone to set me straight. Here's what he said:

"The family offices are generally very wealthy families with massive amounts of assets: Soros, for example. Instead of putting their money into investment houses, they create their own office that engages in fairly sophisticated transactions, including private equity, wealth management, and real estate finance. They now do these sophisticated investments through the attorneys, accountants, and other professionals who manage their accounts."

So essentially it's super-wealthy families managing their own investments in lieu of having, say Morgan Stanley do it for them, with the idea that they can produce better returns on their own. These offices have been around for a long time, but they have grown exponentially in recent years, Parrish told me.

That brings us to the attorney piece of it. Some of these family offices have lawyers working in-house. Many more turn to outside counsel, thus large firms have been racing to assemble family office practices, which typically cobble together attorneys with expertise in corporate transactional work, private equity, real estate transactions, estate planning, and tax law.

The purpose of Indiana's new program is to draw a small cohort of students annually with business backgrounds who are interested in family offices, then provide them with a foundation in the relevant practice areas, as well as some practical experience. Starting next fall, the school aims to bring four to six students annually into the program, who will receive scholarships starting at 50% of their tuition. Among the highlights:

➤ Students in the program may take classes at the university's business school

➤ The school aims to place them in an externship in a family office or family office services practice at a law firm the summer after their 1L year

➤ They will be placed with a mentor and serve as a research assistant to a tax or business law faculty member during their second year.

➤ They will participate in a business clinic in their third year.

The idea, then, is that graduates who have completed the program will be more marketable to law firms that are growing their family office practice areas, Parrish said. (Going in-house to family offices is apparently a tougher nut to crack.)

My Thoughts: Props to Indiana for recognizing an area of growth within the legal industry and trying to figure out how to position graduates for those jobs. That said, I suspect this program will appeal to a very narrow segment of the law school applicant pool. First, they are looking for people with a few years of experience in investment banks, accounting firms, and the like, so already that winnows things down. And we've been hearing a lot lately about how law applicants and students are motivated by a desire to make the world a better place. I'm not sure that helping the super-wealthy to become even more so hits that mark. Still, if completing this program helps a handful of students pursue their career goals, then it seems a worthy enterprise.

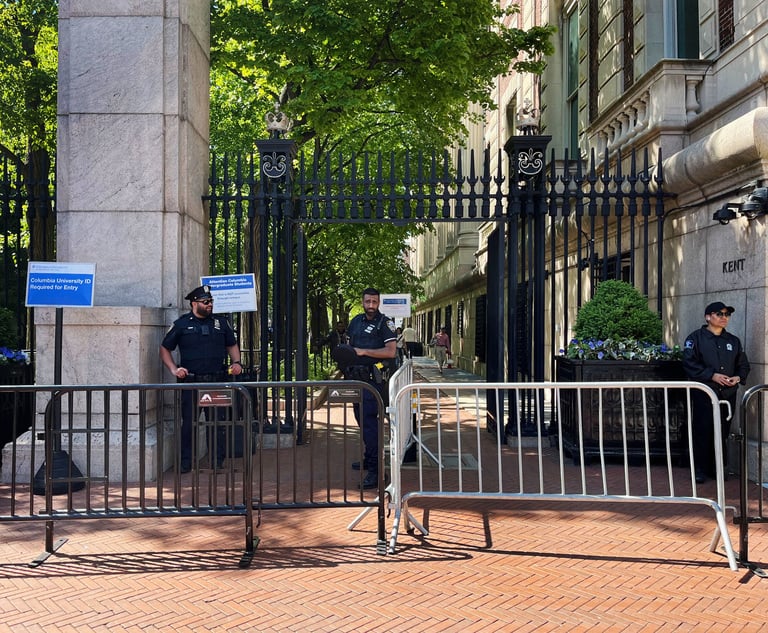

SCOTUS Everywhere

Supreme Court justices just can't stay away from law school … well, at least a few can't. It has been a particularly busy season for SCOTUS visits to campus in recent months. So I figured it's time to check in on who has been making the law school rounds, and which lucky law schools have hosted justices this summer and fall. (Hat tip to SCOTUSmap, which does a great job tracking the public appearances of the justices.)

First off, no one has been busier than the Notorious RBG, who despite health challenges has continued to show up for adoring law students and faculty. On her itinerary:

● She spoke to first-year law students at Georgetown University Law Center on Sept. 12, no doubt offering some inspiration for their future careers. That visit comes just two-and-a-half months after Ginsburg addressed Georgetown Law's Supreme Court Institute.

● Ginsburg also made the rounds to SUNY Buffalo's School of Lawon Aug. 26 to teach and receive an honorary degree. (She was longtime friends with Buffalo law professor Wayne Wisbaum, who died last year.)

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

- 1The Key Moves in the Reshuffling German Legal Market as 2025 Dawns

- 2Social Media Celebrities Clash in $100M Lawsuit

- 3Federal Judge Sets 2026 Admiralty Bench Trial in Baltimore Bridge Collapse Litigation

- 4Trump Media Accuses Purchaser Rep of Extortion, Harassment After Merger

- 5Judge Slashes $2M in Punitive Damages in Sober-Living Harassment Case

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250