Historic Vote on Cannabis Banking: Perspectives from Practitioners | A Court Rules on Marijuana Overtime | 'Marijuana Mitch' | Trade Group Lobbies Up

We've rounded up early commentary from lawyers about the U.S. House's vote embracing cannabis banking legislation. Scroll down for Who Got the Work, headlines and our calendar. Thanks for reading!

September 26, 2019 at 04:00 PM

10 minute read

Welcome back to Higher Law, our weekly briefing on all things cannabis. I'm Cheryl Miller, reporting for Law.com from Sacramento. You have unimpeachably good taste to click open our briefing today.

This week we're looking at

• A historic vote for cannabis in Congress

• A long-awaited ruling on marijuana workers and labor law

• The Cannabis Trade Federation's growing lobbying armada

• Mitch McConnell, legal hemp and confused police

Thanks for reading. Send your feedback, your story ideas and any interesting case news to me at [email protected]. You can also reach me at 916.448.2935. Follow me on Twitter @capitalaccounts.

House Takes Historic Vote on Cannabis

Sure, everyone's been watching Capitol Hill this week. But all the cool kids know the real action was on the House of Representatives floor Wednesday when 321 members approved the SAFE Banking Act. That's the bill that would shield banks that serve state-licensed cannabis and hemp operators, as well as companies and insurers that serve those industries, from federal regulators.

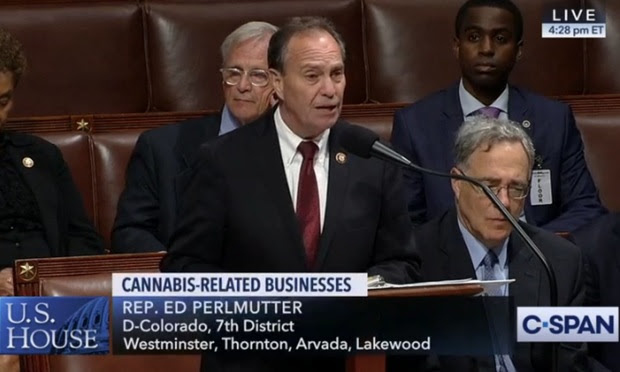

The bill languished for six years without a vote. That it passed so overwhelmingly this week with bipartisan support speaks volumes about the seismic shift in public opinion, and politics, surrounding marijuana. U.S. Rep. Ed Perlmutter, D-Colorado, above, said the bill "will help get cash off our streets and provide certainty so financial institutions can work with cannabis businesses."

Here's what a few lawyers in the cannabis space had to say in their own words about the SAFE Banking Act's passage.

>> Anita Boomstein, partner, Manatt Phelps & Phillips:

>> Anita Boomstein, partner, Manatt Phelps & Phillips:

Under the bill, banks still would need to have robust compliance procedures in place to ensure that their cannabis customers are, in fact, operating legally under the relevant state law. But assuming the bank can satisfy that hurdle, the bill would remove the threat of criminal liability, adverse supervisory action by its federal regulator, or seizure of funds from cannabis-related transactions, all of which have haunted banks up until now.

>> Jason Horst, Horst Legal Counsel:

It certainly is significant. Insurance protections were not originally included in the SAFE Banking Act, but were added in June. If it becomes law, I do think that you will see the dam break a great deal with regard to the number of insurers entering the cannabis insurance markets. The changes may not happen overnight in the way that they might with banking, though. Each new carrier with have to do its due diligence to understand how cannabis risks differ from other risks they insure. But, over time, competition in the markets will increase greatly, and prices and terms of available insurance should improve steadily.

>> Rachel Gillette, chair of Greenspoon Marder's cannabis practice:

All-cash business operations are not only a safety issue, but they are a tremendous challenge, and the lack of available banking in a multi-billion dollar industry makes little sense. The lack of banking has only served to undermine states that have chosen the alternative path to end marijuana prohibition. Normalized banking relationships between licensed cannabis businesses and financial institutions adds the level of transparency states have needed in their regulatory efforts to quash the marijuana black market.

>> Jonathan Havens, partner, Saul Ewing Arnstein & Lehr:

The bill is significant for a few reasons. First, this is the first standalone cannabis reform bill that has reached the House floor. Second, this legislation would help address one of the cannabis industry's primary challenges: Finding financial institutions that will take them on as customers. Third, once implemented, the bill could pave the way for commercial lending and capital markets opportunities for plant-touching US entities.

Now, the bad news: Our take is that the SAFE Act will not become law this year. Senate Majority Leader Mitch McConnell, while a strong proponent of hemp, has not yet signaled a willingness to take up the marijuana—hemp's "illicit cousin," as McConnell calls it—reform measure in the Senate.

Federal Overtime Rules Apply to Marijuana Workers, Court Says

Employers in the state-licensed marijuana industry still have to pay their workers overtime, even though the federal government considers such business operations illegal.

That's what the U.S. Court of Appeals for the Tenth Circuit said last week in a long-awaited ruling. Nine months after oral arguments in the case, a unanimous three-judge panel affirmed a Colorado federal district court ruling allowing the Fair Labor Standards Act claims of marijuana security worker Robert Kenney to proceed against his former employer, Helix TCS Inc.

Kenney's attorney, Lindsay Itkin of Josephson Dunlap, said she isn't sure what took the court so long to produce the 12-page opinion, but she's pleased with the result.

"I think it does have broader implications than just this specific case," Itkin said. "It further helps legitimize an industry that's striving to become legitimate in people's eyes."

Kenney alleged he and other employees regularly worked more than 40 hours a week, but Helix refused to pay overtime because they worked at Colorado-sanctioned marijuana outlets, which are considered illegal operations under the federal Controlled Substances Act.

"The district court correctly reasoned and case law has repeatedly confirmed that employers are not excused from complying with federal laws just because their business practices are federally prohibited," Senior Judge Stephanie Kulp Seymour wrote for the panel.

Helix attorney Jordan Factor of Allen Vellone Wolf Helfrich & Factor said in a statement that the Tenth Circuit "got it wrong" and the company is considering an appeal to the U.S. Supreme Court.

"Congress did not intend to guarantee overtime to workers in the federally illegal marijuana industry," Factor said. "Rather, Congress and courts around the country have said for decades that no one has a right under federal law to demand payment for participating in the sale of marijuana. Until Congress changes our outdated marijuana laws, that remains the case."

The appellate panel did not weigh in on the merits of Kenney's labor complaint. Itkin said the plaintiff is eager to get the case back to a trial court where she suggested more than 50 similarly situated Helix workers could join in the complaint.

Who Got the Work

>> U.K. law firms are jumping on the green wave. Hill Dickinson; DAC Beachcroft; Memery Crystal and Mackrell Turner Garrett have all in formally dedicated resources to the increasingly lucrative area of medical cannabis, my colleague Krishnan Nair writes. [Legal Week]

>> Los Angeles-based cannabis holding company Shryne Group Inc. has hired its former outside counsel at Arent Fox to serve as the startup firm's top lawyer, my colleague Phillip Bantz reports. John Malone, an expert on corporate governance and regulatory compliance, joins Shryne as general counsel after having helped cannabis startups navigate regulatory schemes while he was in private practice.

>> The Cannabis Trade Federation has retained Mercury Public Affairs to lobby on federal cannabis policy. The trade group, whose founding members represent some of the biggest names in the cannabis industry, already works with a fleet of contract lobbyists, including those from Brownstein Hyatt Farber Schreck, VS Strategies and Jochum Shore & Trossevin.

In the Weeds…

>> Marijuana Mitch? How McConnell's hemp push has made pot busts harder. A big assist from U.S. Senate leader Mitch McConnell got hemp legalized in the 2018 Farm Bill. But police are having a hard time telling the difference now between legal hemp and its sometimes less-than-legal cousin, marijuana. [Politico]

>> Eaze has filed a countersuit against Dionymed. Things have gotten messier in the litigation involving delivery platform Eaze Technologies Inc. and DionyMed Brands. In June, DionyMed subsidiary Herban Industries accused Eaze in San Francisco Superior Court of mislabeling marijuana credit card transactions to avoid sales rejections by financial institutions. Last week Eaze filed a countersuit accusing Dionymed of using "dirty tricks" to drive customers away from Eaze to its own competing platform. [Green Market Report]

>> Is Green Roads skimping on the CBD in its products? That's what a putative class action filed in the Southern District of Florida contends. Attorneys with Kopelowitz Ostrow Ferguson Weiselberg Gilbert in Fort Lauderdale contend that Green Roads' labeling, packaging and website make customers think they're getting more CBD in the company's oil, gummies, capsules, topicals, syrups, tea and coffee than they actually contain. A Green Roads spokeswoman said the suit is without merit. [Daily Business Review]

>> A regional approach to regulating cannabis? The governors of New York and Connecticut say they're considering working together on vaping regulations and decriminalization of marijuana. With limited federal guidance on cannabis, "let's hook our boats together and see if we can find a way through this storm," New York Gov. Andrew Cuomo said. [Connecticut Law Tribune]

>> A Washington state plaintiff is suing a vape pen distributor over his bout with pneumonia. Charles Wilcoxen's complaint, filed in Pierce County Superior Court by attorney Mark Lindquist, targets Everett-based CannaBrand Solutions, which distributes the Chinese-made Ccell pens and batteries that the Puyallup Tribal Police officer said he used. CannaBrand's CEO Daniel Allen declined to comment on the suit. The Centers for Disease Control is studying lung injuries associated with e-cigarettes but has not identified a specific cause. [The Seattle Times]

>> Massachusetts regulators say yes to cannabis cafes and deliveries. The Cannabis Control Commission approved new rules that will allow for door-to-door deliveries and outlets that offer on-site use. Social equity and economic empower applicants will get first crack at the new categories. The new rules will require delivery vehicles to be fitted with alarms, secure storage areas, GPS monitoring devices and cameras. Deliveries must also stop at 9 p.m. [MassLive]

>> Pennsylvania's governor says he supports recreational marijuana. Gov. Tom Wolf on Wednesday asked the legislature to consider expanding the medical marijuana program to allow recreational use. He also said he wants legislation expunging low-level marijuana convictions. [AP]

Calendar: Time to Mark It

Oct. 1 - Reed Smith hosts the webinar "Cannabis, Coverage, and Products Liability–An Overview." Firm partner Michael Sampson and Martin Fox-Foster, director of claims at Emergent Risk, will present.

Oct. 2 - NJ Cannabis Insider Live takes place in Edison, N.J. Speakers and panelists include Fruqan Mouzon, cannabis law chair at McElroy, Deutsch, Mulvaney & Carpenter; Chiesa, Shahinian & Giantomasi attorney Lee Vartan and Capehart Scatchard cannabis law practice chair Sheila Mints

Oct. 3-5 - The International Cannabis Bar Association hosts its annual Cannabis Law Institute at the New York Law School in Manhattan. Scheduled speakers include Aurora Cannabis general counsel Jillian Swainson, Acreage Holdings general counsel Jim Doherty and Terra Tech general counsel Joe Segilia.

Correction: The Aug. 19 edition of Higher Law misidentified the last name of Quinn Emanuel Urquhart & Sullivan partner Robert Becher.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

NY Cannabis Marketing Rulings / Rescheduling Effects / Honigman's Work on Trademark Suit / Goodbye

9 minute read

Workplace Weed and Labor Pacts / State AGs and Hemp / Maryland Licensing Suit / Vicente Sues Recruiter

9 minute readTrending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250