Compliance Hot Spots: How DOJ's Evaluating Compliance Programs | An Apology from Jones Day | Treasury Retreats in Russian 'Oligarch' Case | All the New Moves | Who Got the Work

DOJ's Matt Miner has some new thoughts on how prosecutors are evaluating compliance programs. Plus: did you see the mea culpa from Jones Day for revealing grand jury info? Plus: Skadden's going to bat for a JPM executive, and scroll down for all the big new moves making headlines.

September 17, 2019 at 09:00 PM

11 minute read

Welcome to Compliance Hot Spots, and good evening from Washington. Tips, feedback and general thoughts on your practices are always appreciated. I'm C. Ryan Barber—reach me at [email protected] and 202-828-0315, or follow me on Twitter @cryanbarber. Thanks for reading!

How DOJ's Evaluating the Adequacy of Compliance Programs

The U.S. Justice Department's Matthew Miner was a keynote speaker this week at the 18th Annual Compliance & Ethics Institute. Miner, a deputy assistant attorney general in the criminal division, addressed prosecution approaches to evaluating and crediting corporate compliance programs.

"Our prosecution efforts need to differentiate between companies that are investing in compliance and working hard to build a strong culture, and those that are not," Miner (at left) said in his prepared remarks. "The department's voluntary self-disclosure policies certainly help in that regard for companies that detect misconduct through well-functioning compliance programs. There are clear incentives, up to and including a presumption of declination of prosecution for eligible companies that self-disclose in a timely fashion, fully cooperate, and conduct thorough remediation."

"Our prosecution efforts need to differentiate between companies that are investing in compliance and working hard to build a strong culture, and those that are not," Miner (at left) said in his prepared remarks. "The department's voluntary self-disclosure policies certainly help in that regard for companies that detect misconduct through well-functioning compliance programs. There are clear incentives, up to and including a presumption of declination of prosecution for eligible companies that self-disclose in a timely fashion, fully cooperate, and conduct thorough remediation."

Miner identified three ways that the he said the adequacy of a compliance program should play into a criminal resolution:

– "What form of resolution or prosecution should the Criminal Division pursue, if any? The options here cross the spectrum, ranging from a declination to an indictment, with various options in between, including non-prosecution and deferred prosecution agreements and parent or subsidiary-level guilty pleas."

– "What fine or criminal monetary penalty is appropriate? This category is probably the most familiar to federal prosecutors because the U.S. Sentencing Guidelines set forth criteria to determine whether compliance program credit should be available to reduce a fine amount."

– "The third consideration is somewhat different from the other two insofar as it is forward looking. In this third category, prosecutors are asked to evaluate the adequacy and effectiveness of a company's compliance program to determine what compliance-related obligations should be contained in any criminal resolution. For example, is a monitorship appropriate or is reporting adequate?"

Miner spoke in Houston last week about the increasing use of data analytics in enforcement. You can read a copy of his prepared remarks here. Compliance Week posted this story on the speech: "If Feds Find Fraud Using Analytics, Corporations Better Have Found It First."

An Apology from Jones Day

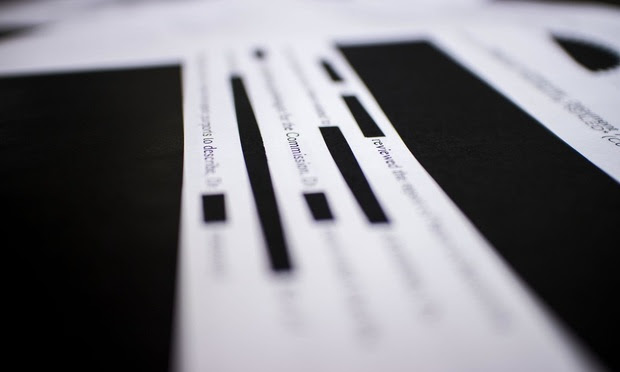

Lawyers from Jones Day have apologized to a Virginia federal judge for exposing secret grand jury information in a court filing in a criminal case, an error the law firm attributed to a failure by the legal team to use certain software that is designed to "avoid such issues."

"We very much regret that this incident occurred and can assure the court that it will not happen again," Cleveland-based Jones Day partner James Wooley said in the filing in a drug marketing case in Virginia.

The original court filing, a reply memorandum, exposed testimony that was protected by grand jury secrecy rules, and a U.S. magistrate judge had ordered all the lawyers in the case to explain how that happened, why Jones Day should not face sanctions and what's being done to prevent any subsequent mishaps. The firm, as co-counsel, represents the drug company Indivior Inc. in the criminal case.

Wooley said a team of Jones Day lawyers reviewed the court filing before it was submitted to the court to make sure any grand jury testimony had been redacted. The filing appeared "fully" redacted, Wooley said. But it turned out that it was not redacted at all. A news reporter, Wooley said, "defeated" the redaction by copying the black-out boxes and pasting the text into a new document.

The senior lawyers on the Indivior team, Wooley said, "will make certain that all future redactions in this matter are made with the proper software to avoid such issues in the future."

What happened in the Jones Day case, while rare, isn't unique. The same error occurred months ago in a filing in the Paul Manafort case in Washington's federal trial court. Paul Manafort's defense lawyers errantly revealed material that was supposed to be redacted. The public still was able to "see" purported redactions by copying the redacted black boxes into a new file.

Who Got the Work

>> A team from Skadden, Arps, Slate, Meagher & Flom—including David Meister, Jocelyn Strauber and Chad Silverman—is representing Michael Nowak, head of the JPMorgan global precious metals desk who was charged this week with two other current and former bank officials in an alleged market manipulation scheme. Nowak's lawyers told Reuters he "has done nothing wrong" and that they expect him to be exonerated. Meister heads Skadden's government enforcement and white-collar group in New York. Strauber formerly was co-chief of the Manhattan U.S. attorney's terrorism and international narcotics unit.

>> Morrison & Foerster managing partner Craig Martin represented Marvell Technology Group Ltd. as the Silicon Valley chipmaker agreed to pay $5.5 million to resolve charges it misled investors. The Securities and Exchange Commission alleged that the company used an undisclosed revenue management scheme, counting sales in one quarter even though they were scheduled for future quarters, to meet publicly-issued revenue guidance. MarketWatch has more on the settlement here.

>> Baker & McKenzie's Robert Walton successfully argued for Pfizer Inc. in the U.S. Court of Appeals for the Second Circuit, which had appealed the dismissal of its claim against the U.S. for overpayment of interest on a delayed tax refund. "Because jurisdiction over Pfizer's claim for overpayment interest lies exclusively with the United States Court of Federal Claims, we vacate the judgment of the 28 district court and transfer this case to the Court of Federal Claims," the appeals court said in a new ruling. Christine Poscablo argued for the government.

>> The Washington litigation boutique Gupta Wessler—including attorneys Deepak Gupta, Jonathan Taylor and Alexandria Twinem—represent XY Planning Network in a new suit against the U.S. Securities and Exchange Commission's "best interest" rule. Read the complaint in Manhattan federal district court.

>> Facebook Inc. has added to its roster of outside lobbyists, bringing on Alexander Sternhell and Mike Ahern of Washington's Sternhell Group to lobby on "issues related to blockchain and digital currency policy." Sternhell formerly served as deputy staff director and senior policy advisor at the Senate Banking Committee, and Ahern was a staffer on the House Financial Services Committee.

Compliance Reading Corner

White-collar

>> 'None of the Government's Business': Prosecutors Rebuked Over Search of Law Firm. A federal appeals court has barred federal prosecutors in Maryland from continuing to directly review thousands of files obtained from a search warrant executed in June at a Baltimore law firm. A judge on the panel expressed broad concerns about how the government was conducting the search. [NLJ]

Trump administration

>> Why Some Banks Are Ditching Their State Regulators. "Banks in the U.S. may be licensed and overseen primarily by state or federal regulators. While firms may switch in either direction, banks usually switch from federal to state regulators, because state regulators are generally viewed as more accessible and flexible than their Washington-based counterparts." [Wall Street Journal]

>> US Treasury Retreats From Naming American CEO as Russian 'Oligarch'. The Trump administration last week disavowed its decision to include a Moscow-born American businessman on a public list of Russian "oligarchs," resolving a months-long court fight in which the U.S. Treasury Department was accused of copying a roster of Russian billionaires that Forbes Magazine published in 2017.[NLJ]

>> Huawei Tries to Romance a Washington That Spurns Its Overtures. "The company isn't giving up trying to win friends and influence people in Washington. In March, it registered Washington lobbyists with Congress for the first time since 2012. Those hired include Samir Jain (at left), a Jones Day partner who was a cybersecurity official under Democratic President Barack Obama. Huawei also has engaged the law firms Sidley Austin LLP and Steptoe & Johnson, and Michael Esposito, who on his firm's website is described as part of the senior leadership of the Republican National Committee. On Aug. 30, three lobbyists from Squire Patton Boggs registered to work for Huawei." [Bloomberg]

>> Huawei Tries to Romance a Washington That Spurns Its Overtures. "The company isn't giving up trying to win friends and influence people in Washington. In March, it registered Washington lobbyists with Congress for the first time since 2012. Those hired include Samir Jain (at left), a Jones Day partner who was a cybersecurity official under Democratic President Barack Obama. Huawei also has engaged the law firms Sidley Austin LLP and Steptoe & Johnson, and Michael Esposito, who on his firm's website is described as part of the senior leadership of the Republican National Committee. On Aug. 30, three lobbyists from Squire Patton Boggs registered to work for Huawei." [Bloomberg]

>> U.S. Antitrust Enforcers Signal Discord Over Probes of Big Tech. "Bad blood between the U.S. government entities investigating the giants of the tech industry has grown more intense with the delivery of a letter from one agency to the other that might be considered the equivalent of a brushback pitch." [WSJ]

Law firm hiring

>> Despite Slowed White-Collar Demand, National Firms Add High-Profile Partners. Legal recruiters are split on the strength of the market for white-collar lawyers. Larry Watanabe, founder of Watanabe Nason in Solana Beach, California, said the demand is up across the board, especially in California. But other recruiters caution that the market for white-collar lawyers has not been extraordinarily strong lately, despite the numerous big-firm announcements since Labor Day. [Texas Lawyer]

>> As State Prosecutors Keep Teaming Up, Another State AGs Practice Is Born. As state prosecutors around the country continue to band together to take on corporations and federal policies, a number of national law firms have established teams of lawyers to help clients address the amped-up regulatory and enforcement pressures. [The American Lawyer]

Notable Moves & New Hires

• Kirkland & Ellis said former Illinois Attorney General Lisa Madigan (above) is joining its Chicago and Washington offices as an equity partner. In an interview, Madigan said the firm offered her a "unique opportunity to work on complex legal issues that I have spent much of my career already working on."

• Munger, Tolles & Olson has added John Berry, a former U.S. Securities and Exchange Commission senior official, as a partner in Los Angeles. Berry formerly served as associate regional director for the SEC's Los Angeles office.

• Covington & Burling hired Amanda Kramer (at left), a longtime assistant U.S. attorney in Manhattan, as a partner in New York. Kramer's return to private practice—she'd previously been an associate at Weil, Gotshal & Manges—comes after about 11 years in the Southern District on New York U.S. Attorney's office. She said Covington was at the top of her mind when looking at her post-government options, noting she knew and respected partners at the firm including Arlo Devlin-Brown, an SDNY alum who led the public corruption unit, and Nancy Kestenbaum, who co-chairs Covington's white-collar practice.

• Covington & Burling hired Amanda Kramer (at left), a longtime assistant U.S. attorney in Manhattan, as a partner in New York. Kramer's return to private practice—she'd previously been an associate at Weil, Gotshal & Manges—comes after about 11 years in the Southern District on New York U.S. Attorney's office. She said Covington was at the top of her mind when looking at her post-government options, noting she knew and respected partners at the firm including Arlo Devlin-Brown, an SDNY alum who led the public corruption unit, and Nancy Kestenbaum, who co-chairs Covington's white-collar practice.

• King & Spalding has hired Sumon Dantiki as a partner in the firm's special matters and government investigations group. Dantiki, arriving from the FBI, was senior counsel and advised leadership at the bureau on, among other things, national security matters, cybersecurity and privacy.

• Dorothy DeWitt was named Tuesday director of the U.S. Commodity Futures Trading Commission's division of market oversight. DeWitt joins the agency from the cryptocurrency company Coinbase, where she was vice president and general counsel for business lines and markets. DeWitt also earlier worked at Davis Polk & Wardwell. She succeeds Amir Zaidi, who had served as the market oversight director since January 2017. Zaidi is now global head of compliance at the interdealer broker TP ICAP.

• BakerHostetler brought on Shawn Cleveland as a partner in the white-collar, Investigations and securities enforcement and litigation team. Cleveland was most recently at Winston & Strawn. Cleveland said BakerHostetler's commitment to north Texas impressed him when he was considering his move. He said he also was drawn to the firm's "sophisticated capabilities" in the white-collar defense practice and in other areas including complex commercial litigation, M&A and data privacy and security.

• Blank Rome said Jonathan Scott Goldman has rejoined the firm as a partner in the commercial litigation group in the Philadelphia office. Goldman, a 10-year veteran of the firm, arrives from the Pennsylvania attorney general's office, where he had served as executive deputy attorney general.

• The El Segundo, California-based financial services firm Cetera Financial Group Inc. has picked David Greene, the former head of the Financial Industry Regulatory Authority in Los Angeles, for general counsel. Greene succeeds Brian Stern, who will be leaving the company at the end of the year.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Compliance Hot Spots: GOP Eyes ESG as an Antitrust Issue + Another DOJ Crypto Seizure + Sidley Partner Jumps to Main Justice

9 minute read

Compliance Hot Spots: Lessons from Lafarge + Fraud Section Chief Talks Compliance + Cravath Lands FTC Commissioner

11 minute readTrending Stories

- 1The Lawyers Waging the Legal Fight Against the Trump Administration

- 2McDermott's Onetime London Leader Headed to Pillsbury

- 3A&O Shearman To Lose Another Five Lawyers to EY

- 4Pearl Cohen Enters San Francisco Market Via Combination With IP Boutique

- 5'Incredibly Complicated'? Antitrust Litigators Identify Pros and Cons of Proposed One Agency Act

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250